Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the explanation in Excel format Question 5 (6 Marks) It is September 1, 2019 and Richard Spender has a problem... HE SPENDS TOO

Please show the explanation in Excel format

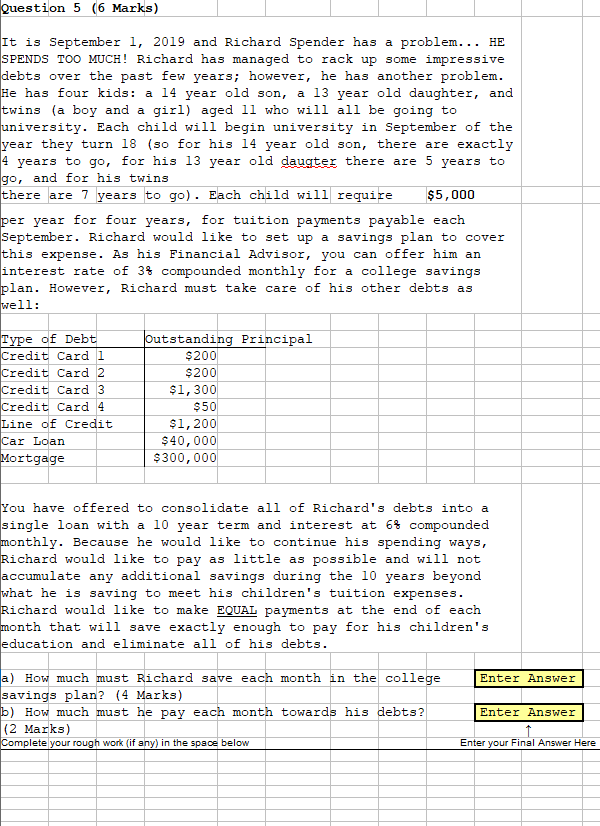

Question 5 (6 Marks) It is September 1, 2019 and Richard Spender has a problem... HE SPENDS TOO MUCH! Richard has managed to rack up some impressive debts over the past few years; however, he has another problem. He has four kids: a 14 year old son, a 13 year old daughter, and twins (a boy and a girl) aged 1l who will all be going to university. Each child will begin university in September of the year they turn 18 (so for his 14 year old son, there are exactly 14 years to go, for his 13 year old daugter there are 5 years to go, and for his twins there are 7 years to go). Each child will require $5,000 per year for four years, for tuition payments payable each September. Richard would like to set up a savings plan to cover this expense. As his Financial Advisor, you interest rate of 3% compounded monthly for a college savings plan. However, Richard must take care of his other debts as well: Type of Debt Credit Card i Credit Card 2 Credit Card 3 Credit Card 4 Line of Credit Car Loan Mortgage outstanding Principal $200 $200 $1,300 $50 $1,200 $40,000 $300,000 You have offered to consolidate all of Richard's debts into a single loan with a 10 year term and interest at 6% compounded monthly. Because he would like to continue his spending ways, Richard would like to pay as little as possible and will not accumulate any additional savings during the 10 years beyond what he is saving to meet his children's tuition expenses. Richard would like to make EQUAL payments at the end of each month that will save exactly enough to pay for his children's education and eliminate all of his debts. Enter Answer a) How much must Richard save each month in the college savings plan? (4 Marks) b) How much must he pay each month towards his debts? (2 Marks) Complete your rough work (if any) in the space below Enter Answer Enter your Final Answer Here Question 5 (6 Marks) It is September 1, 2019 and Richard Spender has a problem... HE SPENDS TOO MUCH! Richard has managed to rack up some impressive debts over the past few years; however, he has another problem. He has four kids: a 14 year old son, a 13 year old daughter, and twins (a boy and a girl) aged 1l who will all be going to university. Each child will begin university in September of the year they turn 18 (so for his 14 year old son, there are exactly 14 years to go, for his 13 year old daugter there are 5 years to go, and for his twins there are 7 years to go). Each child will require $5,000 per year for four years, for tuition payments payable each September. Richard would like to set up a savings plan to cover this expense. As his Financial Advisor, you interest rate of 3% compounded monthly for a college savings plan. However, Richard must take care of his other debts as well: Type of Debt Credit Card i Credit Card 2 Credit Card 3 Credit Card 4 Line of Credit Car Loan Mortgage outstanding Principal $200 $200 $1,300 $50 $1,200 $40,000 $300,000 You have offered to consolidate all of Richard's debts into a single loan with a 10 year term and interest at 6% compounded monthly. Because he would like to continue his spending ways, Richard would like to pay as little as possible and will not accumulate any additional savings during the 10 years beyond what he is saving to meet his children's tuition expenses. Richard would like to make EQUAL payments at the end of each month that will save exactly enough to pay for his children's education and eliminate all of his debts. Enter Answer a) How much must Richard save each month in the college savings plan? (4 Marks) b) How much must he pay each month towards his debts? (2 Marks) Complete your rough work (if any) in the space below Enter Answer Enter your Final Answer Here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started