Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show steps that lead to the answer The following example serves to explain the application of ratio analysis and interpretation: The financial statements of

Please show steps that lead to the answer

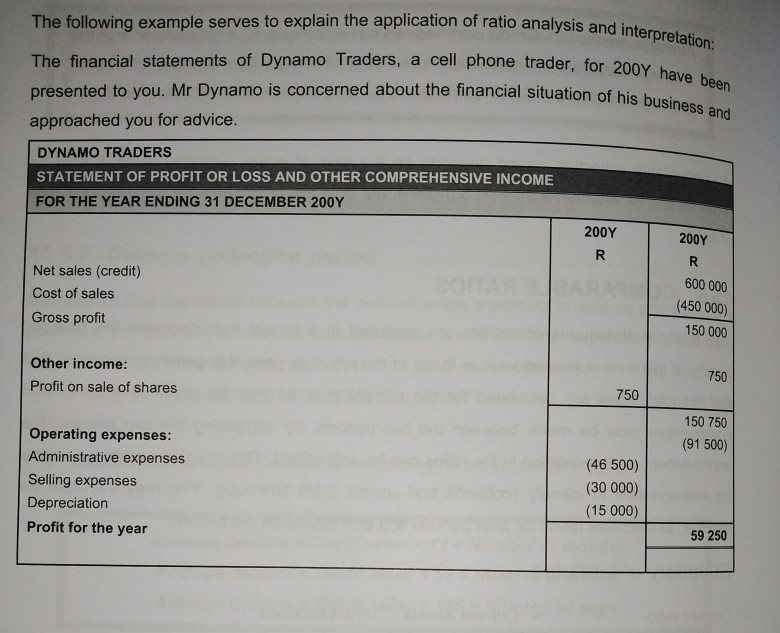

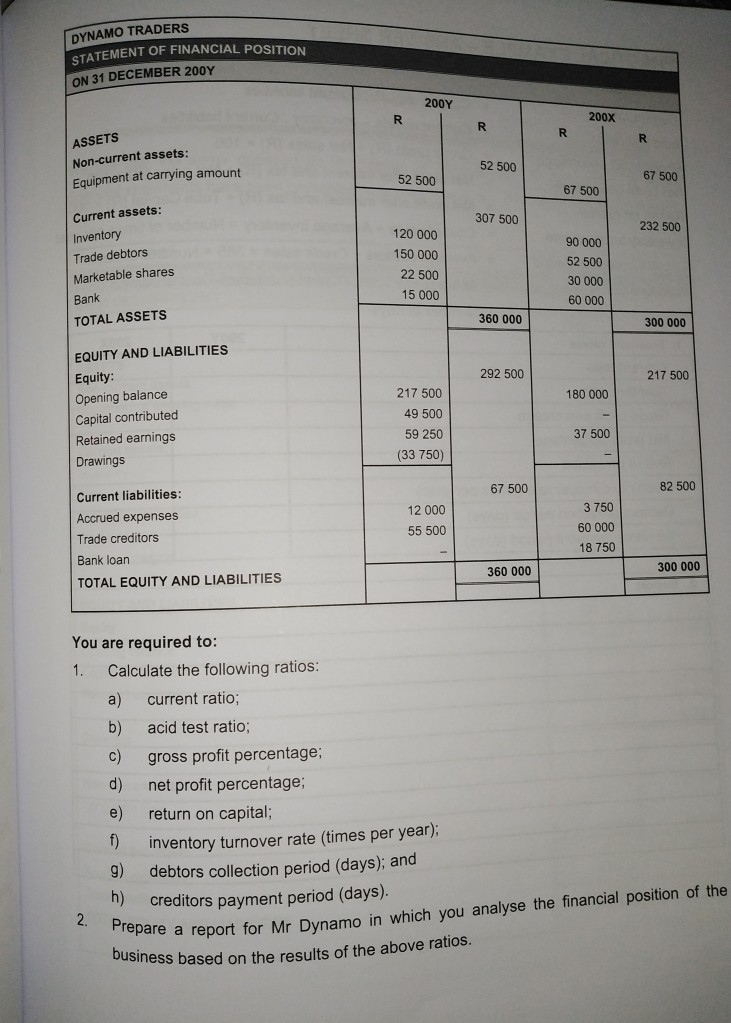

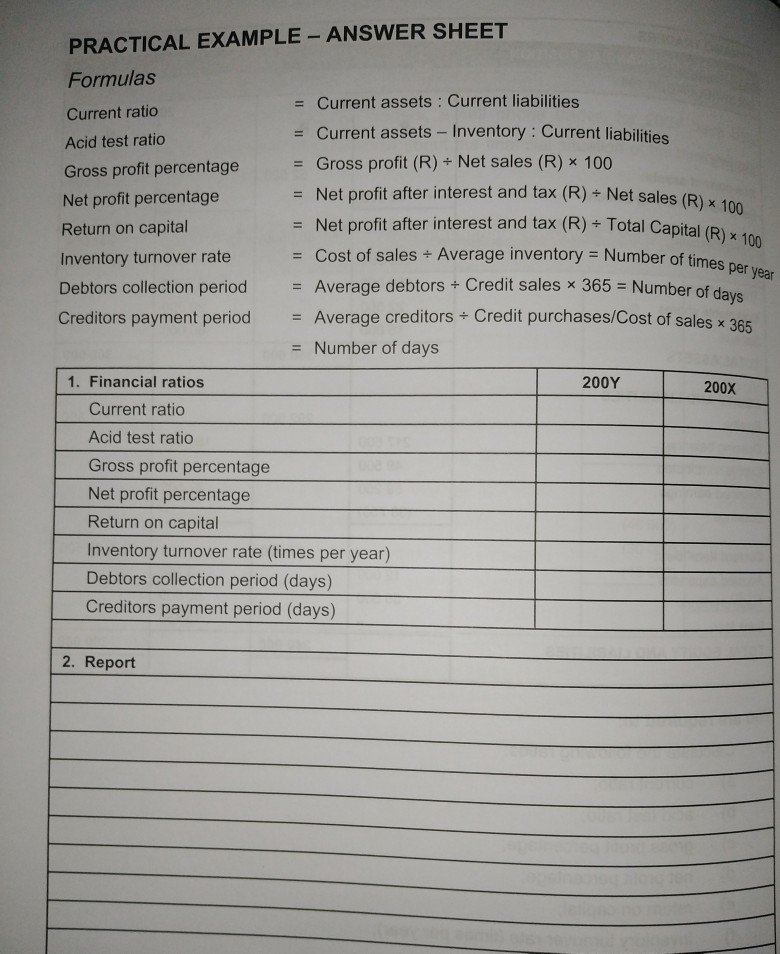

The following example serves to explain the application of ratio analysis and interpretation: The financial statements of Dynamo Traders, a cell phone trader, for 200Y have been presented to you. Mr Dynamo is concerned about the financial situation of his business and approached you for advice. DYNAMO TRADERS STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDING 31 DECEMBER 200Y 200Y 200Y 20 R Net sales (credit) Cost of sales Gross profit 600 000 (450 000) 150 000 Other income: Profit on sale of shares 750 750 150 750 (91 500) Operating expenses: Administrative expenses Selling expenses Depreciation Profit for the year (46 500) (30 000) (15 000) 59 250 business based on the results of the above ratios. DYNAMO TRADERS STATEMENT OF FINANCIAL POSITION ON 31 DECEMBER 2007 200Y R 2007 R R R ASSETS Non-current assets: 52 500 Equipment at carrying amount 52 500 67 500 67 500 307 500 232 500 Current assets: Inventory Trade debtors Marketable shares Bank TOTAL ASSETS 120 000 150 000 22 500 15 000 90 000 52 500 30 000 60 000 360 000 300 000 292 500 217 500 180 000 EQUITY AND LIABILITIES Equity: Opening balance Capital contributed Retained earnings