Please show step by step so I can better understand please. Thank You!

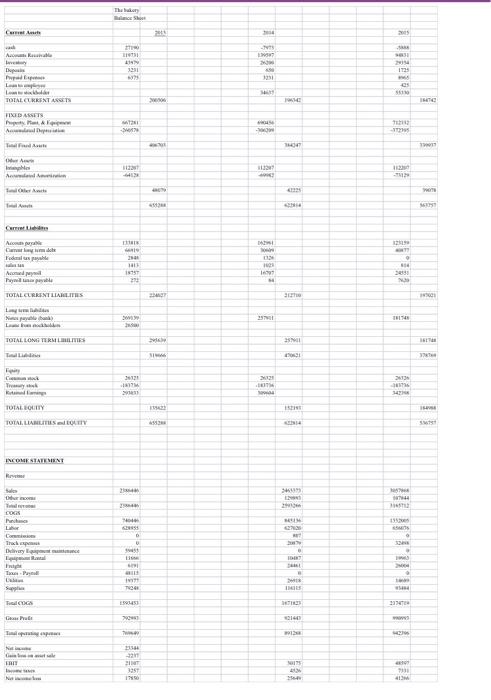

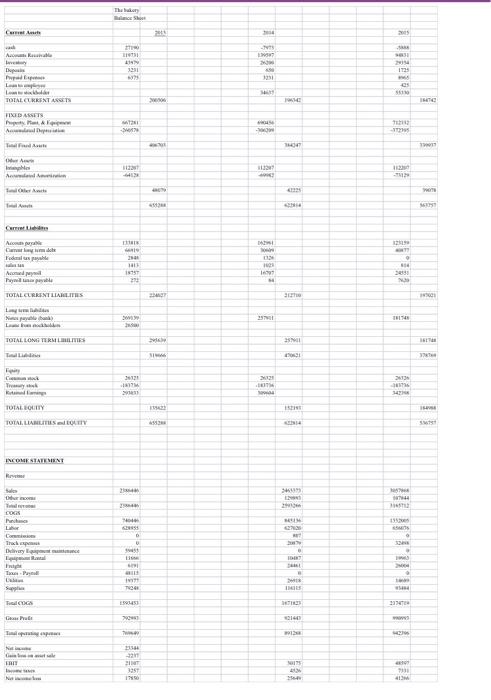

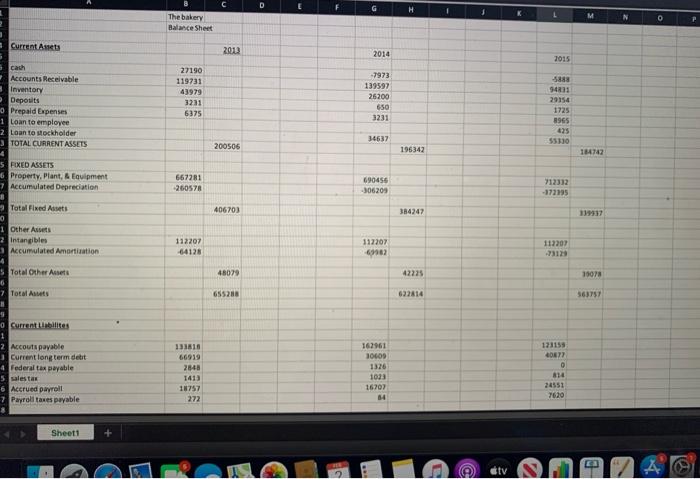

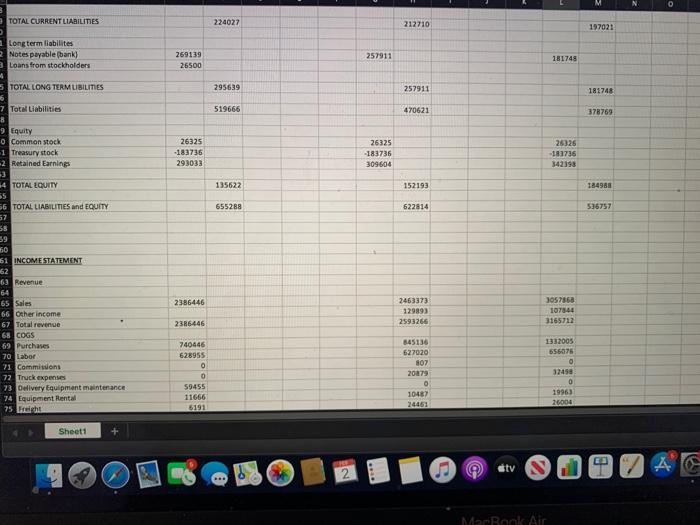

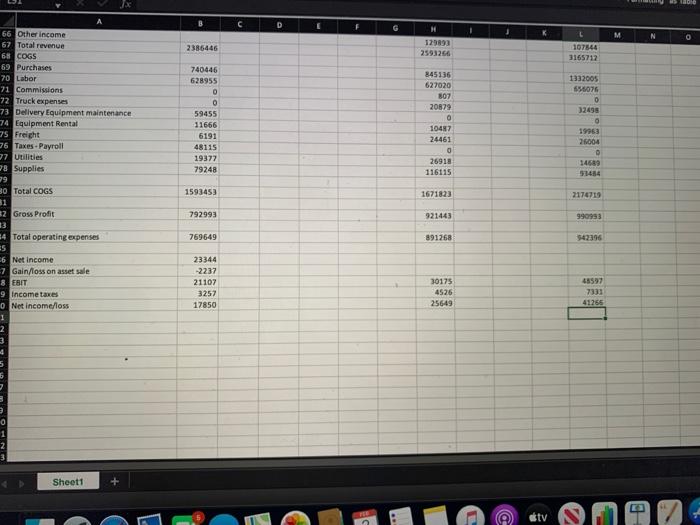

Case Financial Ratios A financial ratio analysis will spotlight potential issues that a business may not even be aware of. A good counselor follows several steps. The first is listening to the client's story. Make notes. The second step is performing a complete financial analysis. You must understand the ratios, and what they are telling you. There are many financial ratios, but not every ratio is needed in every case. However, there are several ratios that are needed in every instance. These include the liquidity ratios, both current and quick, the solvency ratio, debt to equity ratio, inventory turnover ratio, days receivable, and payables, and net profit ratio. Other ratios that may be needed, at your discretion on case by case basis, include: 1. Profitability Ratios A. ROA B. ROE C. COGS D. ROI 2. Efficiency Ratios A. Accounts receivable ratio B. Fixed asset turnover 3. Coverage Ratio A. Times interest earned B. Debt service ratio 4. Market Ratios A. Dividend yield B. P/E Ratio C. EPS D. Dividend Payout Ratio Analyze the company with the ratios you deem important to this case. The client has come to you for assistance. The owner wants to expand to another location in Raleigh. Should the owner continue on this venture? Elu AR Dop FELI 16 es Louie TOTAL CURRENT ASSETS FIXED ASSETS MORE - Taman LE E T! pe A Aco Dance Fadal urutt A wil v TOTAL CURRENT LARIS LOCE TWINS TOTAL LONG TERM LIVES INE 1 T C SNC . YE TOTALITY TOTAL LASTY INEME STATEMENT Sales M 04 . Com Trap Delivery Lane To FI Tul a SPO BE NE GP HION Tum -211 FRIT 15 3357 D H N 0 The bakery Balance Sheet Current Anets 2012 2014 2015 27190 119731 43979 3231 6375 -5888 9411 cach Accounts Receivable Inventory Deposits Prepaid Expenses 1 Loan to employee 2 Loan to stockholder TOTAL CURRENT ASSETS -7973 139597 26200 650 3231 29154 1725 1965 425 55110 3.4637 200506 196342 154742 FIXED ASSETS 6. Property. Plant Equipment 7 Accumulated Depreciation 667281 260578 690456 -306209 712312 -372195 406703 384247 Total Fixed Assets 0 1 Other Assets 2 Intangibles Accumulated Amortization 4 Total Other Assets 112207 64128 112207 69762 112207 -73120 48079 42225 11073 7 Total 655288 363757 123153 o current ability 1 2 Accouts payable Current long term debit Federal tax payable 5. salestas 6 Accrued payroll 2 Payroll taxes payable 131618 66919 2848 1413 18757 272 162961 0609 1326 1013 16707 34 O 814 7620 Sheet1 + ctv + A TOTAL CURRENT LIABILITIES 224027 212710 197021 Longterm