Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the process thank you the answer is posted below, but I could not understand, could you please show more details? a) From the

Please show the process thank you

the answer is posted below, but I could not understand, could you please show more details?

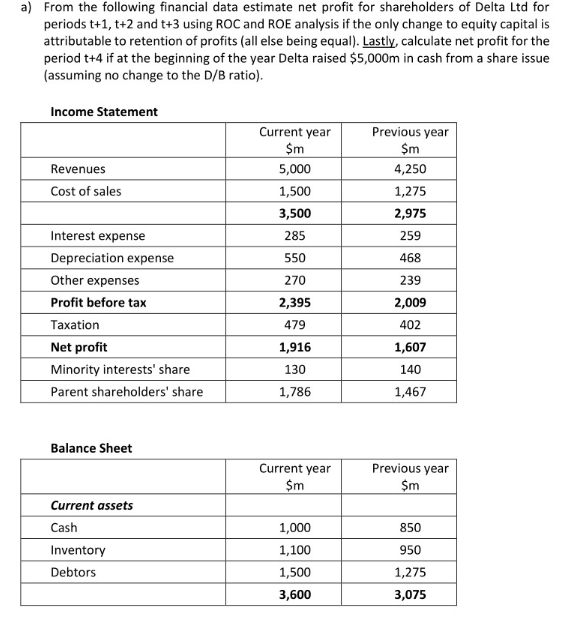

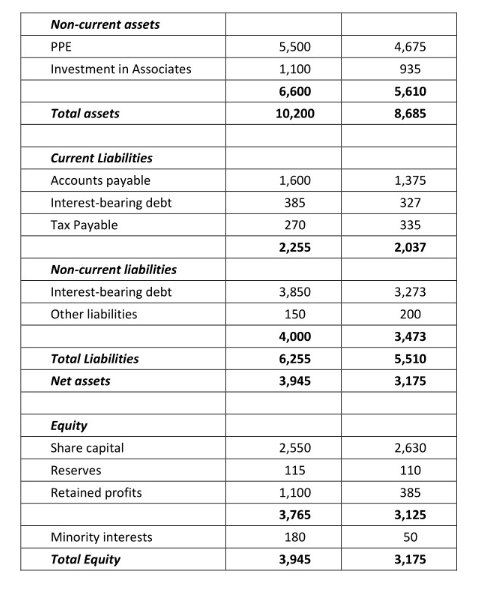

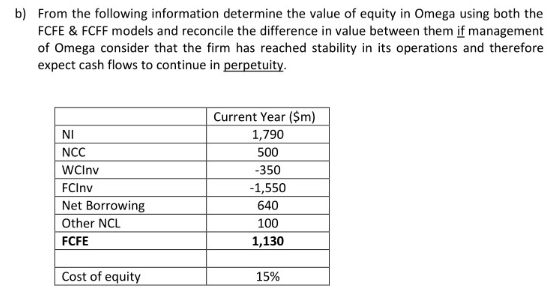

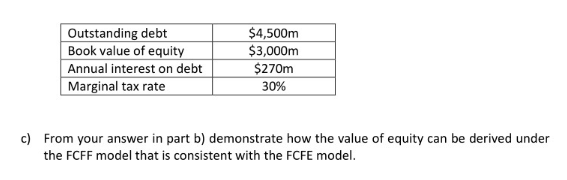

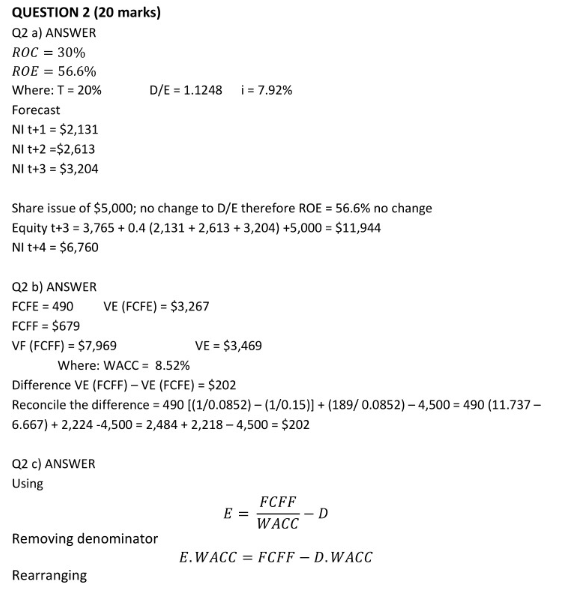

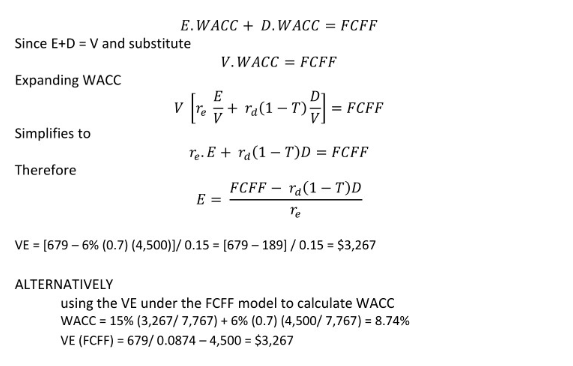

a) From the following financial data estimate net profit for shareholders of Delta Ltd for periods t+1, t+2 and t+3 using ROC and ROE analysis if the only change to equity capital is attributable to retention of profits (all else being equal). Lastly, calculate net profit for the period t+4 if at the beginning of the year Delta raised $5,000m in cash from a share issue (assuming no change to the D/B ratio). Income Statement Revenues Cost of sales Current year $m 5,000 1,500 3,500 Previous year $m 4,250 1,275 2,975 259 285 550 468 270 239 2,009 Interest expense Depreciation expense Other expenses Profit before tax Taxation Net profit Minority interests' share Parent shareholders' share 2,395 479 402 1,916 130 1,607 140 1,786 1,467 Balance Sheet Current year $m Previous year $m 850 Current assets Cash Inventory Debtors 950 1,000 1,100 1,500 3,600 1,275 3,075 Non-current assets PPE Investment in Associates 5,500 1,100 6,600 10,200 4,675 935 5,610 8,685 Total assets 1,375 Current Liabilities Accounts payable Interest-bearing debt Tax Payable 1,600 385 327 270 335 2,255 2,037 Non-current liabilities Interest-bearing debt Other liabilities 3,850 150 4,000 6,255 3,945 3,273 200 3,473 5,510 3,175 Total Liabilities Net assets 2,550 2,630 Equity Share capital Reserves Retained profits 115 110 385 1,100 3,765 3,125 180 50 Minority interests Total Equity 3,945 3,175 b) From the following information determine the value of equity in Omega using both the FCFE & FCFF models and reconcile the difference in value between them if management of Omega consider that the firm has reached stability in its operations and therefore expect cash flows to continue in perpetuity. NI NCC WCInv FCInv Net Borrowing Other NCL FCFE Current Year ($m) 