Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show the steps clealy with excel, don't give answer directly The information is full here. 6. [Spreadsheet Exercises) The following questions are based on

please show the steps clealy with excel, don't give answer directly

The information is full here.

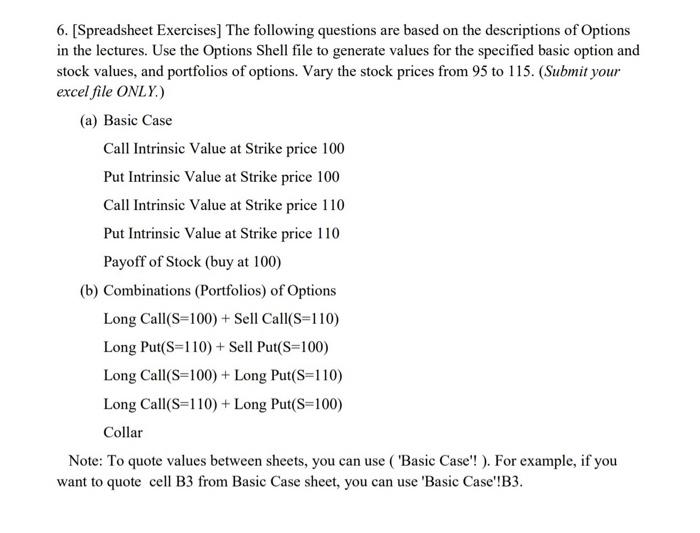

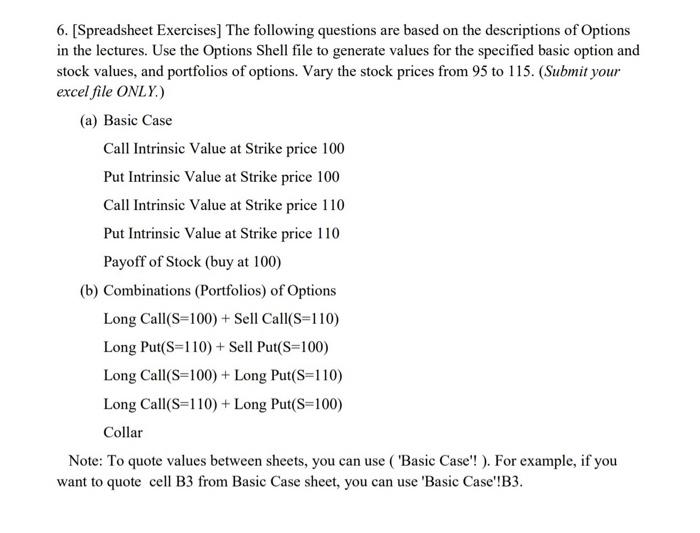

6. [Spreadsheet Exercises) The following questions are based on the descriptions of Options in the lectures. Use the Options Shell file to generate values for the specified basic option and stock values, and portfolios of options. Vary the stock prices from 95 to 115. (Submit your excel file ONLY.) (a) Basic Case Call Intrinsic Value at Strike price 100 Put Intrinsic Value at Strike price 100 Call Intrinsic Value at Strike price 110 Put Intrinsic Value at Strike price 110 Payoff of Stock (buy at 100) (b) Combinations (Portfolios) of Options Long Call(S=100) + Sell Call(S=110) Long Put(S=110) + Sell Put(S=100) Long Call(S=100) + Long Put(S=110) Long Call(S=110) + Long Put(S=100) Collar Note: To quote values between sheets, you can use ("Basic Case'!). For example, if you want to quote cell B3 from Basic Case sheet, you can use 'Basic Case'!B3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started