liabilites 2 Notes payable bank) Loans from stockholders 257911 269139 26500 181748 5 TOTAL LONG TERM LIBILITIES 295639 257911 181748 7 Total Liabilities 519666 470621 378769 9 Equity 0 Common stock 1 Treasury stock 2 Retained Earnings 26325 -183735 293033 26325 -183736 309604 26326 181736 342118 4 TOTAL EQUITY 135622 152193 184983 655288 622814 536757 2386446 56 TOTAL LIABILITIES and EQUITY 57 55 59 160 61 INCOME STATEMENT 162 63 Revenue 64 65 Sales 66 Other income 67 Total revenue 68 COGS 69 Purchases 70 Labor 71 Commision 72 Truck expenses 73 Delivery Equipment maintenance 74 Equipment Rental 75 Leicht 2463373 129893 2591266 3057860 107844 3165712 2386446 740446 628955 0 0 59455 11666 5191 545136 627020 807 20879 0 10467 24461 1332005 656075 0 32458 0 1996) 26000 Sheet1 E or 2 ty MacBook Air X D F G H M 2385446 12993 2593266 107544 3165712 845136 627020 807 20879 1332005 696076 0 32495 740446 628955 0 0 59455 11666 6191 48115 19377 79248 10487 24461 0 26918 116115 19953 2004 0 14689 66 Other income 67 Total revenue 68 COGS 69 Purchases 70 Labor 21 Commissions 22 Truck expenses 73 Delivery Equipment maintenance 74 Equipment Rental 75 Freight 26 Takes - Payroll 27 Utilities 98 Supplies 29 30 Total COGS 31 32 Gross Profit 13 34 Total operating expenses ES 6 Net Income 7 Gain/loss on asset sale 8. EBIT 9 Income taxes 0 Net income/loss 1 2 3 1593453 1671823 2176710 792993 921443 990953 759649 891268 542396 23344 -2237 21107 3257 17850 30175 4526 25649 48597 7331 41255 0 1 2 3 Sheet1 tv Case Financial Ratios A financial ratio analysis will spotlight potential issues that a business may not even be aware of. A good counselor follows several steps. The first is listening to the client's story. Make notes. The second step is performing a complete financial analysis. You must understand the ratios, and what they are telling you. There are many financial ratios, but not every ratio is needed in every case. However, there are several ratios that are needed in every instance. These include the liquidity ratios, both current and quick, the solvency ratio, debt to equity ratio, inventory turnover ratio, days receivable, and payables, and net profit ratio. Other ratios that may be needed, at your discretion on case by case basis, include: 1. Profitability Ratios A. ROA B. ROE C. COGS D. ROI 2. Efficiency Ratios A. Accounts receivable ratio B. Fixed asset turnover 3. Coverage Ratio A. Times interest earned B. Debt service ratio 4. Market Ratios A. Dividend yield B. P/E Ratio C. EPS D. Dividend Payout Ratio Analyze the company with the ratios you deem important to this case. The client has come to you for assistance. The owner wants to expand to another location in Raleigh. Should the owner continue on