Answered step by step

Verified Expert Solution

Question

1 Approved Answer

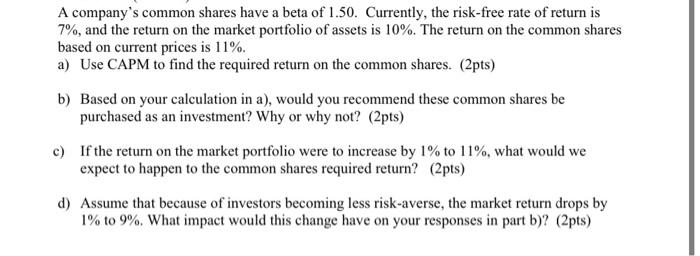

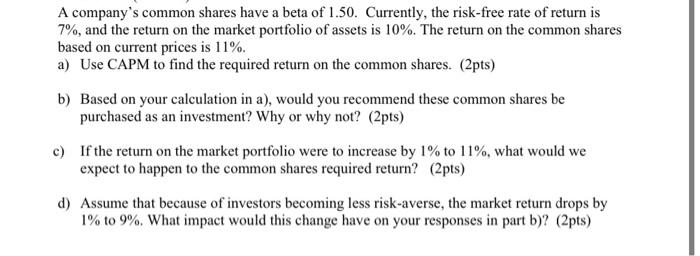

please show the calculations (without excel) A company's common shares have a beta of 1.50. Currently, the risk-free rate of return is 7%, and the

please show the calculations (without excel)

A company's common shares have a beta of 1.50. Currently, the risk-free rate of return is 7%, and the return on the market portfolio of assets is 10%. The return on the common shares based on current prices is 11%. a) Use CAPM to find the required return on the common shares. (2pts) b) Based on your calculation in a), would you recommend these common shares be purchased as an investment? Why or why not? (2pts) c) If the return on the market portfolio were to increase by 1% to 11%, what would we expect to happen to the common shares required return? (2pts) d) Assume that because of investors becoming less risk-averse, the market return drops by 1% to 9%. What impact would this change have on your responses in part b)? (2pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started