Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show steps I. What is the standard deviation for a stock that has had annual returns over the last three years of 8%, 14%

please show steps

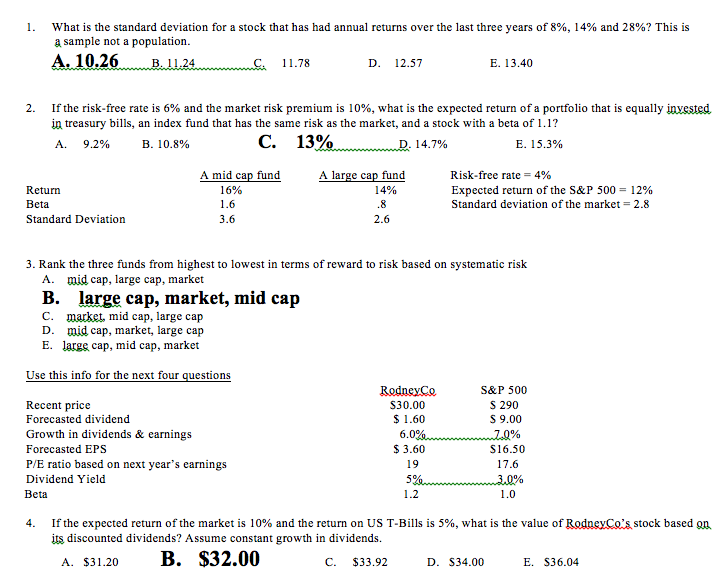

I. What is the standard deviation for a stock that has had annual returns over the last three years of 8%, 14% and 28%? This is a sample not a population. 10.26 24 11.78 D. 12.57 E. 13.40 2. If the risk-free rate is 6% and the market risk premium is 10%, what is the expected return of a portfolio that is equally invested in treasury bills, an index fund that has the same risk as the market, and a stock with a beta of 1.1? A. 9.2% C. 13% 14.7% B. 10.8% E. 15.3% A mid cap fund A large cap fund Risk-free rate 4% Expected return of the S&P 500-12% Standard deviation of the market- 2.8 16% Return Beta Standard Deviation 14% 3. Rank the three funds from highest to lowest in terms of reward to risk based on systematic risk A. B. c. D. E. mid cap, large cap, market large cap, market, mid cap market, mid cap, large cap mid cap, market, large cap largg cap, mid cap, market Use this info for the next four questions RodneyCo S30.00 $1.60 S&P 500 S 290 S 9.00 Recent price Forecasted dividend Growth in dividends & earnings Forecasted EPS P/E ratio based on next year's earnings Dividend Yield Beta $3.60 S16.50 17.6 4. If the expected return of the market is 10% and the return on US T-Bills is 5%, what is the value of RodneyCoS stock based on its discounted dividends? Assume constant growth in dividends. A. $31.20 B. S32.00 C. $33.92 D. S34.00 E. S36.04Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started