please show the process, like numbers to input the formula! thanks

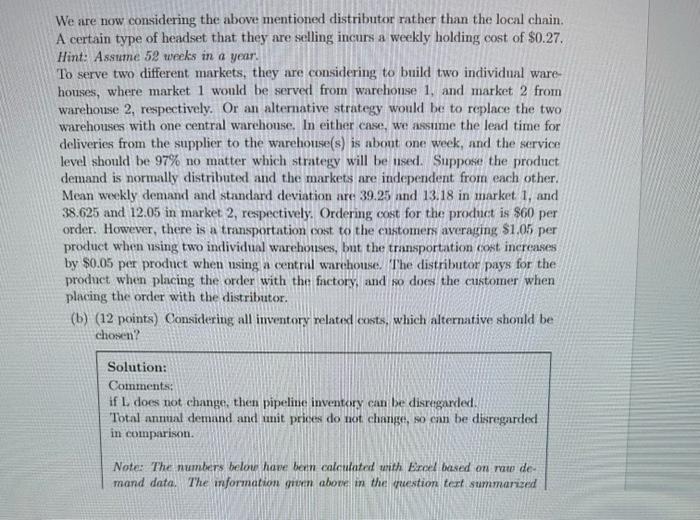

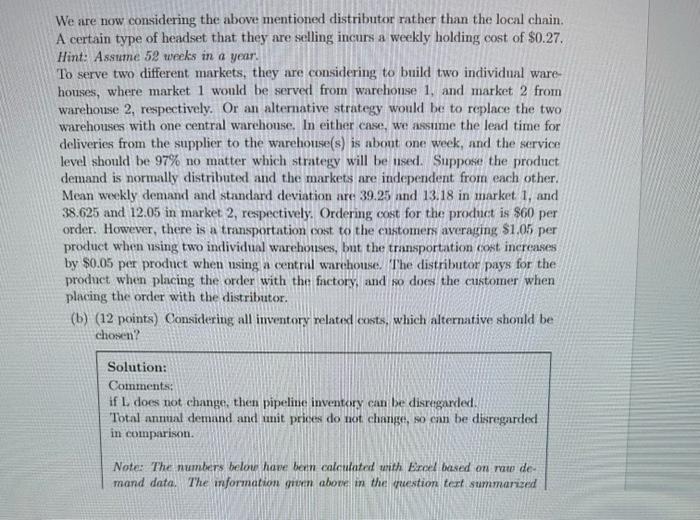

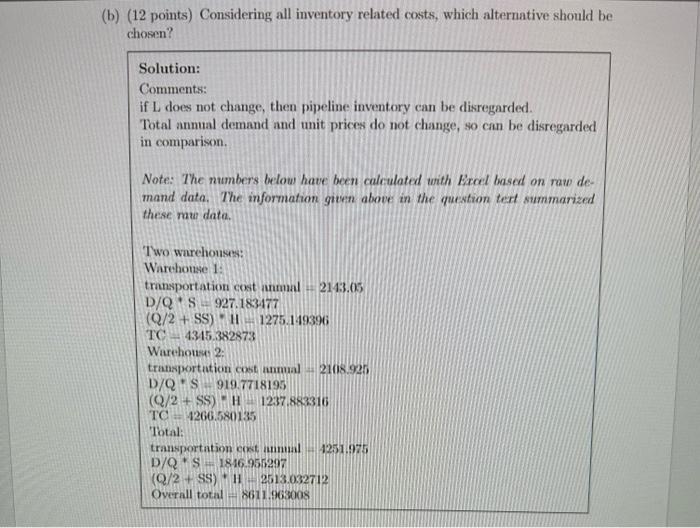

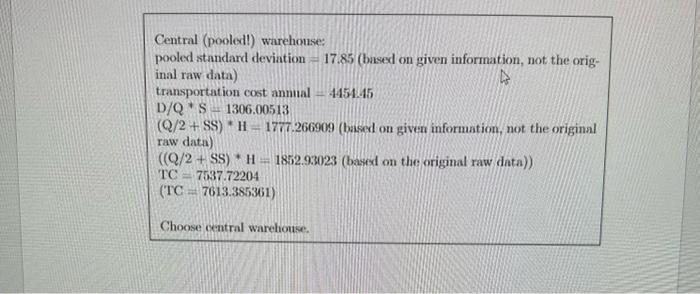

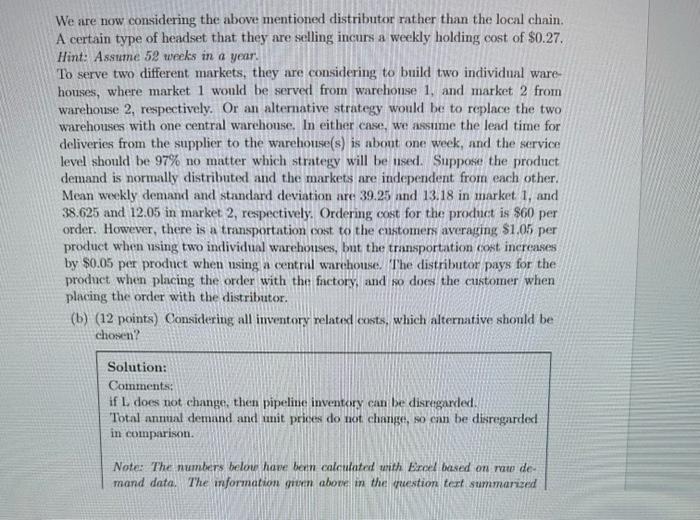

We are now considering the above mentioned distributor rather than the local chain. A certain type of headset that they are selling incurs a weekly holding cost of $0.27. Hint: Assume 52 weeks in a year. To serve two different markets, they are considering to build two individual warehouses, where market 1 would be server from warehouse 1 , and market 2 from warehouse 2 , respectively. Or an alternative strategy would be to replace the two warehouses with one central warehouse. In either case, we assume the lead time for deliveries from the supplier to the warehouse(s) is about one week, and the service level should be 97% no matter which strategy will be used. Suppose the product demand is normally distributed and the markets are independent from each other. Mean weekly demand and standard deviation are 39.25 and 13.18 in market 1 , and 38.625 and 12.05 in market 2 , respectively. Ordering cost for the product is $60 per order. However, there is a transportation cost to the customers averaging $1.05 per product when using two individual warehouses, but the transportation cost increases by $0.05 per product when using a central warchouse. The distributor pays for the product when placing the order with the factory, and so does the customer when placing