Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the problems step by step. and show how to process. Paul and Judy Vance are married and file a joint return. Paul is

Please show the problems step by step. and show how to process.

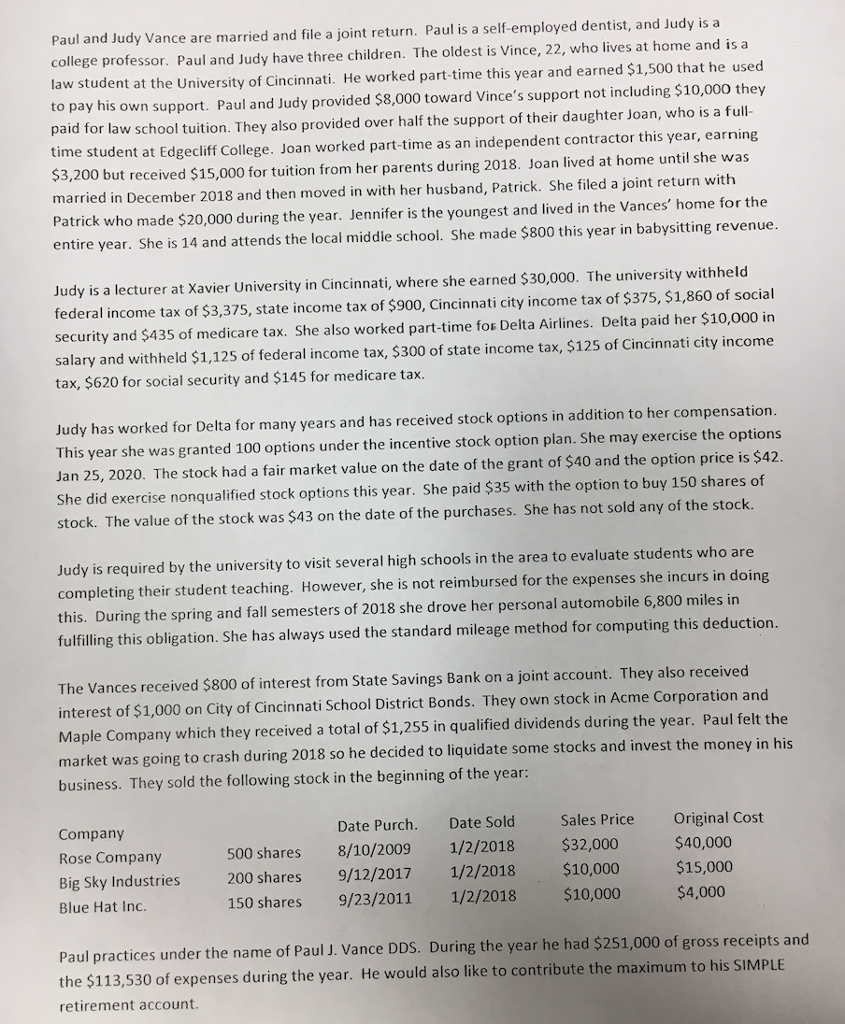

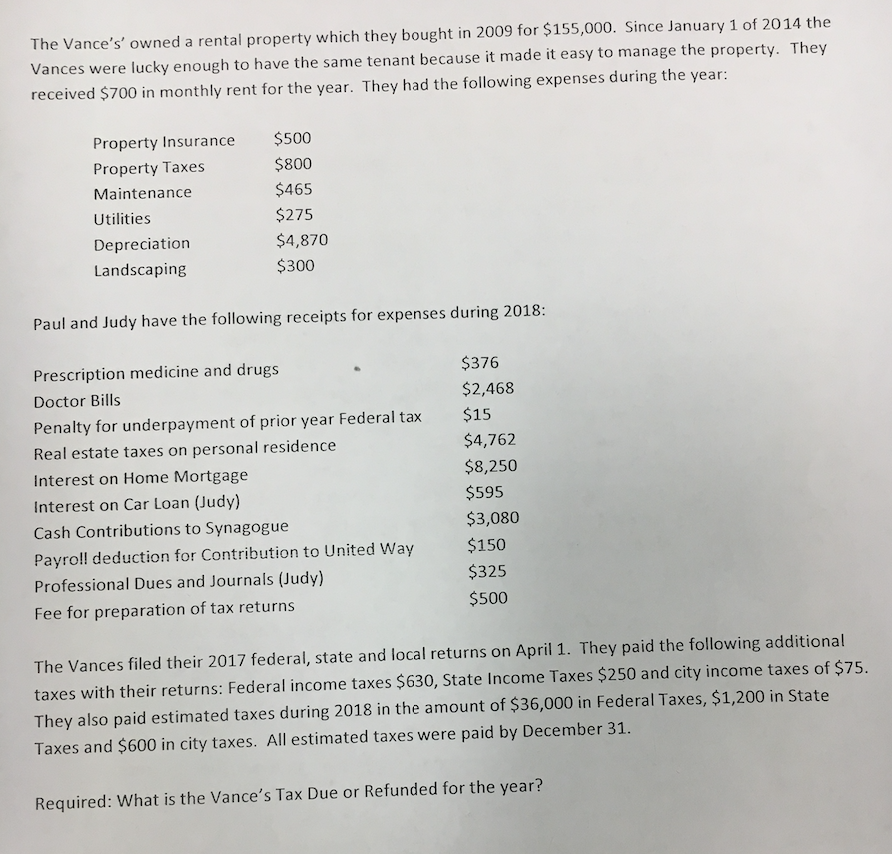

Paul and Judy Vance are married and file a joint return. Paul is a self-employed dentist, and Judy is a college professor. Paul and Judy have three children. The oldest is Vince, 22, who lives at home and is a law student at the University of Cincinnati. He worked part-time this year and earned $1,500 that he used to pay his own support. Paul and Judy provided $8,000 toward Vince's support not including $10,000 paid for law school tuition. They also provided over half the support of their daughter Joan, who is a full they e student at Edgecliff College. Joan worked part-time as an independent contractor this year, earning. $3, 200 but received $15,000 for tuition from her parents during 2018. Joan lived at home until she was married in December 2018 and then moved in with her husband, Patrick. She filed a joint return with Patrick who made $20,000 during the year. Jennifer is the youngest and lived in the Vances' home for the entire year. She is 14 and attends the local middie school. She made $800 this year in babysitting revenue Judy is a lecturer at Xavier University in Cincinnati, where she earned $30,000. The university withheld federal income tax of $3,375, state income tax of $900, Cincinnati city income tax of $375, $1,860 of social security and $435 of medicare tax. She also worked part-time for Delta Airlines. Delta paid her $10,000 in salary and withheld $1,125 of federal income tax, $300 of state income tax, $125 of Cincinnati city income tax, $620 for social security and $145 for medicare tax Judy has worked for Delta for many years and