Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show step by step, being as detailed as possible. Thank you in advance. The Erskine Incorporated Metals Division manufactures an industrial compound used in

Please show step by step, being as detailed as possible. Thank you in advance.

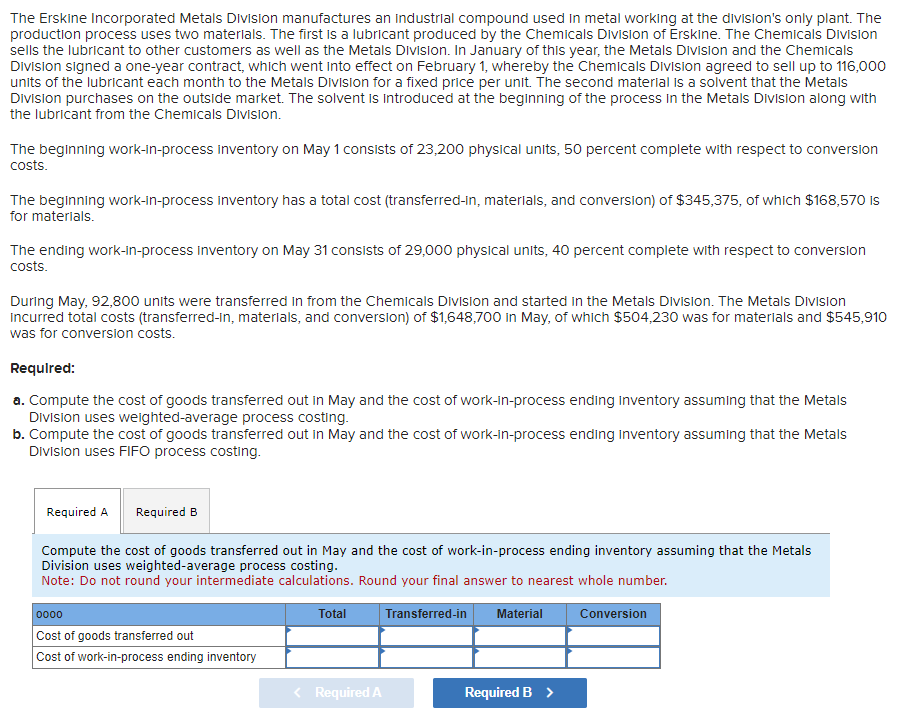

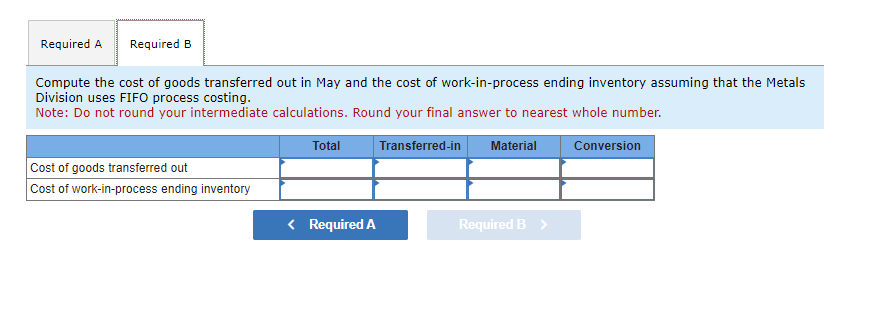

The Erskine Incorporated Metals Division manufactures an industrial compound used in metal working at the division's only plant. The production process uses two materlals. The first is a lubricant produced by the Chemicals Division of Erskine. The Chemicals Division sells the lubricant to other customers as well as the Metals Division. In January of this year, the Metals Division and the Chemicals Division signed a one-year contract, which went Into effect on February 1, whereby the Chemicals Division agreed to sell up to 116,000 units of the lubricant each month to the Metals Division for a fixed price per unit. The second material is a solvent that the Metals Division purchases on the outside market. The solvent is introduced at the beginning of the process in the Metals Division along with the lubricant from the Chemicals Division. The beginning work-in-process inventory on May 1 consists of 23,200 physical units, 50 percent complete with respect to conversion costs. The beginning work-in-process inventory has a total cost (transferred-in, materlals, and conversion) of $345,375, of which $168,570 is for materlals. The ending work-in-process inventory on May 31 consists of 29,000 physical units, 40 percent complete with respect to conversion costs. During May, 92,800 units were transferred in from the Chemicals Division and started in the Metals Division. The Metals Division Incurred total costs (transferred-In, materlals, and conversion) of $1,648,700 in May, of which $504,230 was for materlals and $545,910 was for conversion costs. Requlred: a. Compute the cost of goods transferred out in May and the cost of work-in-process ending inventory assuming that the Metals Division uses weighted-average process costing. b. Compute the cost of goods transferred out in May and the cost of work-in-process ending inventory assuming that the Metals DivIsion uses FIFO process costing. Compute the cost of goods transferred out in May and the cost of work-in-process ending inventory assuming that the Metals Division uses weighted-average process costing. Note: Do not round your intermediate calculations. Round your final answer to nearest whole number. Compute the cost of goods transferred out in May and the cost of work-in-process ending inventory assuming that the Metals Division uses FIFO process costing. Note: Do not round your intermediate calculations. Round your final answer to nearest whole numberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started