1,790 500 -350 -1,550 640 100 1,130 Cost of equity 15% Outstanding debt Book value of equity Annual interest on debt Marginal tax rate $4,500m $3,000m $270m 30% c) From your answer in part b) demonstrate how the value of equity can be derived under the FCFF model that is consistent with the FCFE model. QUESTION 2 (20 marks) Q2 a) ANSWER ROC = 30% ROE = 56.6% Where: T = 20% D/E = 1.1248 i = 7.92% Forecast NI t+1 = $2,131 NI T+2 =$2,613 NI t+3 = $3,204 Share issue of $5,000; no change to D/E therefore ROE = 56.6% no change Equity t+3 = 3,765 +0.4 (2,131 + 2,613 +3,204) +5,000 = $11,944 NI t+4 = $6,760 Q2 b) ANSWER FCFE = 490 VE (FCFE) = $3,267 FCFF = $679 VF (FCFF) = $7,969 VE = $3,469 Where: WACC = 8.52% Difference VE (FCFF) - VE (FCFE) = $202 Reconcile the difference = 490 [(1/0.0852) - (1/0.15)) + (189/0.0852) 4,500 = 490 (11.737 - 6.667) + 2,224 -4,500 = 2,484 +2,218 - 4,500 = $202 Q2 C) ANSWER Using FCFF E = WACC D Removing denominator E.WACC = FCFF - D.WACC Rearranging E.WACC + D.WACC = FCFF Since E+D = V and substitute V.WACC = FCFF Expanding WACC E = FCFF Simplifies to re. E + ra(1 -T)D = FCFF Therefore FCFF ra(1-T)D E = re v brat + ra(1 - ) ra(1-T1 = VE = [679-6% (0.7) (4,500)]/0.15 = [679 - 189] / 0.15 = $3,267 ALTERNATIVELY using the VE under the FCFF model to calculate WACC WACC = 15% (3,267/ 7,767) + 6% (0.7) (4,500/ 7,767) = 8.74% VE (FCFF) = 679/0.0874 -4,500 = $3,267 a) From the following financial data estimate net profit for shareholders of Delta Ltd for periods t+1, t+2 and t+3 using ROC and ROE analysis if the only change to equity capital is attributable to retention of profits (all else being equal). Lastly, calculate net profit for the period t+4 if at the beginning of the year Delta raised $5,000m in cash from a share issue (assuming no change to the D/B ratio). Income Statement Revenues Cost of sales Current year $m 5,000 1,500 3,500 Previous year $m 4,250 1,275 2,975 259 285 550 468 270 239 2,009 Interest expense Depreciation expense Other expenses Profit before tax Taxation Net profit Minority interests' share Parent shareholders' share 2,395 479 402 1,916 130 1,607 140 1,786 1,467 Balance Sheet Current year $m Previous year $m 850 Current assets Cash Inventory Debtors 950 1,000 1,100 1,500 3,600 1,275 3,075 Non-current assets PPE Investment