the order with the distributor. (b) (12 points) Considering all imventory related costs, which alternative should be chosen? Solution: Comments: if L. does not change, then pipeline inventory can be disregarded. Total anmal demand and unit prices do not change, so can be disregarded in comparison. Note: The numbers below have bern calculated uith Erol based on raw demand data. The information given above in the question text summarized b) (12 points) Considering all inventory related costs, which alternative should be chosen? Solution: Comments: if L does not change, then pipeline inventory can be disregarded. Total annual demand and unit prices do not change, so can be disregarded in comparison. Note: The numbers below have been calculated with Eral based on raw demand data. The information given above in the question tert summarized these mav data. Two warehonses: Warehouse 1: transportation cost anmal +2143.05 D/Q+S=927.18347 (Q/2+SS)H1275.149396 TC=4345.382873 Warchous: 2: transportution cost anmual 2108.925 D/Q+S=919.7718195 (Q/2+SS)=H=1237.883316 TC=4266.580135 Tbtal: trausportation cost lumual 1251.975 D/QS=1816.955297 (Q/2+SS)+H2513.032712 Overall total =8611.963008 Central (pooled!) warehouse: pooled standard deviation =17.85 (based on given information, not the original raw data) transportation cost annual =4454.45 D/Q+S1306.00513 (Q/2+SS)H=1777.266909 (based on given information, not the original raw data) ((Q/2+SS)H=1852.93023 (based on the original raw data)) TC=7537.72204 (TC=7613.385361) Choose central warehouse