Please show the formulas too.

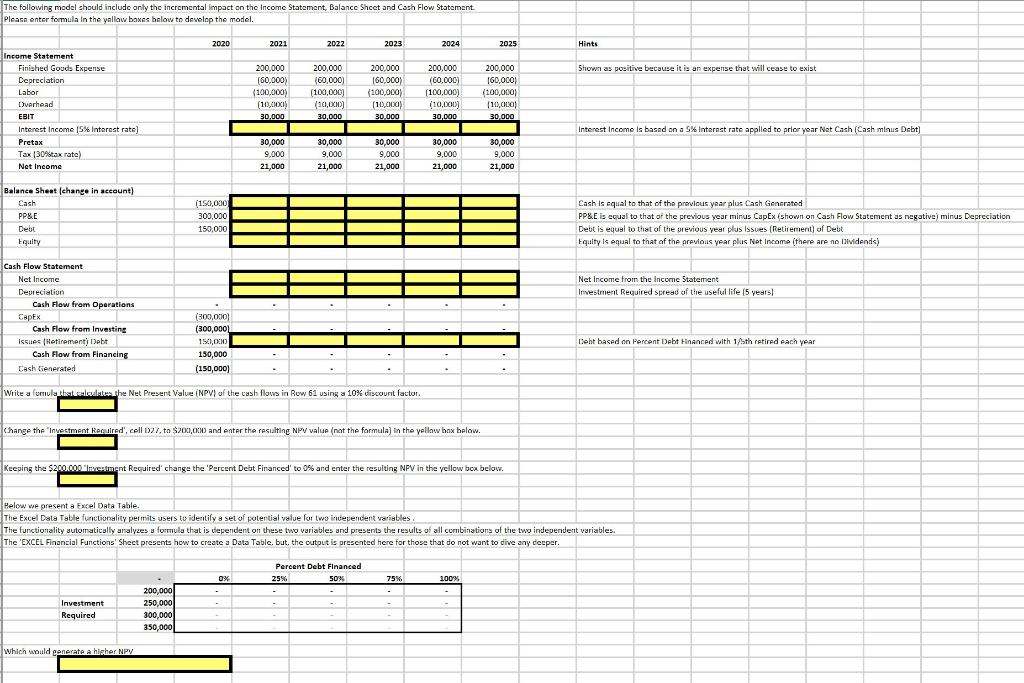

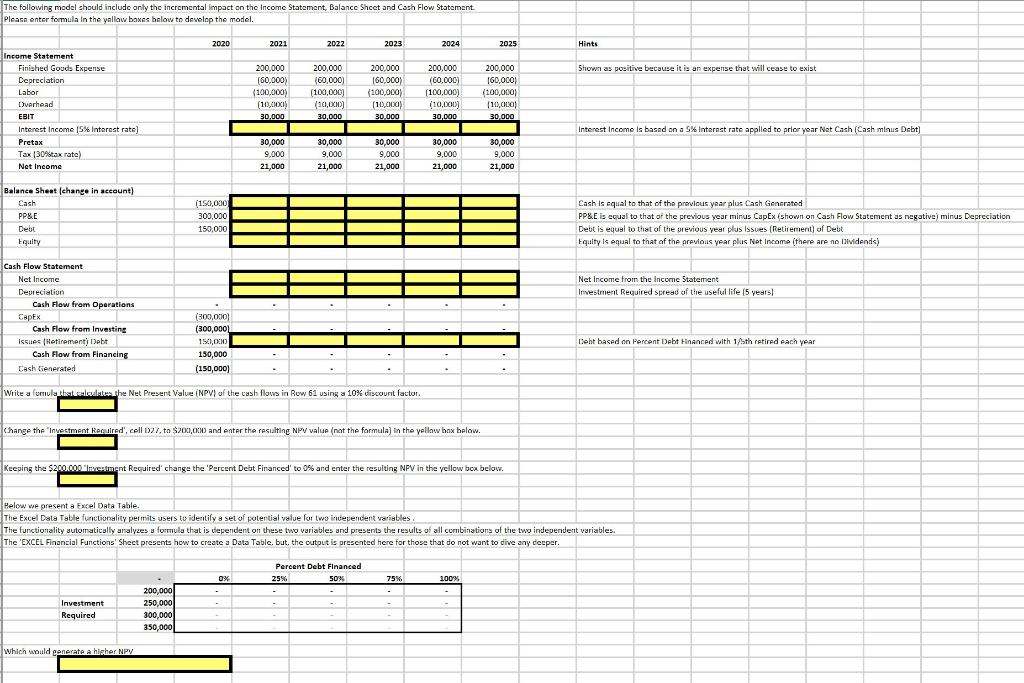

The following model should include only the incremental impact on the Income Statement, Balance Sheet and Cash Flow Statement Please enter formula In the yallow boxes below to develop the model. 2020 2021 2022 2023 2024 2025 Hints Shown as positive because it is an expense that will cease to exist Income Statement Finished Goods Expense Depreciation Labor Dverhead EBIT Interest Income 15% Interest rate) Pretax Tax (30%tax rate) Net Income 200,000 (60,000) (100,000) (10,000) 30.000 200,000 (60,000) (100,000) (100,000) 30,000 200,000 160,000) (100,000) (10,000) 30.000 200,000 (60,000) (100,000) (10,000) 30.000 200,000 160,000) (100,000) (10,000) 30.000 Interest Income is based on a 5% Interest rate applied to prior year Net Cash (Cash minus Debt] 30,000 9,000 21,000 30,000 9,000 21,000 30,000 9,000 21,000 30,000 9,000 21,000 30,000 9,000 21,000 Balance Sheet (change in account) Cash PPLE Debt Equity (150,000 ( 300,000 150,000 Cash is equal to that of the previous year plus Cash Generated PP&E is equal to that of the previous year minus CapEx (shown on Cash Flow Statement as negative) minus Depreciation Debt is equal to that of the previous year plus Issues (Retirement of Debt Equity is equal to that of the previous year plus Net Income (there are no Xvidends) Net Income from the Income Statement Investment Required spread of the useful life (5 years) Cash Flow Statement Net Income Depreciation Cash Flow from Operations Capex Cash Flow from Investing Issues (Hetirement) Debt ) Cash Flow from Financing Cash Generated (300,000) (300,0001 1.500,000 150,000 (150,000] Debt based on Percent Debt Financed with 1/5th retired each year Write a fumultuate the Net Present Value (NPV) of the cash flows in Row 61 using a 10% discount factor. Change the investment Recuired', cell D27, to $200,000 and enter the resulting NPV value (not the formula) in the yellow box below. Keeping the $200.000. Investment Required' change the 'Percent Debt Financed' to 0% and enter the resulting NPV in the yellow box below. Below we present a Excel Data Table. The Excel Data Table functionality permits users to identify a set of potential value for two independent variables The functionality automatically analyzes a formula that is dependent on these two variables and presents the results of all combinations of the two independent variables. The 'EXCEL Financial Functions' Sheet presents how to create a Data Table, but the output is presented here for those that do not want to dive any deeper. Percent Debt Financed 25% 50% 100% 75% - Investment Required 200,000 250,000 300,000 350,000 which would generate a higher NPV The following model should include only the incremental impact on the Income Statement, Balance Sheet and Cash Flow Statement Please enter formula In the yallow boxes below to develop the model. 