please show steps. correct answers are given. thanks!

please show steps. correct answers are given. thanks!

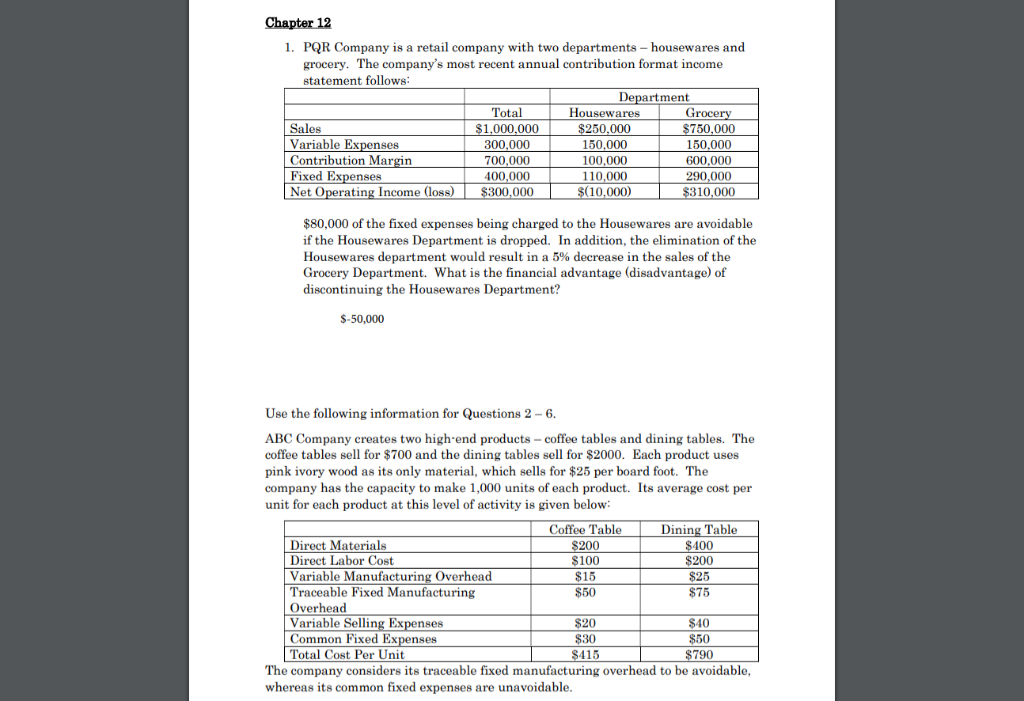

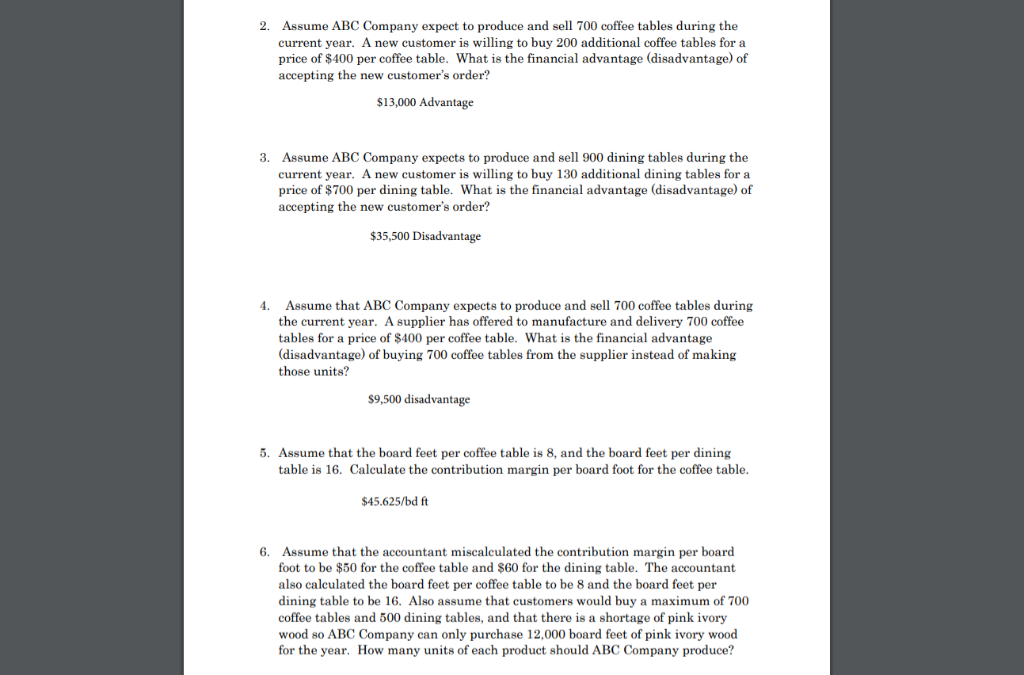

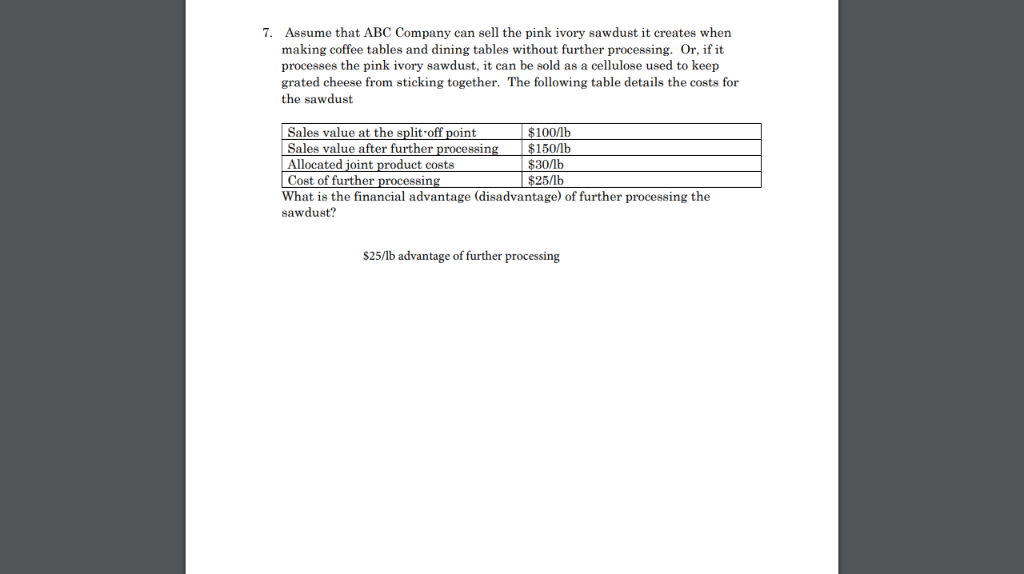

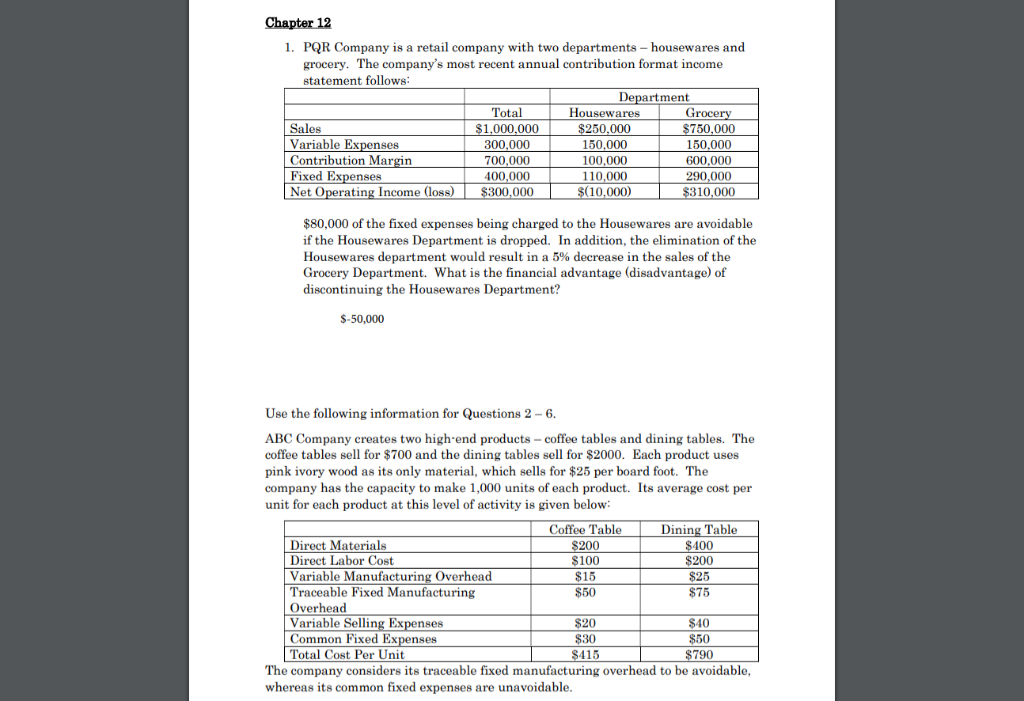

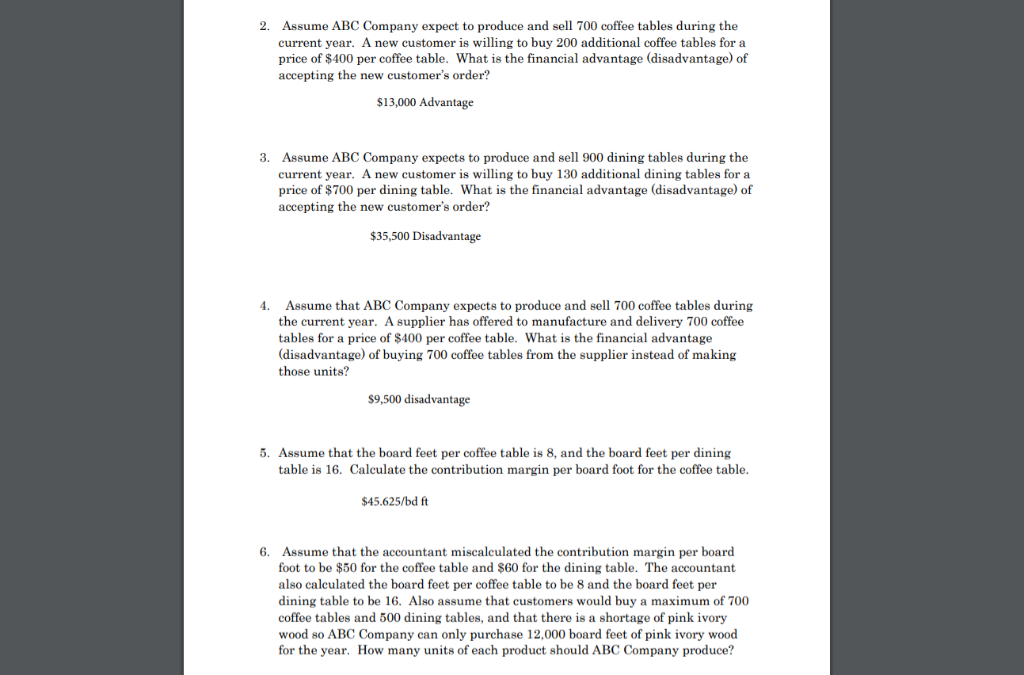

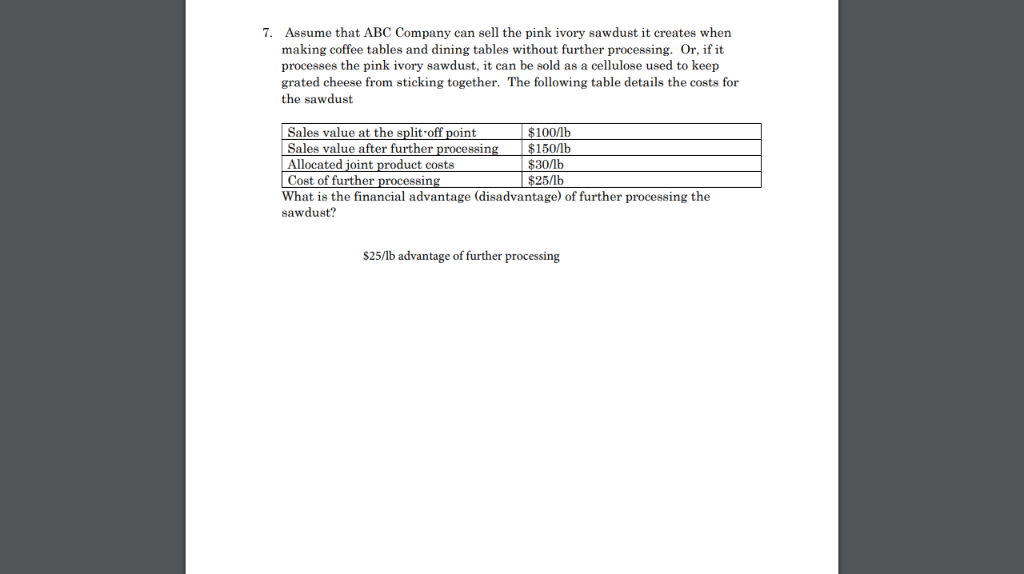

Chapter 12 1. PQR Company is a retail company with two departments housewares and grocery. The company's most recent annual contribution format income statement follows Department Sales Variable Expenses Contribution Margin Fixed Expenses Net Operating Income (loss) Total 1,000,000 300,000 700,000 400,000 $300,000 Housewares $250,000 150,000 100,000 110,000 (10,000) rocer $750,000 150,000 600,000 310,000 $80,000 of the fixed expenses being charged to the Housewares are avoidable if the Housewares Department is dropped. In addition, the elimination of the Housewares department would result in a 5% decrease in the sales of the Grocery Department. What is the financial advantage (disadvantage) of discontinuing