please show steps for question a,b,c

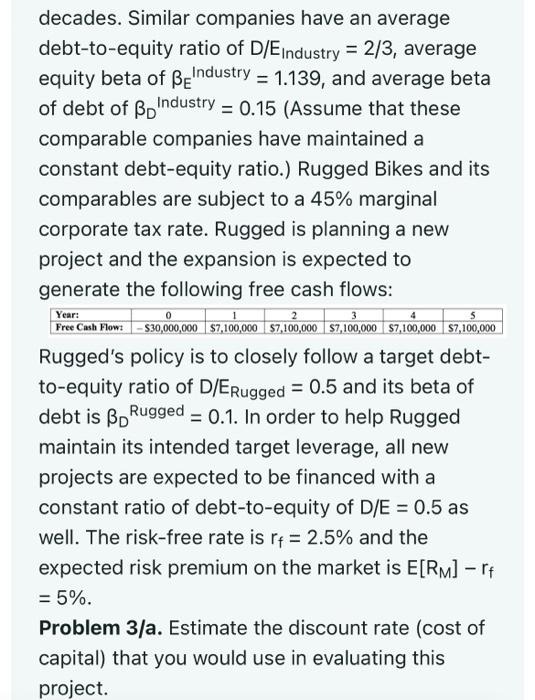

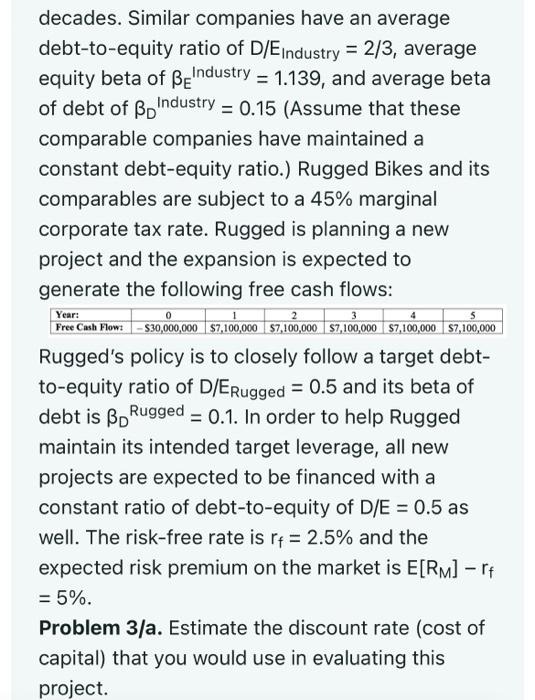

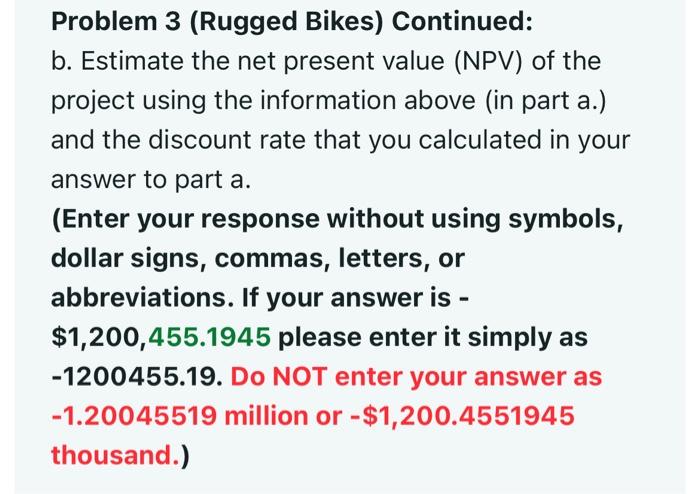

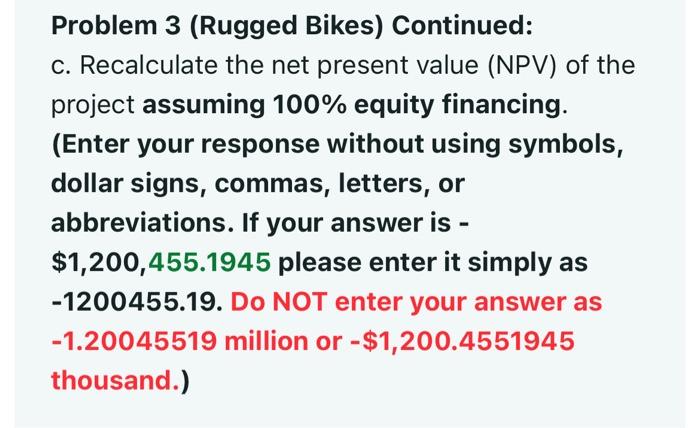

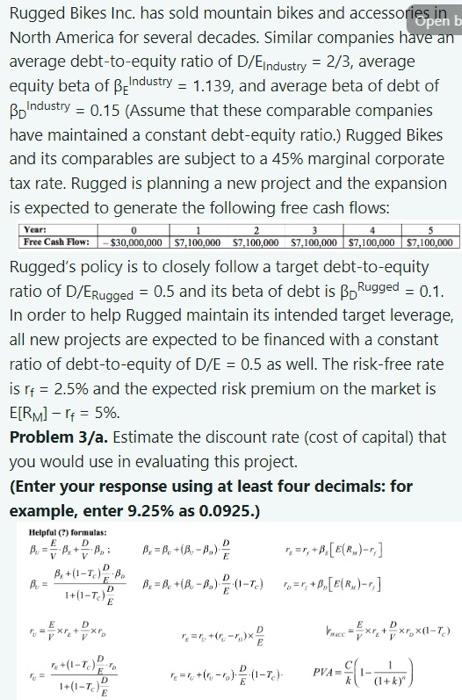

Problem 3 (Rugged Bikes) Continued: c. Recalculate the net present value (NPV) of the project assuming 100% equity financing. (Enter your response without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $1,200,455.1945 please enter it simply as -1200455.19. Do NOT enter your answer as -1.20045519 million or $1,200.4551945 thousand.) Problem 3 (Rugged Bikes) Continued: b. Estimate the net present value (NPV) of the project using the information above (in part a.) and the discount rate that you calculated in your answer to part a. (Enter your response without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $1,200,455.1945 please enter it simply as -1200455.19. Do NOT enter your answer as -1.20045519 million or $1,200.4551945 thousand.) decades. Similar companies have an average debt-to-equity ratio of D/EIndustry=2/3, average equity beta of EIndustry=1.139, and average beta of debt of DIndustry=0.15 (Assume that these comparable companies have maintained a constant debt-equity ratio.) Rugged Bikes and its comparables are subject to a 45% marginal corporate tax rate. Rugged is planning a new project and the expansion is expected to generate the following free cash flows: Rugged's policy is to closely follow a target debtto-equity ratio of D/ERugged=0.5 and its beta of debt is DRugged=0.1. In order to help Rugged maintain