2020 2021 2022 2023 2024 2025 Hints Shown as positive because it is an expense that will cease to exist Income Statement Finished Goods Expense Depreciation Labor Dverhead EBIT Interest Income 15% Interest rate) Pretax Tax (30%tax rate) Net Income 200,000 (60,000) (100,000) (10,000) 30.000 200,000 (60,000) (100,000) (100,000) 30,000 200,000 160,000) (100,000) (10,000) 30.000 200,000 (60,000) (100,000) (10,000) 30.000 200,000 160,000) (100,000) (10,000) 30.000 Interest Income is based on a 5% Interest rate applied to prior year Net Cash (Cash minus Debt] 30,000 9,000 21,000 30,000 9,000 21,000 30,000 9,000 21,000 30,000 9,000 21,000 30,000 9,000 21,000 Balance Sheet (change in account) Cash PPLE Debt Equity (150,000 ( 300,000 150,000 Cash is equal to that of the previous year plus Cash Generated PP&E is equal to that of the previous year minus CapEx (shown on Cash Flow Statement as negative) minus Depreciation Debt is equal to that of the previous year plus Issues (Retirement of Debt Equity is equal to that of the previous year plus Net Income (there are no Xvidends) Net Income from the Income Statement Investment Required spread of the useful life (5 years) Cash Flow Statement Net Income Depreciation Cash Flow from Operations Capex Cash Flow from Investing Issues (Hetirement) Debt ) Cash Flow from Financing Cash Generated (300,000) (300,0001 1.500,000 150,000 (150,000] Debt based on Percent Debt Financed with 1/5th retired each year Write a fumultuate the Net Present Value (NPV) of the cash flows in Row 61 using a 10% discount factor. Change the investment Recuired', cell D27, to $200,000 and enter the resulting NPV value (not the formula) in the yellow box below. Keeping the $200.000. Investment Required' change the 'Percent Debt Financed' to 0% and enter the resulting NPV in the yellow box below. Below we present a Excel Data Table. The Excel Data Table functionality permits users to identify a set of potential value for two independent variables The functionality automatically analyzes a formula that is dependent on these two variables and presents the results of all combinations of the two independent variables. The 'EXCEL Financial Functions' Sheet presents how to create a Data Table, but the output is presented here for those that do not want to dive any deeper. Percent Debt Financed 25% 50% 100% 75% - Investment Required 200,000 250,000 300,000 350,000 which would generate a higher NPV