Please show the equations used.

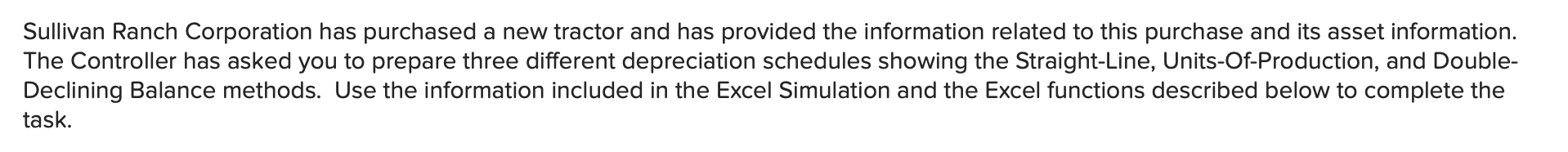

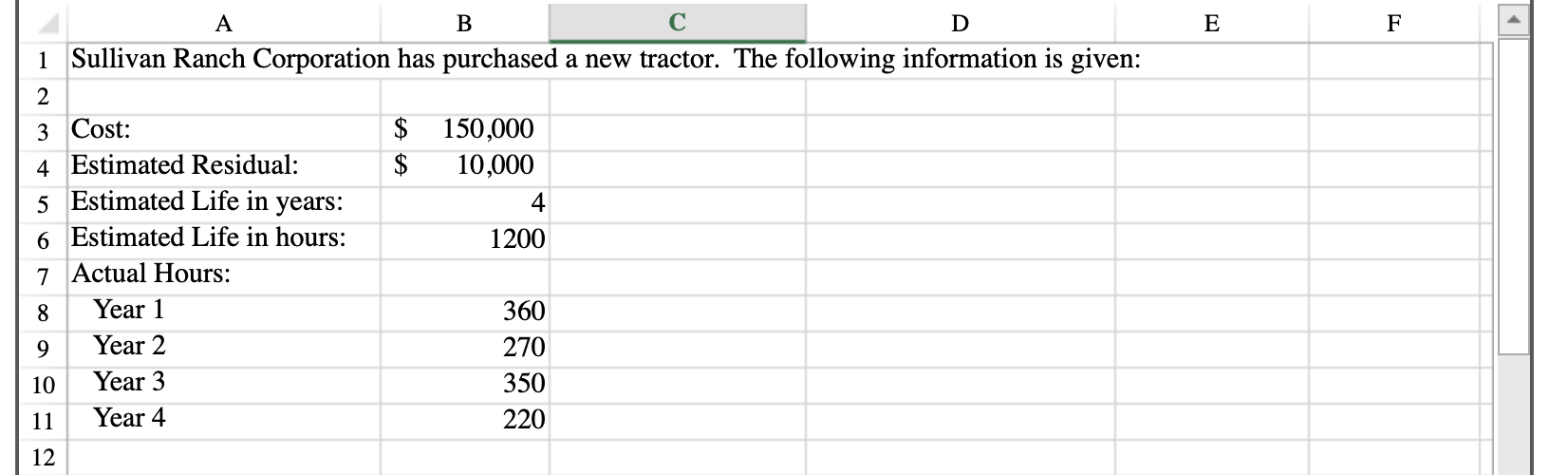

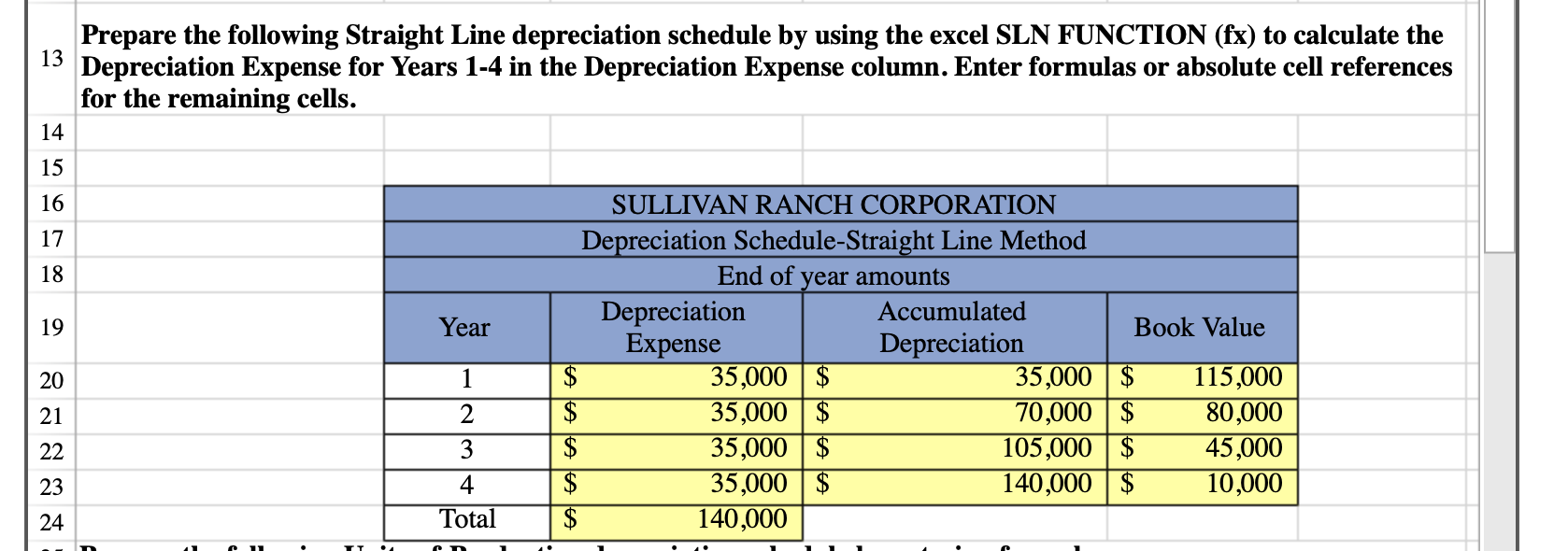

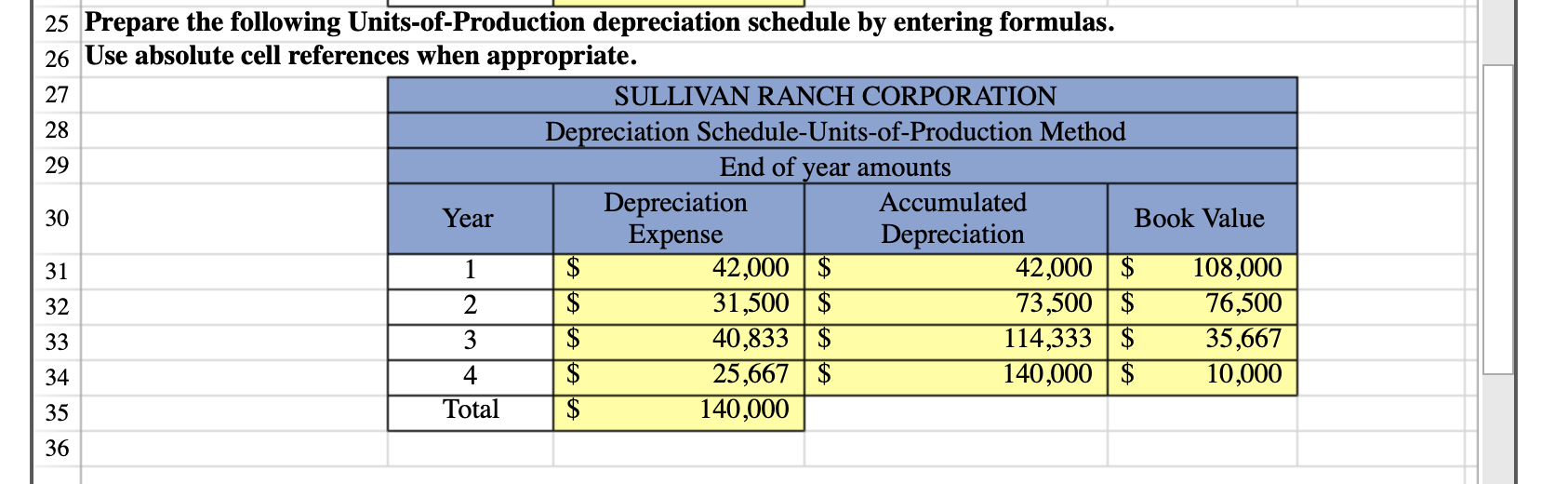

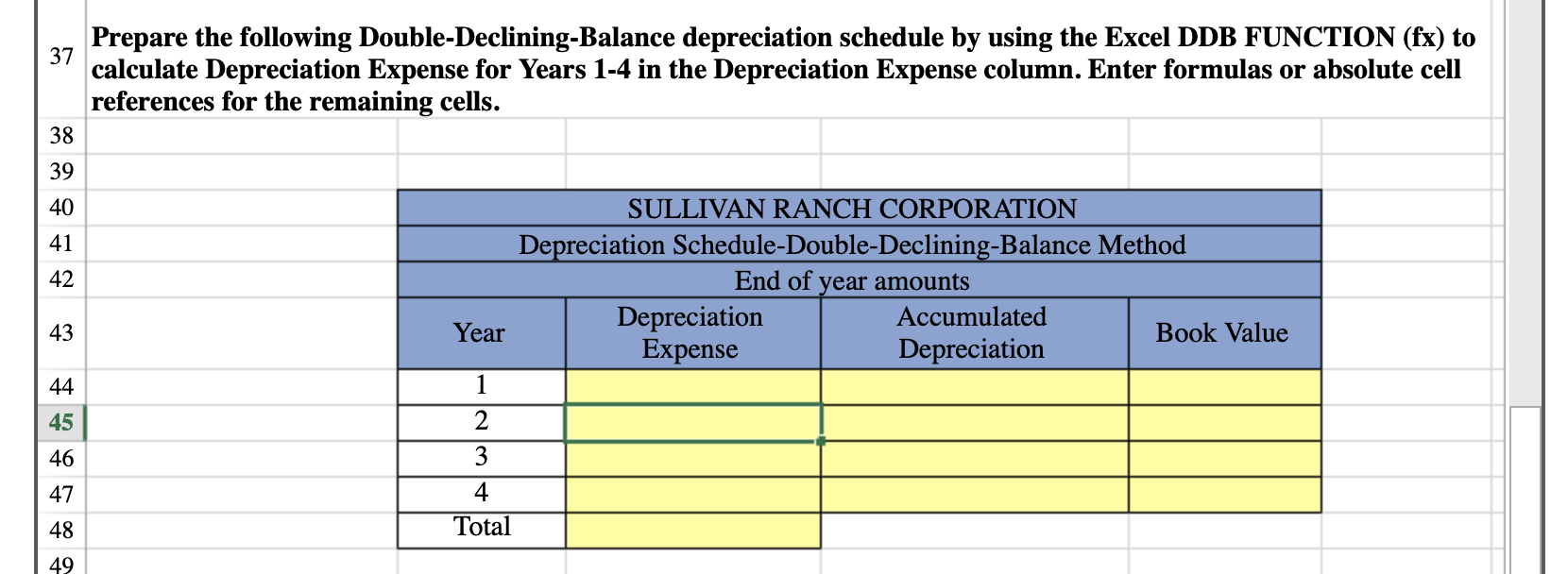

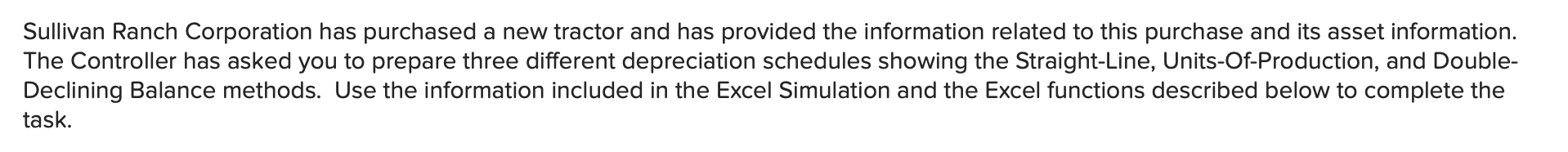

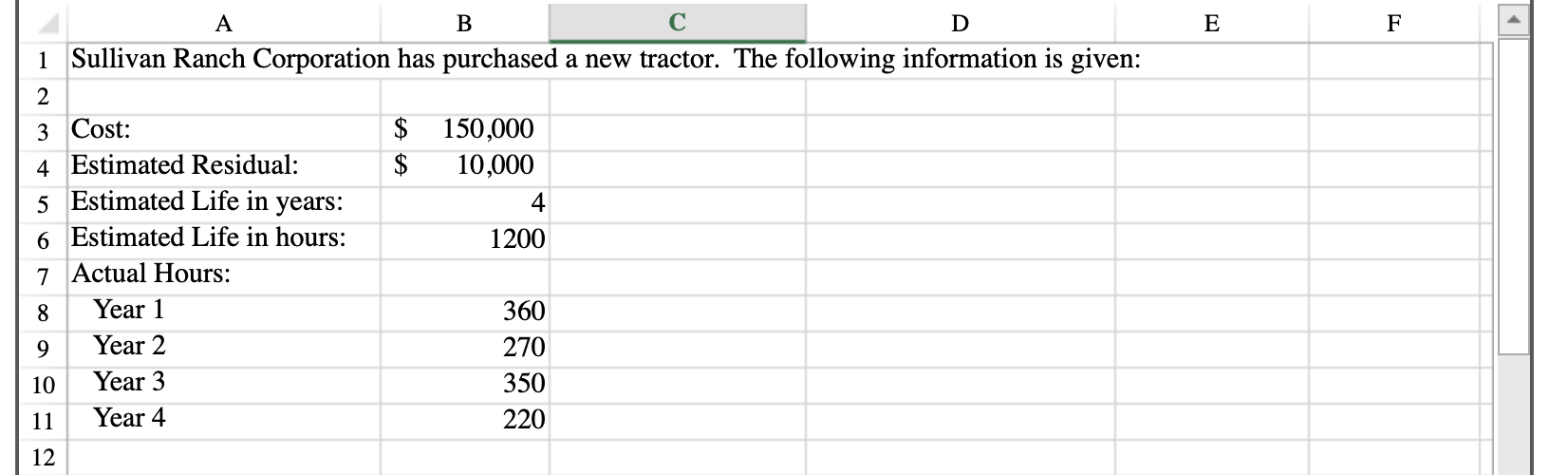

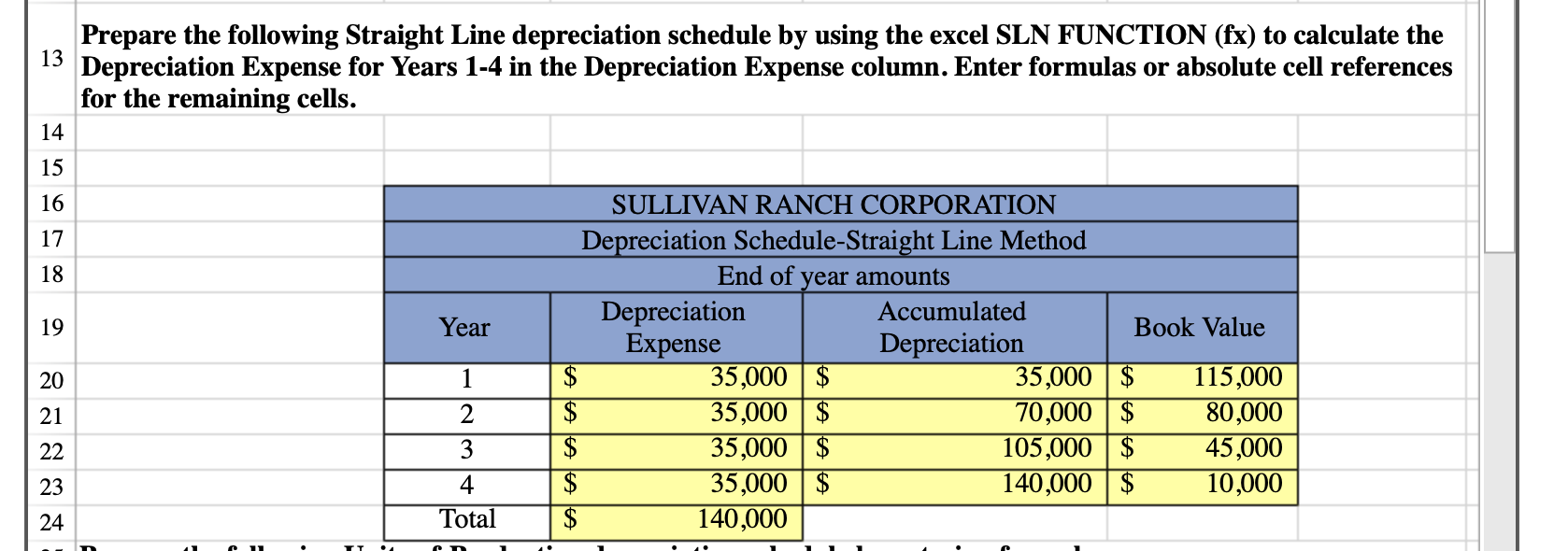

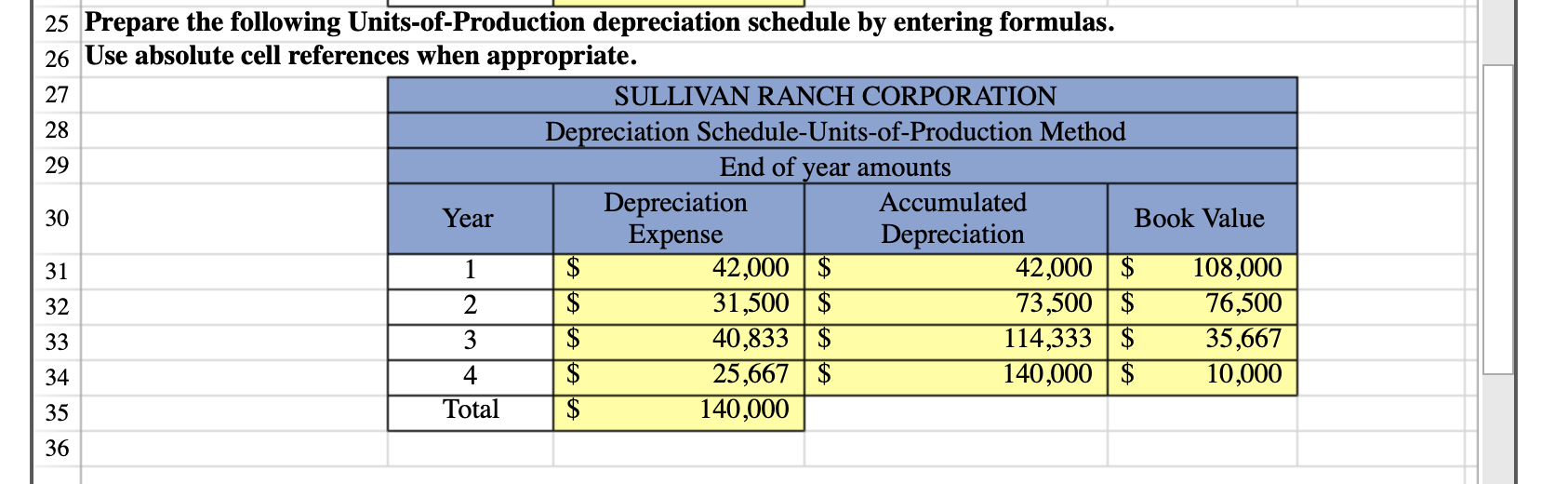

