Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show solutions. Dan Knight and Patricia Chen, who are good friends, form Crane Corporation. Dan transfers land (worth $200,000, basis of $60,000) for 50%

Please show solutions.

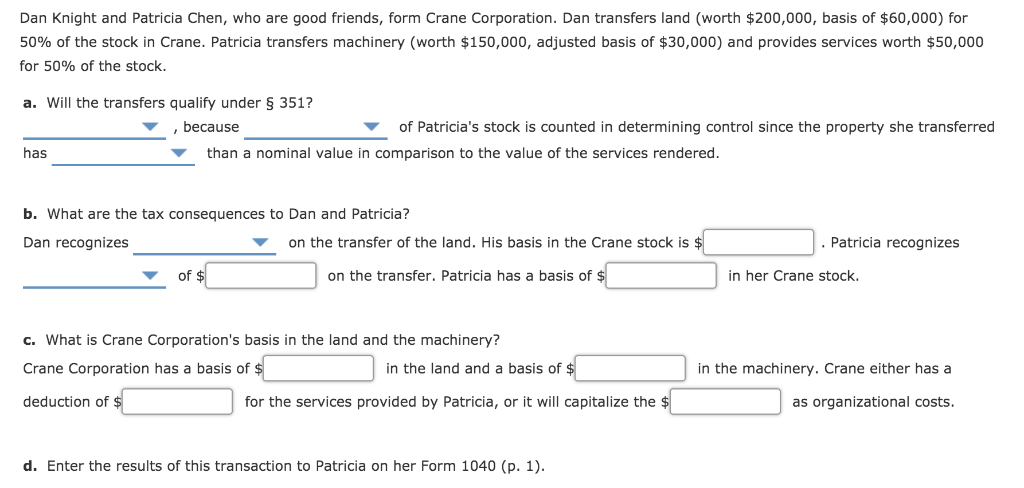

Dan Knight and Patricia Chen, who are good friends, form Crane Corporation. Dan transfers land (worth $200,000, basis of $60,000) for 50% of the stock in Crane. Patricia transfers machinery (worth $150,000, adjusted basis of $30,000) and provides services worth $50,000 for 50% of the stock. a. Will the transfers qualify under 351? because of Patricia's stock is counted in determining control since the property she transferred than a nominal value in comparison to the value of the services rendered has b. What are the tax consequences to Dan and Patricia? Dan recognizes on the transfer of the land. His basis in the Crane stock is $ Patricia recognizes of on the transfer. Patricia has a basis of $ in her Crane stock. c. What is Crane Corporation's basis in the land and the machinery? in the land and a basis of $ Crane Corporation has a basis of $ in the machinery. Crane either has a deduction of $ as organizational costs. for the services provided by Patricia, or it will capitalize the $ d. Enter the results of this transaction to Patricia on her Form 1040 (p. 1)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started