Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show the work and how you calculated each value!! Problem 2 The comptroller of the Macrosoft Corporation has $100 million of excess funds to

please show the work and how you calculated each value!!

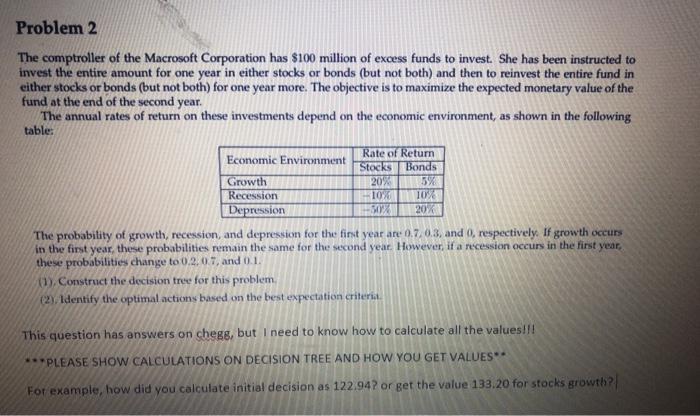

Problem 2 The comptroller of the Macrosoft Corporation has $100 million of excess funds to invest. She has been instructed to invest the entire amount for one year in either stocks or bonds (but not both) and then to reinvest the entire fund in either stocks or bonds (but not both) for one year more. The objective is to maximize the expected monetary value of the fund at the end of the second year. The annual rates of return on these investments depend on the economic environment, as shown in the following table: Rate of Return Economic Environment Stocks Bonds Growth 20% 5% Recession 10% 10% Depression SOX 20% The probability of growth, recession, and depression for the first year are 0.7.0.3, and 0, respectively. If growth occurs in the first year, these probabilities remain the same for the second year. However, if a recession occurs in the first year, these probabilities change to 0.2.0.7, and 0.1. (3) Construct the decision tree for this problem (2). Identify the optimal actions based on the best expectation criteria. This question has answers on chegg, but I need to know how to calculate all the values !!! ***PLEASE SHOW CALCULATIONS ON DECISION TREE AND HOW YOU GET VALUES For example, how did you calculate initial decision as 122.947 or get the value 133.20 for stocks growth Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started