Answered step by step

Verified Expert Solution

Question

1 Approved Answer

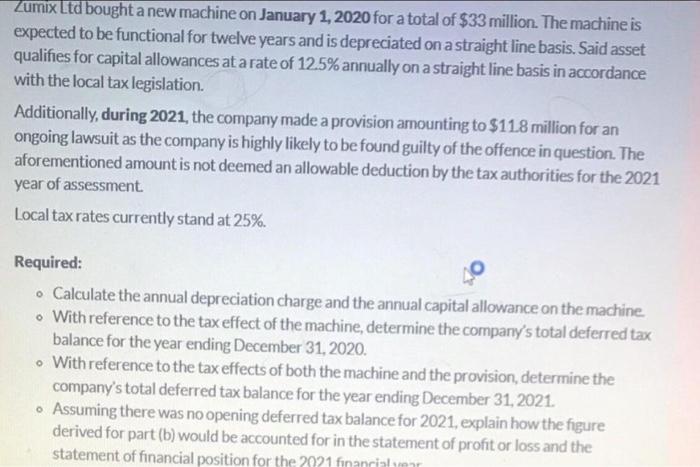

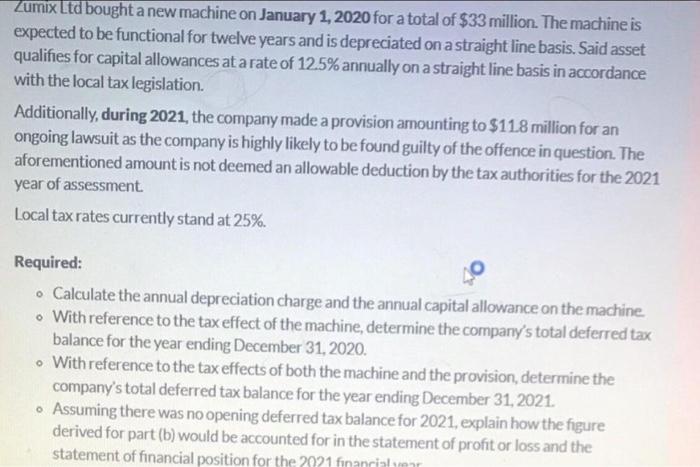

Please show step by step Lumix Ltd bought a new machine on January 1, 2020 for a total of $33 million. The machine is expected

Please show step by step

Lumix Ltd bought a new machine on January 1, 2020 for a total of $33 million. The machine is expected to be functional for twelve years and is depreciated on a straight line basis. Said asset qualifies for capital allowances at a rate of 12.5% annually on a straight line basis in accordance with the local tax legislation. Additionally, during 2021, the company made a provision arnounting to $118 million for an ongoing lawsuit as the company is highly likely to be found guilty of the offence in question. The aforementioned amount is not deemed an allowable deduction by the tax authorities for the 2021 year of assessment Local tax rates currently stand at 25%. Required: - Calculate the annual depreciation charge and the annual capital allowance on the machine - With reference to the tax effect of the machine, determine the company's total deferred tax balance for the year ending December 31, 2020. - With reference to the tax effects of both the machine and the provision, determine the company's total deferred tax balance for the year ending December 31, 2021. - Assuming there was no opening deferred tax balance for 2021, explain how the figure derived for part (b) would be accounted for in the statement of profit or loss and the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started