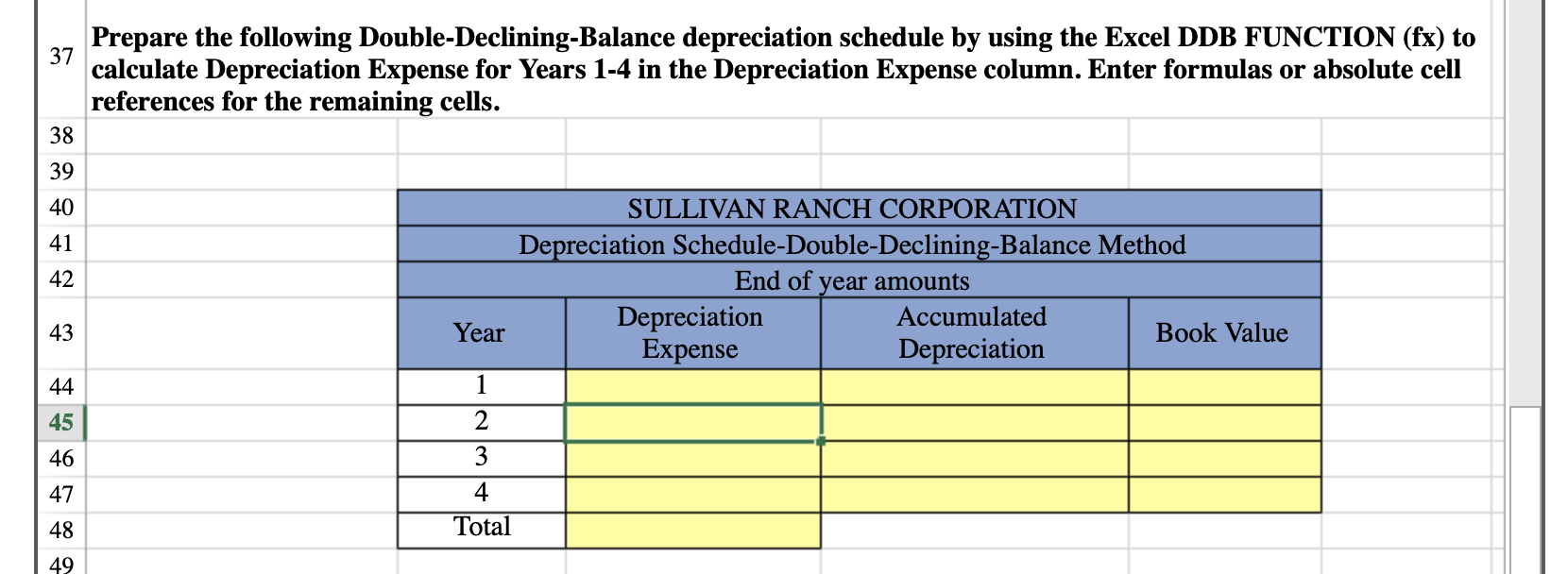

Sullivan Ranch Corporation has purchased a new tractor and has provided the information related to this purchase and its asset information. The Controller has asked you to prepare three different depreciation schedules showing the Straight-Line, Units-Of-Production, and Double- Declining Balance methods. Use the information included in the Excel