Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show solutions Cash Flow Hedge with Adjusting Entry: Call Options On June 1, 2020, Capital Foods forecasts that it will purchase 5,000,000 bushels of

Please show solutions

Please show solutions

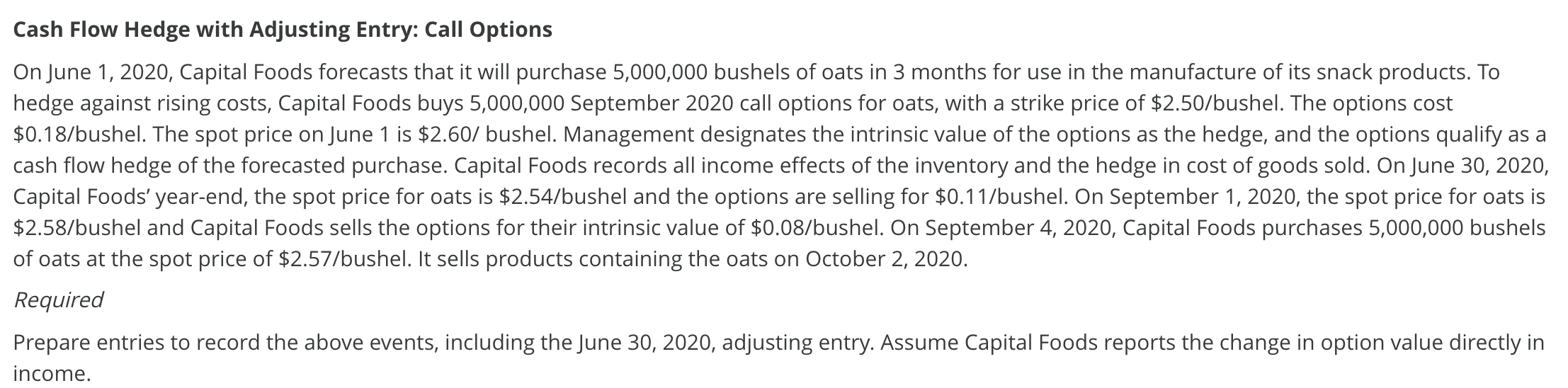

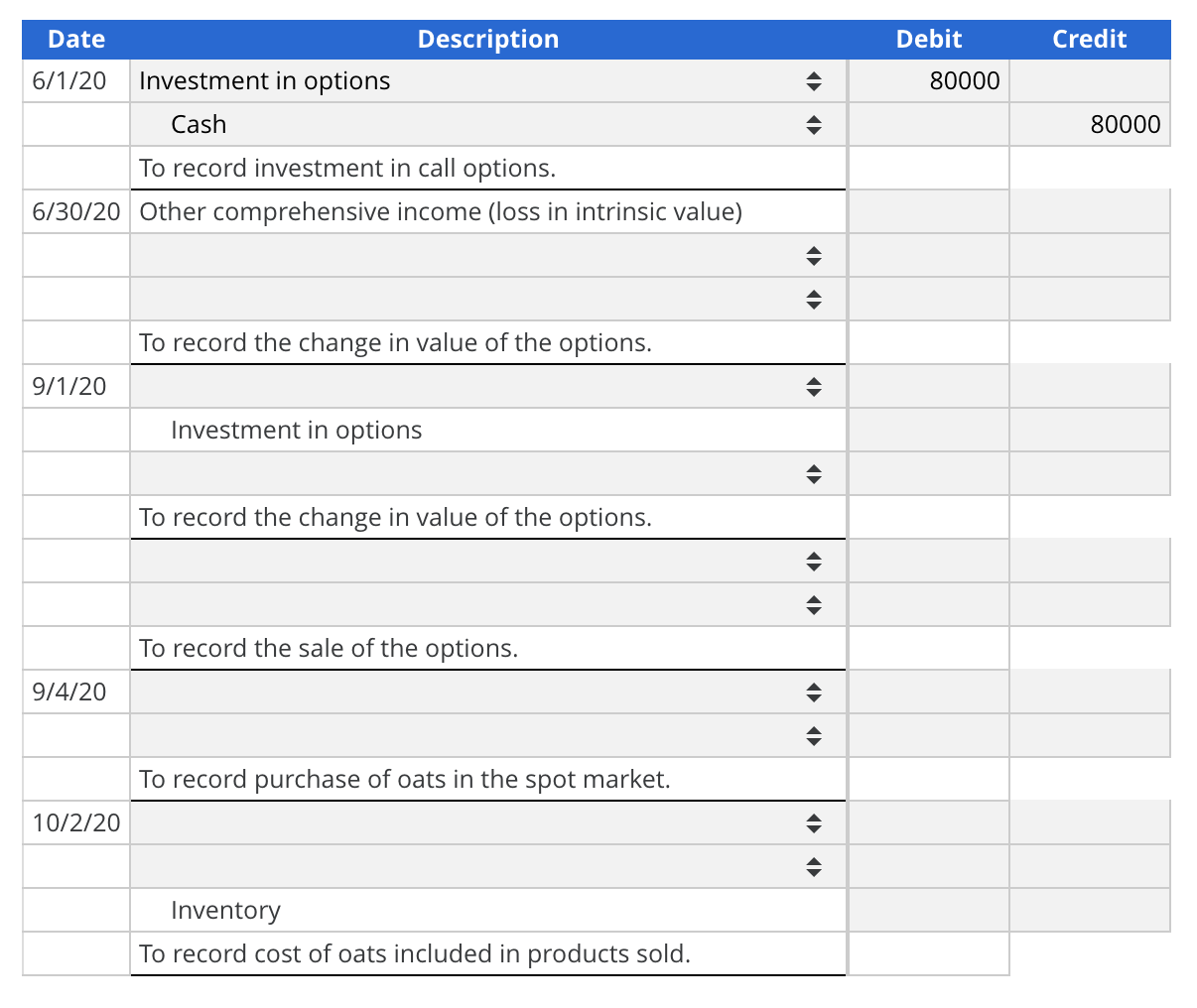

Cash Flow Hedge with Adjusting Entry: Call Options On June 1, 2020, Capital Foods forecasts that it will purchase 5,000,000 bushels of oats in 3 months for use in the manufacture of its snack products. To hedge against rising costs, Capital Foods buys 5,000,000 September 2020 call options for oats, with a strike price of $2.50/bushel. The options cost $0.18/bushel. The spot price on June 1 is $2.60/ bushel. Management designates the intrinsic value of the options as the hedge, and the options qualify as a cash flow hedge of the forecasted purchase. Capital Foods records all income effects of the inventory and the hedge in cost of goods sold. On June 30, 2020, Capital Foods' year-end, the spot price for oats is $2.54/bushel and the options are selling for $0.11/bushel. On September 1, 2020, the spot price for oats is $2.58/bushel and Capital Foods sells the options for their intrinsic value of $0.08/bushel. On September 4, 2020, Capital Foods purchases 5,000,000 bushels of oats at the spot price of $2.57/bushel. It sells products containing the oats on October 2, 2020. Required Prepare entries to record the above events, including the June 30, 2020, adjusting entry. Assume Capital Foods reports the change in option value directly in income. Date Description Debit Credit 6/1/20 80000 Investment in options Cash 80000 To record investment in call options. 6/30/20 Other comprehensive income (loss in intrinsic value) To record the change in value of the options. 9/1/20 Investment in options To record the change in value of the options. To record the sale of the options. 