its intended target leverage, all new projects are expected to be financed with a constant ratio of debt-to-equity of D/E=0.5 as well. The risk-free rate is rf=2.5% and the expected risk premium on the market is E[RM]rf =5%. Problem 3/a. Estimate the discount rate (cost of capital) that you would use in evaluating this project. Rugged Bikes Inc. has sold mountain bikes and accessofies in North America for several decades. Similar companies have an average debt-to-equity ratio of D/EIndustry=2/3, average equity beta of EIndustry=1.139, and average beta of debt of DIndustry=0.15 (Assume that these comparable companies have maintained a constant debt-equity ratio.) Rugged Bikes and its comparables are subject to a 45% marginal corporate tax rate. Rugged is planning a new project and the expansion is expected to generate the following free cash flows: Rugged's policy is to closely follow a target debt-to-equity ratio of D/ERugged=0.5 and its beta of debt is D Rugged =0.1. In order to help Rugged maintain its intended target leverage, all new projects are expected to be financed with a constant ratio of debt-to-equity of D/E=0.5 as well. The risk-free rate is rf=2.5% and the expected risk premium on the market is E[RM]rf=5%. Problem 3/a. Estimate the discount rate (cost of capital) that you would use in evaluating this project. (Enter your response using at least four decimals: for example, enter 9.25% as 0.0925 .) e=1+(1Tc)EDs+(1Tc)EDec=c+(cs)ED(1Tc)rb=rc+p[E(Ru)rf]rb=VEre+VDrDrc=rs+(rcrD)EDrnecc=VErc+VDrD(1Tc)re=1+(1Tc)EDre+(1Tc)EDTbrc=re+(rcr0)ED(1Tc).PVA=kC(1(1+k)n1)