Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the formula used in excel for risk and sharpe ratio. 2) You are looking to combine stock & bond portfolios. The risk and

Please show the formula used in excel for risk and sharpe ratio.

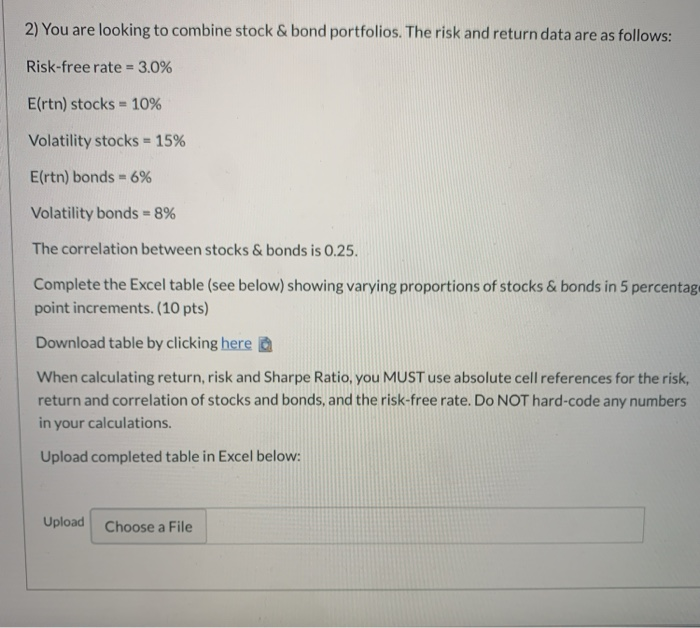

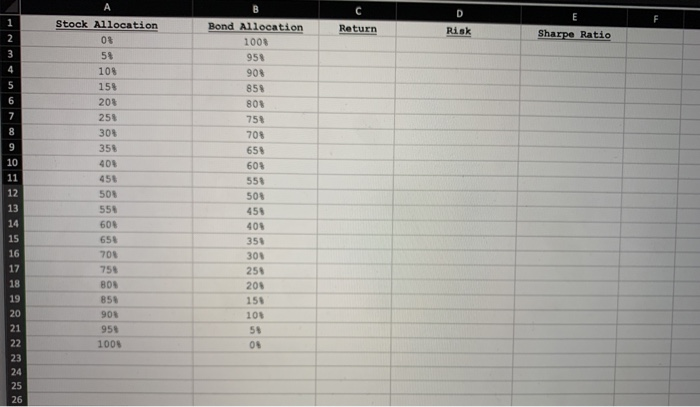

2) You are looking to combine stock & bond portfolios. The risk and return data are as follows: Risk-free rate = 3.0% Eartn) stocks = 10% Volatility stocks = 15% Ertn) bonds - 6% Volatility bonds = 8% The correlation between stocks & bonds is 0.25. Complete the Excel table (see below) showing varying proportions of stocks & bonds in 5 percentag point increments. (10 pts) Download table by clicking here When calculating return, risk and Sharpe Ratio, you MUST use absolute cell references for the risk, return and correlation of stocks and bonds, and the risk-free rate. Do NOT hard-code any numbers in your calculations. Upload completed table in Excel below: Upload Choose a File A B D C Return E Risk Sharpe Ratio 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Stock Allocation 0% 5% 108 158 208 258 308 355 401 456 508 556 600 656 700 758 BOS 858 905 958 1005 Bond Allocation 1000 958 908 858 801 758 708 659 608 558 505 458 400 350 301 258 205 158 105 58 05 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started