Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the answers for a, b and c parts Part B Three companies ET plc, Ant plc, Tiger plc operate in the same type

Please show the answers for a, b and c parts

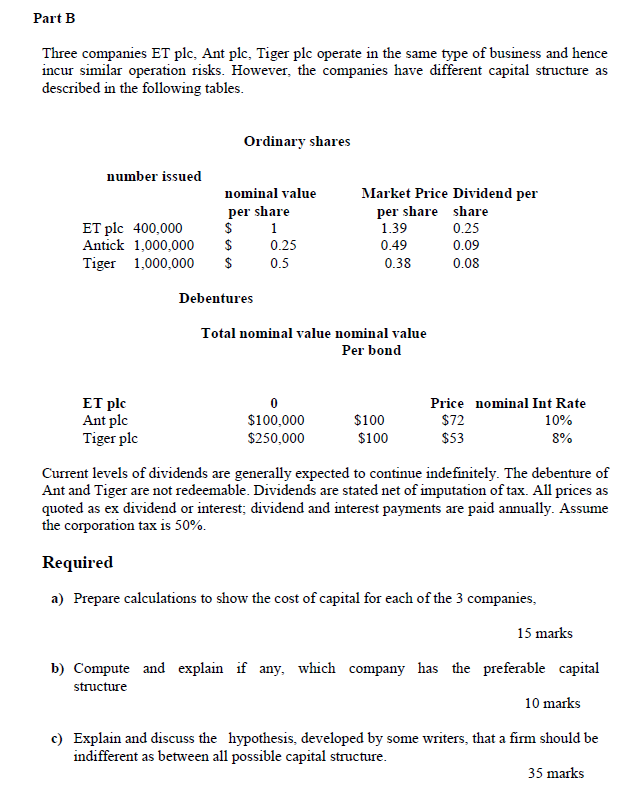

Part B Three companies ET plc, Ant plc, Tiger plc operate in the same type of business and hence incur similar operation risks. However, the companies have different capital structure as described in the following tables. Ordinary shares number issued ET plc 400,000 Antick 1,000,000 Tiger 1,000,000 nominal value per share $ 1 $ 0.25 $ 0.5 Market Price Dividend per per share share 1.39 0.25 0.49 0.09 0.38 0.08 Debentures Total nominal value nominal value Per bond ET plc 0 Price nominal Int Rate Ant plc $100,000 $100 $72 10% Tiger plc $250,000 $100 $53 8% Current levels of dividends are generally expected to continue indefinitely. The debenture of Ant and Tiger are not redeemable. Dividends are stated net of imputation of tax. All prices as quoted as ex dividend or interest; dividend and interest payments are paid annually. Assume the corporation tax is 50%. Required a) Prepare calculations to show the cost of capital for each of the 3 companies, 15 marks b) Compute and explain if any, which company has the preferable capital structure 10 marks c) Explain and discuss the hypothesis, developed by some writers, that a firm should be indifferent as between all possible capital structure. 35 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started