Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show the work- no Excel Breakeven and Target-Point Analysis: Construction You are the financial analyst for a construction firm studying the feasibility of a

please show the work- no Excel

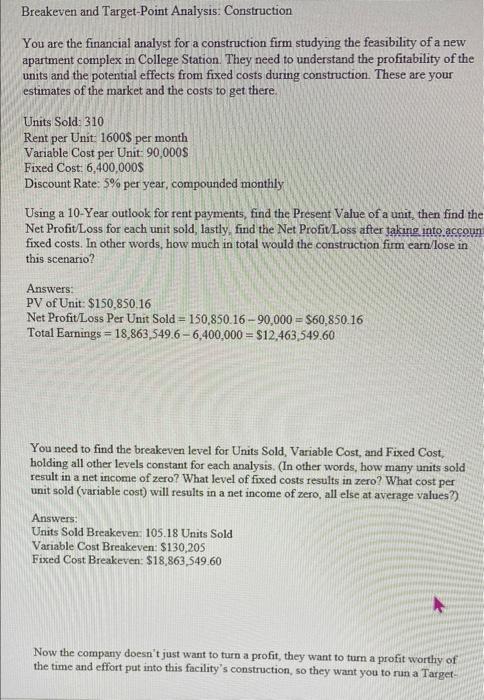

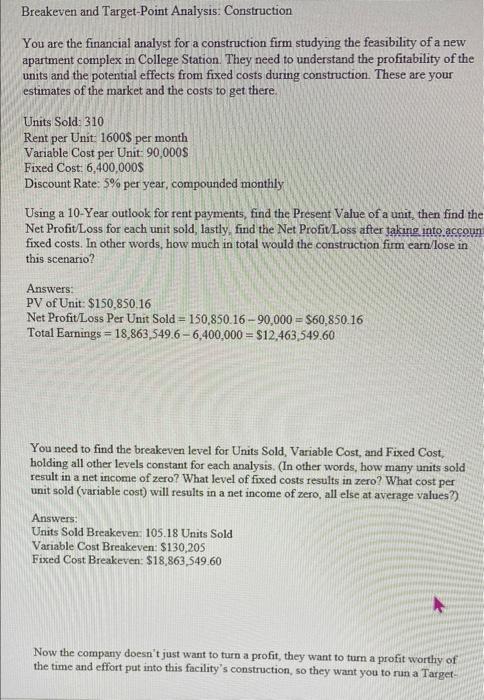

Breakeven and Target-Point Analysis: Construction You are the financial analyst for a construction firm studying the feasibility of a new apartment complex in College Station. They need to understand the profitability of the units and the potential effects from fixed costs during construction. These are your estimates of the market and the costs to get there. Units Sold: 310 Rent per Unit: 1600$ per month Variable Cost per Unit: 90,000$ Fixed Cost: 6,400,000$ Discount Rate: 5% per year, compounded monthly Using a 10-Year outlook for rent payments, find the Present Value of a unit, then find the Net Profit/Loss for each unit sold, lastly, find the Net Profit/Loss after taking into accoun fixed costs. In other words, how much in total would the construction firm earn/lose in this scenario? Answers: PV of Unit: $150,850.16 Net Profit/Loss Per Unit Sold = 150.850.16-90,000 = $60,850.16 Total Earnings = 18,863,549.6-6,400,000 = $12,463,549.60 You need to find the breakeven level for Units Sold Variable Cost, and Fixed Cost, holding all other levels constant for each analysis. (In other words, how many units sold result in a net income of zero? What level of fixed costs results in zero? What cost per unit sold (variable cost) will results in a net income of zero, all else at average values?) Answers: Units Sold Breakeven: 105.18 Units Sold Variable Cost Breakeven: $130,205 Fixed Cost Breakeven: $18,863,549.60 Now the company doesn't just want to turn a profit, they want to turn a profit worthy of the time and effort put into this facility's construction, so they want you to run a Target

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started