Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show solutions. Holbrook, a calendar year S corporation, distributes $158,800 cash to its only shareholder, Cody, on December 31. Cody's basis in his stock

Please show solutions.

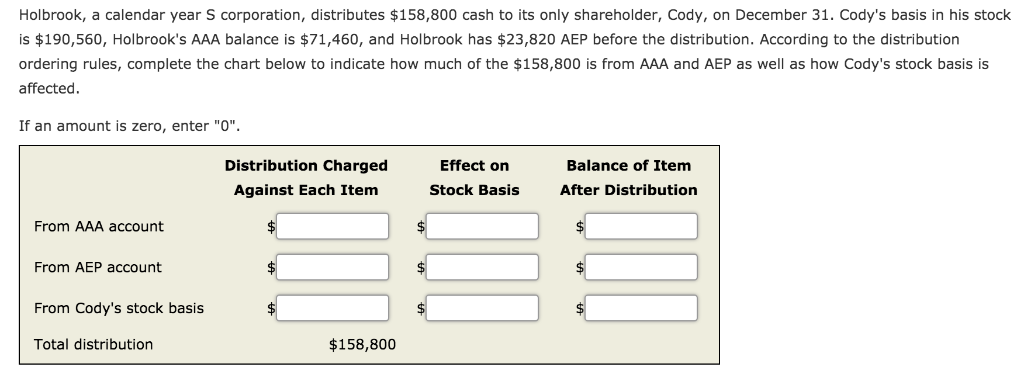

Holbrook, a calendar year S corporation, distributes $158,800 cash to its only shareholder, Cody, on December 31. Cody's basis in his stock is $190,560, Holbrook's AAA balance is $71,460, and Holbrook has $23,820 AEP before the distribution. According to the distribution ordering rules, complete the chart below to indicate how much of the $158,800 is from AAA and AEP as well as how Cody's stock basis is affected If an amount is zero, enter "0". Distribution Charged Effect on Balance of Item Against Each Item Stock Basis After Distribution From AAA account $ $ From AEP account From Cody's stock basis Total distribution $158,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started