has received stock options in addition to her compensation This year she was granted 100 options under the incentive stock option plan. She may exercise the options Jan 25, 2020. The stock had a fair market value on the date of the grant of $40 and the option price is $42 he did exercise nonqualified stock options this year. She paid $35 with the option to buy 150 shares of stock. The value of the stock was $43 on the date of the purchases. She has not sold any of the stock Judy is required by the university to visit several high schools in the area to evaluate students who are completing their student teaching. However, she is not reimbursed for the expenses she incurs in doing his. During the spring and fall semesters of 2018 she drove her personal automobile 6,800 miles in fulfilling this obligation. She has always used the standard mileage method for computing this deductio ed $800 of interest from State Savings Bank on a joint account. They also received The Vances receiv interest of $1,000 on City of Cincinnati School District Bonds. They own stock in Acme Corporation a Maple Company which market was going to crash during 2018 so he decided to liquidate some business. They sold the following stock in the beginning of the year nd they received a total of $1,255 in qualified dividends during the year. Paul felt the stocks and invest the money in his Company Rose Company Big Sky Industries Blue Hat Inc. Date Purch. Date Sold 500 shares 8/10/2009 1/2/2018 $32,000 200 shares 9/12/2017 1/2/2018 $10,000 150 shares 9/23/2011 1/2/2018 $10,000 Sales Price Original Cost 40,000 $15,000 4,000 Paul practices under the name of Paul J. Vance DDS. During the year he had $251 ,000 of gross receipt s and the $113,530 of expenses during the year. He would also like to contribute the maximum to his SIMPLE retirement account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started