Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Show some formulas please dont answer the questions, I figure them out. 9. Conventional versus nonconventional cash flow streams The net annual cash flows

Please Show some formulas

please dont answer the questions, I figure them out.

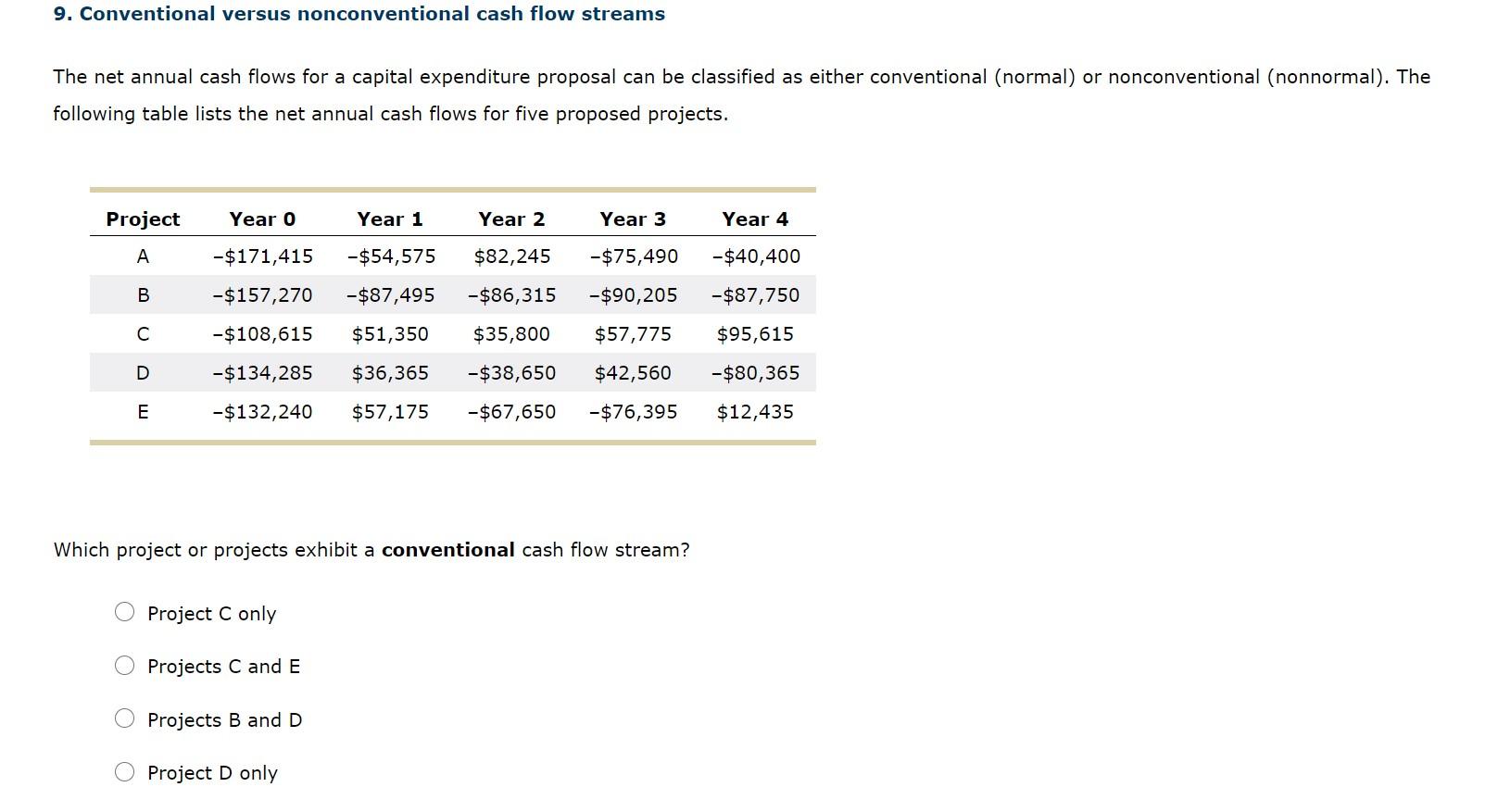

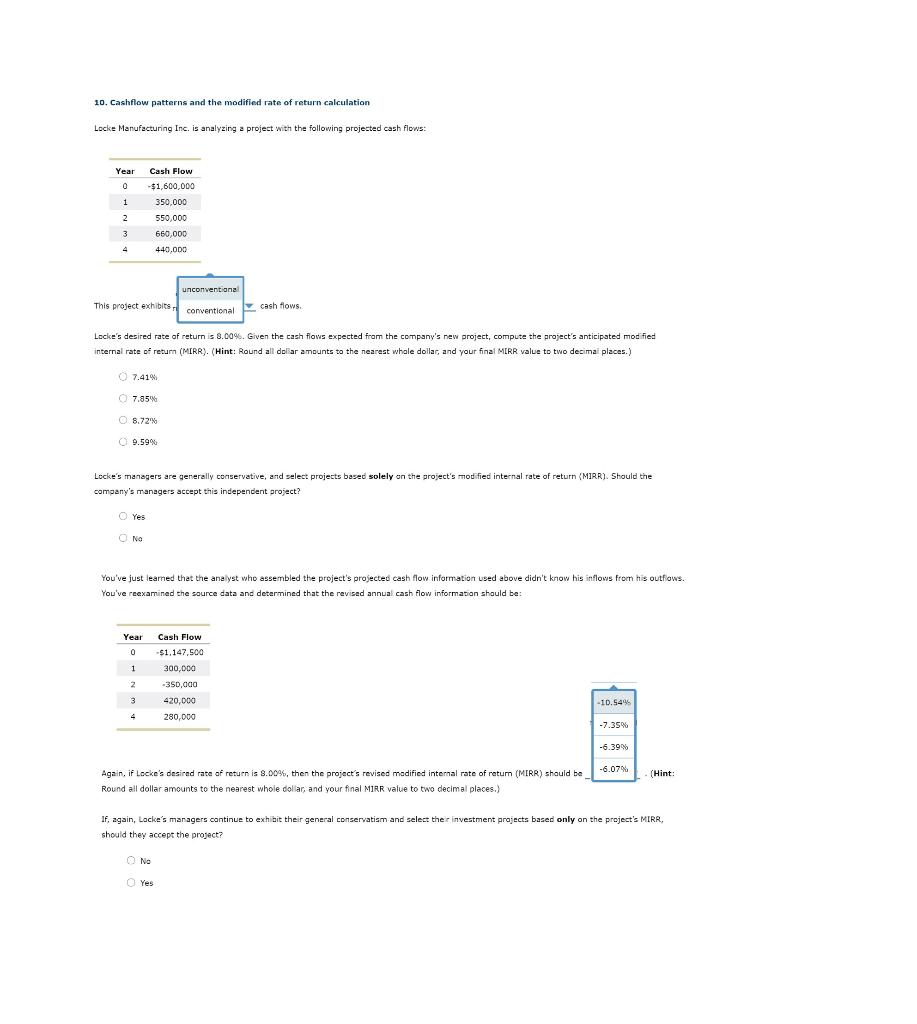

9. Conventional versus nonconventional cash flow streams The net annual cash flows for a capital expenditure proposal can be classified as either conventional (normal) or nonconventional (nonnormal). The following table lists the net annual cash flows for five proposed projects. Project Year o Year 1 Year 2 Year 3 Year 4 A -$171,415 -$54,575 $82,245 -$75,490 - $40,400 B -$157,270 - $87,495 - $86,315 - $90,205 -$87,750 -$108,615 $51,350 $35,800 $57,775 $95,615 D -$134,285 $36,365 - $38,650 $42,560 - $80,365 E -$132,240 $57,175 - $67,650 -$76,395 $12,435 Which project or projects exhibit a conventional cash flow stream? Project C only Projects C and E Projects B and D Project D only 10. Cashflow patterns and the modified rate of return calculation Locke Manufacturing Inc. is analyzing a project with the following projected cash flows: Year 0 Cash Flow -$1,600,000 350,000 1 2 3 550,000 660,000 440.000 4 unconventional This project exhibits conventional . conventional cash flows Locke's desired rate of return is 8.00%. Given the cash flows expected from the company's new project, compute the project's anticipated modified internal rate of return (MIRR). (Hint: Round all dollar amounts to the nearest whale dollar, and your final MIRR value to two decimal places.) 7.41% 7.85% O 8.72% 9.59% Locke's managers are generally conservative, and select projects based solely on the project's modified internal rate of return (MIRR). Should the company's managers accept this independent project? NG You've just learned that the analyst who assembled the project's projected cash flow information used above didn't know his inflows from his outfiows. You've reexamined the source data and determined that the revised annual cash flow information should be: Year 0 Cash Flow -$1.147.500 300,000 1 2 2 3 -350,000 420,000 280,000 -10.54% 4 2 -7.35% -6.39% -6.079 (Hint: Again, if Locke's desired rate of return is 3.0096, then the project's revised modified internal rate of retum (MIRR) should be Round all dollar amounts to the nearest whole dollar, and your final MIRR value to two decimal places.) If, again, Lacke's managers