this venture? Elu AR Dop FELI 16 es Louie TOTAL CURRENT ASSETS FIXED ASSETS MORE - Taman LE E T! pe A Aco Dance Fadal urutt A wil v TOTAL CURRENT LARIS LOCE TWINS TOTAL LONG TERM LIVES INE 1 T C SNC . YE TOTALITY TOTAL LASTY INEME STATEMENT Sales M 04 . Com Trap Delivery Lane To FI Tul a SPO BE NE GP HION Tum -211 FRIT 15 3357 D H N 0 The bakery Balance Sheet Current Anets 2012 2014 2015 27190 119731 43979 3231 6375 -5888 9411 cach Accounts Receivable Inventory Deposits Prepaid Expenses 1 Loan to employee 2 Loan to stockholder TOTAL CURRENT ASSETS -7973 139597 26200 650 3231 29154 1725 1965 425 55110 3.4637 200506 196342 154742 FIXED ASSETS 6. Property. Plant Equipment 7 Accumulated Depreciation 667281 260578 690456 -306209 712312 -372195 406703 384247 Total Fixed Assets 0 1 Other Assets 2 Intangibles Accumulated Amortization 4 Total Other Assets 112207 64128 112207 69762 112207 -73120 48079 42225 11073 7 Total 655288 363757 123153 o current ability 1 2 Accouts payable Current long term debit Federal tax payable 5. salestas 6 Accrued payroll 2 Payroll taxes payable 131618 66919 2848 1413 18757 272 162961 0609 1326 1013 16707 34 O 814 7620 Sheet1 + ctv + A TOTAL CURRENT LIABILITIES 224027 212710 197021 Longterm liabilites 2 Notes payable bank) Loans from stockholders 257911 269139 26500 181748 5 TOTAL LONG TERM LIBILITIES 295639 257911 181748 7 Total Liabilities 519666 470621 378769 9 Equity 0 Common stock 1 Treasury stock 2 Retained Earnings 26325 -183735 293033 26325 -183736 309604 26326 181736 342118 4 TOTAL EQUITY 135622 152193 184983 655288 622814 536757 2386446 56 TOTAL LIABILITIES and EQUITY 57 55 59 160 61 INCOME STATEMENT 162 63 Revenue 64 65 Sales 66 Other income 67 Total revenue 68 COGS 69 Purchases 70 Labor 71 Commision 72 Truck expenses 73 Delivery Equipment maintenance 74 Equipment Rental 75 Leicht 2463373 129893 2591266 3057860 107844 3165712 2386446 740446 628955 0 0 59455 11666 5191 545136 627020 807 20879 0 10467 24461 1332005 656075 0 32458 0 1996) 26000 Sheet1 E or 2 ty MacBook Air X D F G H M 2385446 12993 2593266 107544 3165712 845136 627020 807 20879 1332005 696076 0 32495 740446 628955 0 0 59455 11666 6191 48115 19377 79248 10487 24461 0 26918 116115 19953 2004 0 14689 66 Other income 67 Total revenue 68 COGS 69 Purchases 70 Labor 21 Commissions 22 Truck expenses 73 Delivery Equipment maintenance 74 Equipment Rental 75 Freight 26 Takes - Payroll 27 Utilities 98 Supplies 29 30 Total COGS 31 32 Gross Profit 13 34 Total operating expenses ES 6 Net Income 7 Gain/loss on asset sale 8. EBIT 9 Income taxes 0 Net income/loss 1 2 3 1593453 1671823 2176710 792993 921443 990953 759649 891268 542396 23344 -2237 21107 3257 17850 30175 4526 25649 48597 7331 41255 0 1 2 3 Sheet1 tv