Answered step by step

Verified Expert Solution

Question

1 Approved Answer

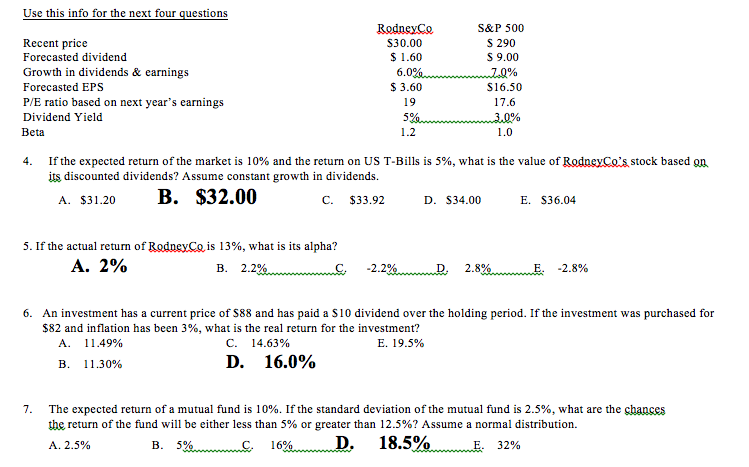

please show steps for #5,7 Use this info for the next four questions RodneyCo S30.00 1.60 S&P 500 S 290 S9.00 Recent price Forecasted dividend

please show steps for #5,7

Use this info for the next four questions RodneyCo S30.00 1.60 S&P 500 S 290 S9.00 Recent price Forecasted dividend Growth in dividends & earnings Forecasted EPS P/E ratio based on next year's earnings Dividend Yield Beta S 3.60 S16.50 17.6 1.2 4. If the expected return of the market is 10% and the return on US T-Bills is 5%, what is the value of RodneyCoS stock based its discounted dividends? Assume constant growth in dividends. A. $31.20 B. S32.00 C. $33.92 D. S34.00 E. S36.04 5. If the actual return of Bodney:Ce.is 13%, what is its alpha? 2.8%wwwwwE. -2.8% 6. An investment has a current price of S88 and has paid a S10 dividend over the holding period. If the investment was purchased for $82 and inflation has been 3%, what is the real return for the investment? A. 11.49% C. 14.63% E. 19.5% B. 11.30% D. 16.0% 7. The expected return of a mutual fund is 10%. If the standard deviation of the mutual fund is 2.5%, what are the chances the return of the fund will be either less than 5% or greater than 12.5%? Assume a normal distribution. A. 2.5% B. 5 16 D. 18.5% 32%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started