in Associates 5,500 1,100 6,600 10,200 4,675 935 5,610 8,685 Total assets 1,375 Current Liabilities Accounts payable Interest-bearing debt Tax Payable 1,600 385 327 270 335 2,255 2,037 Non-current liabilities Interest-bearing debt Other liabilities 3,850 150 4,000 6,255 3,945 3,273 200 3,473 5,510 3,175 Total Liabilities Net assets 2,550 2,630 Equity Share capital Reserves Retained profits 115 110 385 1,100 3,765 3,125 180 50 Minority interests Total Equity 3,945 3,175 b) From the following information determine the value of equity in Omega using both the FCFE & FCFF models and reconcile the difference in value between them if management of Omega consider that the firm has reached stability in its operations and therefore expect cash flows to continue in perpetuity. NI NCC WCInv FCInv Net Borrowing Other NCL FCFE Current Year ($m) 1,790 500 -350 -1,550 640 100 1,130 Cost of equity 15% Outstanding debt Book value of equity Annual interest on debt Marginal tax rate $4,500m $3,000m $270m 30% c) From your answer in part b) demonstrate how the value of equity can be derived under the FCFF model that is consistent with the FCFE model. QUESTION 2 (20 marks) Q2 a) ANSWER ROC = 30% ROE = 56.6% Where: T = 20% D/E = 1.1248 i = 7.92% Forecast NI t+1 = $2,131 NI T+2 =$2,613 NI t+3 = $3,204 Share issue of $5,000; no change to D/E therefore ROE = 56.6% no change Equity t+3 = 3,765 +0.4 (2,131 + 2,613 +3,204) +5,000 = $11,944 NI t+4 = $6,760 Q2 b) ANSWER FCFE = 490 VE (FCFE) = $3,267 FCFF = $679 VF (FCFF) = $7,969 VE = $3,469 Where: WACC = 8.52% Difference VE (FCFF) - VE (FCFE) = $202 Reconcile the difference = 490 [(1/0.0852) - (1/0.15)) + (189/0.0852) 4,500 = 490 (11.737 - 6.667) + 2,224 -4,500 = 2,484 +2,218 - 4,500 = $202 Q2 C) ANSWER Using FCFF E = WACC D Removing denominator E.WACC = FCFF - D.WACC Rearranging E.WACC + D.WACC = FCFF Since E+D = V and substitute V.WACC = FCFF Expanding WACC E = FCFF Simplifies to re. E + ra(1 -T)D = FCFF Therefore FCFF ra(1-T)D E = re v brat + ra(1 - ) ra(1-T1 = VE = [679-6% (0.7) (4,500)]/0.15 = [679 - 189] / 0.15 = $3,267 ALTERNATIVELY using the VE under the FCFF model to calculate WACC WACC = 15% (3,267/ 7,767) + 6% (0.7) (4,500/ 7,767) = 8.74% VE (FCFF) = 679/0.0874 -4,500 = $3,267

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started