the Housewares Department? -50,000 Use the following information for Questions 2-6. ABC Company creates two high end products coffee tables and dining tables. The coffee tables sell for $700 and the dining tables sell for $2000. Each product uses pink ivory wood as its only material, which sells for $25 per board foot. The company has the capacity to make 1,000 units of each product. Its average cost per unit for each product at this level of activity is given below: Coffee Table 200 $100 $15 $50 Dining Table 100 $200 $25 $75 Direct Materials Direct Labor Cost Variable Manufacturing Overhead Traceable Fixed Manufacturing Overhead Variable Selling Expenses Common Fixed Expenses Total Cost Per Unit $20 $30 $40 $50 790 115 The company considers its traceable fixed manufacturing overhead to be avoidable whereas its common fixed expenses are unavoidable Assume ABC Company expect to produce and sell 700 coffee tables during the current year. A new customer is willing to buy 200 additional coffee tables for a price of $400 per coffee table. What is the financial advantage (disadvantage) of accepting the new customer's order? 2. $13,000 Advantage Assume ABC Company expects to produce and sell 900 dining tables during the current year. A new customer is willing to buy 130 additional dining tables for a price of $700 per dining table. What is the financial advantage (disadvantage) of accepting the new customer's order? 3. 35,500 Disadvantage Assume that ABC Company expects to produce and sell 700 coffee tables during the current year. A supplier has offered to manufacture and delivery 700 coffee tables for a price of $400 per coffee table. What is the financial advantage (disadvantage) of buying 700 coffee tables from the supplier instead of making those units? 4. s9,500 disadvantage 5. Assume that the board feet per coffee table is 8, and the board feet per dining table is 16. Calculate the contribution margin per board foot for the coffee table. $45.625/bd ft 6. Assume that the accountant miscalculated the contribution margin per board foot to be $50 for the coffee table and $60 for the dining table. The accountant also calculated the board feet per coffee table to be 8 and the board feet per dining table to be 16. Also assume that customers would buy a maximum of 700 coffee tables and 500 dining tables, and that there is a shortage of pink ivory wood so ABC Company can only purchase 12,000 board feet of pink ivory wood for the year. How many units of each product should ABC Company produce? 7. Assume that ABC Company can sell the pink ivory sawdust it creates when making coffee tables and dining tables without further processing. Or, if it processes the pink ivory sawdust, it can be sold as a cellulose used to keep grated cheese from sticking together. The following table details the costs for the sawdust Sales value at the split-off point Sales value after further processin Allocated joint Cost of further What is the financial advantage (disadvantage) of further processing the sawdust? 100lb 150/lb 30lb uct costs sin $25/1b $25/lb advantage of further processing

please show steps. correct answers are given. thanks!

please show steps. correct answers are given. thanks!