continue to exhibit their general conservatism and select the investment projects based only on the project's MIRR, should they accept the project? Ne Yes 9. Conventional versus nonconventional cash flow streams The net annual cash flows for a capital expenditure proposal can be classified as either conventional (normal) or nonconventional (nonnormal). The following table lists the net annual cash flows for five proposed projects. Project Year o Year 1 Year 2 Year 3 Year 4 A -$171,415 -$54,575 $82,245 -$75,490 - $40,400 B -$157,270 - $87,495 - $86,315 - $90,205 -$87,750 -$108,615 $51,350 $35,800 $57,775 $95,615 D -$134,285 $36,365 - $38,650 $42,560 - $80,365 E -$132,240 $57,175 - $67,650 -$76,395 $12,435 Which project or projects exhibit a conventional cash flow stream? Project C only Projects C and E Projects B and D Project D only 10. Cashflow patterns and the modified rate of return calculation Locke Manufacturing Inc. is analyzing a project with the following projected cash flows: Year 0 Cash Flow -$1,600,000 350,000 1 2 3 550,000 660,000 440.000 4 unconventional This project exhibits conventional . conventional cash flows Locke's desired rate of return is 8.00%. Given the cash flows expected from the company's new project, compute the project's anticipated modified internal rate of return (MIRR). (Hint: Round all dollar amounts to the nearest whale dollar, and your final MIRR value to two decimal places.) 7.41% 7.85% O 8.72% 9.59% Locke's managers are generally conservative, and select projects based solely on the project's modified internal rate of return (MIRR). Should the company's managers accept this independent project? NG You've just learned that the analyst who assembled the project's projected cash flow information used above didn't know his inflows from his outfiows. You've reexamined the source data and determined that the revised annual cash flow information should be: Year 0 Cash Flow -$1.147.500 300,000 1 2 2 3 -350,000 420,000 280,000 -10.54% 4 2 -7.35% -6.39% -6.079 (Hint: Again, if Locke's desired rate of return is 3.0096, then the project's revised modified internal rate of retum (MIRR) should be Round all dollar amounts to the nearest whole dollar, and your final MIRR value to two decimal places.) If, again, Lacke's managers continue to exhibit their general conservatism and select the investment projects based only on the project's MIRR, should they accept the project? Ne YesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started