9/4/20 To record purchase of oats in the spot market. 10/2/20 Inventory To record cost of oats included in products sold. Cash Flow Hedge with Adjusting Entry: Call Options On June 1, 2020, Capital Foods forecasts that it will purchase 5,000,000 bushels of oats in 3 months for use in the manufacture of its snack products. To hedge against rising costs, Capital Foods buys 5,000,000 September 2020 call options for oats, with a strike price of $2.50/bushel. The options cost $0.18/bushel. The spot price on June 1 is $2.60/ bushel. Management designates the intrinsic value of the options as the hedge, and the options qualify as a cash flow hedge of the forecasted purchase. Capital Foods records all income effects of the inventory and the hedge in cost of goods sold. On June 30, 2020, Capital Foods' year-end, the spot price for oats is $2.54/bushel and the options are selling for $0.11/bushel. On September 1, 2020, the spot price for oats is $2.58/bushel and Capital Foods sells the options for their intrinsic value of $0.08/bushel. On September 4, 2020, Capital Foods purchases 5,000,000 bushels of oats at the spot price of $2.57/bushel. It sells products containing the oats on October 2, 2020. Required Prepare entries to record the above events, including the June 30, 2020, adjusting entry. Assume Capital Foods reports the change in option value directly in income. Date Description Debit Credit 6/1/20 80000 Investment in options Cash 80000 To record investment in call options. 6/30/20 Other comprehensive income (loss in intrinsic value) To record the change in value of the options. 9/1/20 Investment in options To record the change in value of the options. To record the sale of the options. 9/4/20 To record purchase of oats in the spot market. 10/2/20 Inventory To record cost of oats included in products sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started