Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show step by step on how to solve it. Turn in one sheet per team. Each team member must sign the back (legibly) to

Please show step by step on how to solve it.

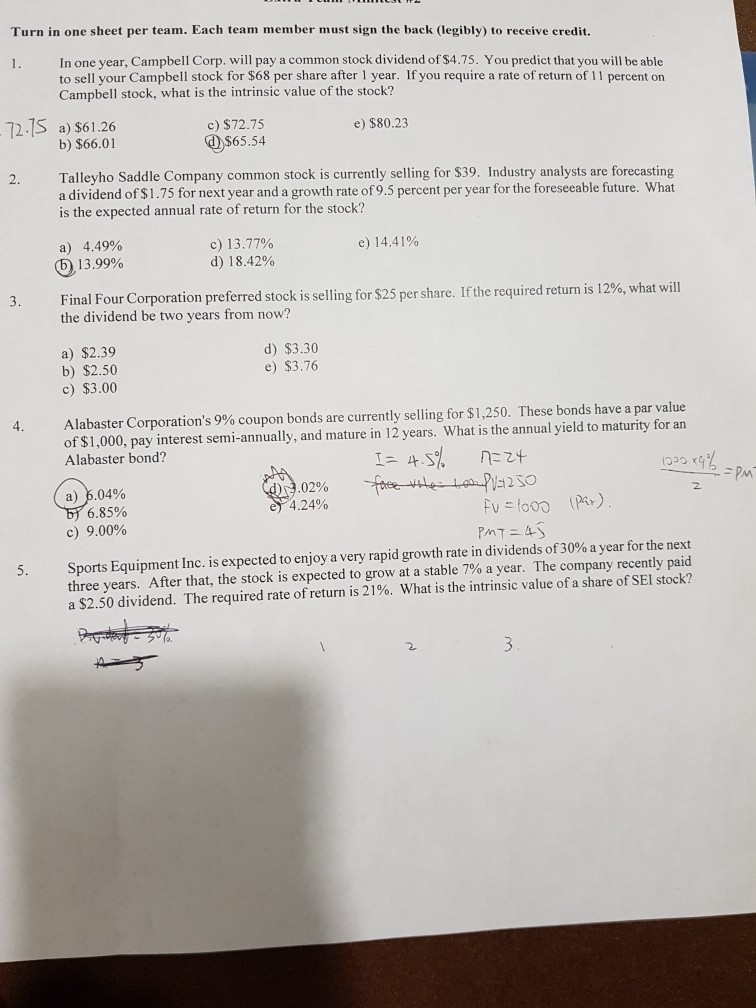

Turn in one sheet per team. Each team member must sign the back (legibly) to receive credit. 1. In one year, Campbell Corp. will pay a common stock dividend of $4.75. You predict that you will be able to sell your Campbell stock for $68 per share after 1 year. If you require a rate of return of 11 percent on Campbell stock, what is the intrinsic value of the stock? 72.1S a) $61.26 c) $72.75 65.54 e) $80.23 b) $66.01 Talleyho Saddle Company common stock is currently selling for $39. Industry analysts are forecasting a dividend of$1.75 for next year and a growth rate of9.5 percent per year for the foreseeable future. What is the expected annual rate of return for the stock? 2. a) 4.49% 0.1 3.99% c) 13.77% d) 18.42% e) 14.41% 3. Final Four Corporation preferred stock is selling for $25 per share. Ifthe required return is 1 2%, what will the dividend be two years from now? a) $2.39 b) $2.50 c) $3.00 d) $3.30 e) $3.76 Alabaster Corporation's 9% coupon bonds are currently selling for $1,250. These bonds have a par value of $1,000, pay interest semi-annually, and mature in 12 years. What is the annual yield to maturity for an Alabaster bond? 4 2 02% e) 4.24% a) 6,04% 2 6.85% c) 9.00% Sports Equipment Inc. is expected to enjoy a very rapid growth rate in dividends of30% a year for the next three years. After that, the stock is expected to grow at a stable 7% a year. The company recently paid a $2.50 dividend. The required rate ofreturn is 21%. What is the intrinsic value ofa share ofSEI stock? 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started