Please show steps/work with formulas or excel

Please show steps/work with formulas or excel

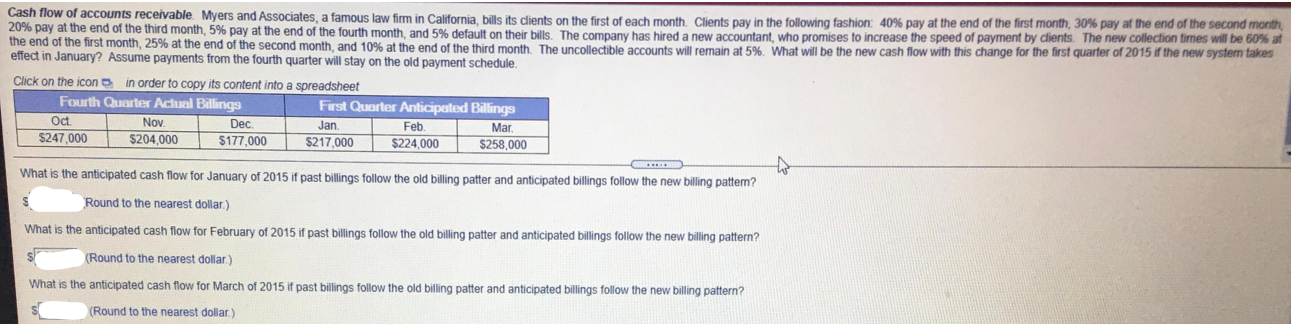

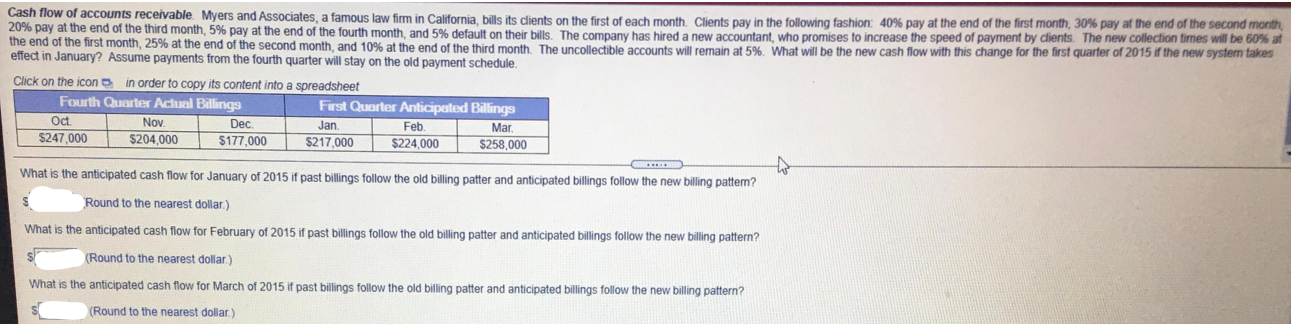

Cash flow of accounts receivable. Myers and Associates, a famous law firm in California, bills its clients on the first of each month. Clients pay in the following fashion: 40% pay at the end of the first month, 30% pay at the end of the second month, 20% pay at the end of the third month, 5% pay at the end of the fourth month, and 5% default on their bills. The company has hired a new accountant, who promises to increase the speed of payment by clients. The new collection times will be 60% af the end of the first month, 25% at the end of the second month, and 10% at the end of the third month. The uncollectible accounts will remain at 5%. What will be the new cash flow with this change for the first quarter of 2015 if the new system takes effect in January? Assume payments from the fourth quarter will stay on the old payment schedule. Click on the icon in order to copy its content into a spreadsheet Fourth Quarter Actual Billings First Quarter Anticipated Billings Oct. Nov Dec Jan. Feb. Mar $247,000 $204,000 $177,000 $217,000 $224,000 $258,000 What is the anticipated cash flow for January of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern? Round to the nearest dollar.) What is the anticipated cash flow for February of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern? (Round to the nearest dollar) What is the anticipated cash flow for March of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern? (Round to the nearest dollar) Cash flow of accounts receivable. Myers and Associates, a famous law firm in California, bills its clients on the first of each month. Clients pay in the following fashion: 40% pay at the end of the first month, 30% pay at the end of the second month, 20% pay at the end of the third month, 5% pay at the end of the fourth month, and 5% default on their bills. The company has hired a new accountant, who promises to increase the speed of payment by clients. The new collection times will be 60% af the end of the first month, 25% at the end of the second month, and 10% at the end of the third month. The uncollectible accounts will remain at 5%. What will be the new cash flow with this change for the first quarter of 2015 if the new system takes effect in January? Assume payments from the fourth quarter will stay on the old payment schedule. Click on the icon in order to copy its content into a spreadsheet Fourth Quarter Actual Billings First Quarter Anticipated Billings Oct. Nov Dec Jan. Feb. Mar $247,000 $204,000 $177,000 $217,000 $224,000 $258,000 What is the anticipated cash flow for January of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern? Round to the nearest dollar.) What is the anticipated cash flow for February of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern? (Round to the nearest dollar) What is the anticipated cash flow for March of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern? (Round to the nearest dollar)

Please show steps/work with formulas or excel

Please show steps/work with formulas or excel