Answered step by step

Verified Expert Solution

Question

1 Approved Answer

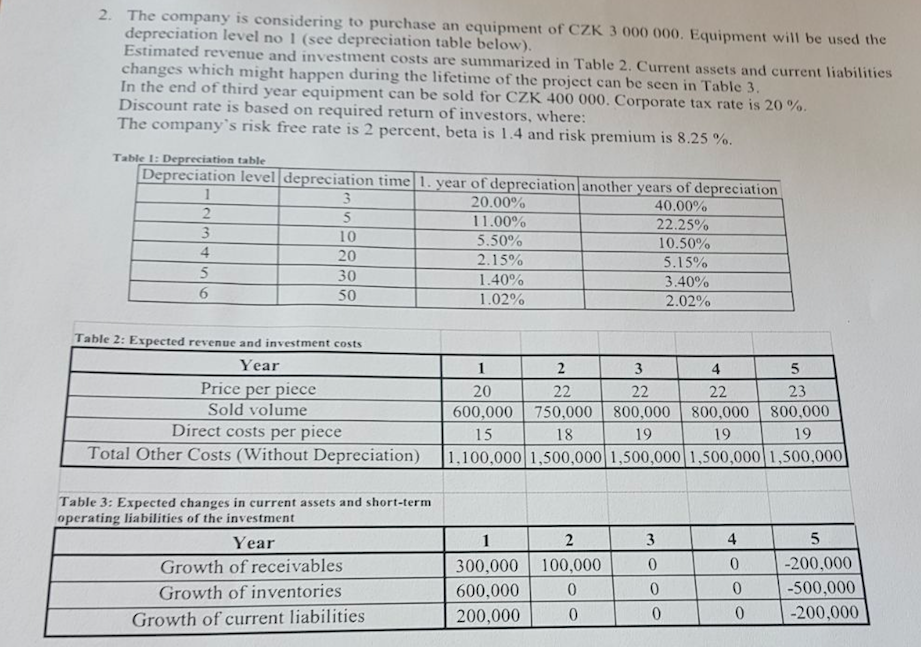

Please show the solution with all formulas and calculations step by step. Do not use exel please. 2. The company is considering to purchase an

Please show the solution with all formulas and calculations step by step. Do not use exel please.

2. The company is considering to purchase an equipment of CZK 3 000 000. Equipment will be used the depreciation level no 1 (see depreciation table below) Estimated revenue and investment costs are summarized in Table 2. Current assets and current liabilities changes which might happen during the lifetime of the project can be seen in Table 3 In the end of third year equipment can be sold for CZK 400 000 . Corporate tax rate is 20 % Discount rate is based on required return of investors, where The company's risk free rate is 2 percent, beta is 1.4 and risk premium is 8.25 % Table 1: Depreciation table reciation time 1. year of depreciation another years of depreciation 20.00 10 20 30 50 11 .00% 5.50% 2.1 5% 1.40% 1.02% 40.00% 22.25% 10.50% 5.1 5% 3.40% 2.02% 4 Table 2: Expected revenue and investment costs Y ear Price per piece Sold volume Direct costs per piece 20 23 600,000 750,000 800,000 800,000800,000 19 15 18 19 Total Other Costs (Without Depreciation) 1,100,000 1,500,000 1,500,000 1,500,000 1,500,000 Table 3: Expected changes in current assets and short-term operating liabilities of the investment 5 200,000 500,000 200,000 4 Year Growth of receivables Growth of inventories Growth of current liabilities 300,000 100,000 600,000 200,000 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started