Drawings 217 500 49 500 59 250 (33 750) 37 500 67 500 82 500 12 000 55 500 Current liabilities: Accrued expenses Trade creditors Bank loan TOTAL EQUITY AND LIABILITIES 3750 60 000 18 750 360 000 300 000 You are required to: 1. Calculate the following ratios: a) current ratio; b) acid test ratio; c) gross profit percentage; d) net profit percentage; e) return on capital; f) inventory turnover rate (times per year); 9) debtors collection period (days); and h) creditors payment period (days). 2. Prepare a report for Mr Dynamo in which you analyse the financial position of the = Net profit after interest and tax (R) + Total Capital (R) x 100 = Cost of sales - Average inventory = Number of times per year PRACTICAL EXAMPLE - ANSWER SHEET Formulas = Current assets : Current liabilities Current ratio = Current assets - Inventory: Current liabilities Acid test ratio Gross profit percentage = Gross profit (R) + Net sales (R) 100 Net profit percentage = Net profit after interest and tax (R) + Net sales (R) x 100 Return on capital Inventory turnover rate Debtors collection period = Average debtors + Credit sales * 365 = Number of days Creditors payment period Average creditors + Credit purchases/Cost of sales * 365 = Number of days 1. Financial ratios 200Y Current ratio 11 200X Acid test ratio Gross profit percentage Net profit percentage Return on capital Inventory turnover rate (times per year) Debtors collection period (days) Creditors payment period (days) 2. ReportStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started