Simulation and the Excel functions described below to complete the task. E F A B D 1 Sullivan Ranch Corporation has purchased a new tractor. The following information is given: 2 3 Cost: $ 150,000 4. Estimated Residual: $ 10,000 5 Estimated Life in years: 4 6 Estimated Life in hours: 1200 7 Actual Hours: 8 Year 1 360 9 Year 2 270 10 Year 3 350 11 Year 4 220 12 Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION (fx) to calculate the 13 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 14 15 16 17 18 19 Year SULLIVAN RANCH CORPORATION Depreciation Schedule-Straight Line Method End of year amounts Depreciation Accumulated Book Value Expense Depreciation $ 35,000 $ 35,000 $ 115,000 $ 35,000 $ 70,000 $ 80,000 $ 35,000 $ 105,000 $ 45,000 $ 35,000 $ 140,000 $ 10,000 $ 140,000 20 1 21 2 22 3 ] ] ] 23 4 Total 24 . 25 Prepare the following Units-of-Production depreciation schedule by entering formulas. 26 Use absolute cell references when appropriate. 27 SULLIVAN RANCH CORPORATION 28 Depreciation Schedule-Units-of-Production Method 29 End of year amounts Depreciation Accumulated 30 Year Book Value Expense Depreciation 31 1 $ 42,000 $ 42,000 $ 108,000 32 2 $ 31,500 $ 73,500 $ 76,500 33 3 $ 40,833 $ 114,333 $ 35,667 34 4. $ 25,667 $ 140,000 $ 10,000 35 Total $ 140,000 36 37 Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (fx) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 38 39 40 41 42 SULLIVAN RANCH CORPORATION Depreciation Schedule-Double-Declining-Balance Method End of year amounts Depreciation Accumulated Book Value Expense Depreciation 43 Year 44 1 2 45 46 3 47 4 Total 48 49