Answered step by step

Verified Expert Solution

Question

1 Approved Answer

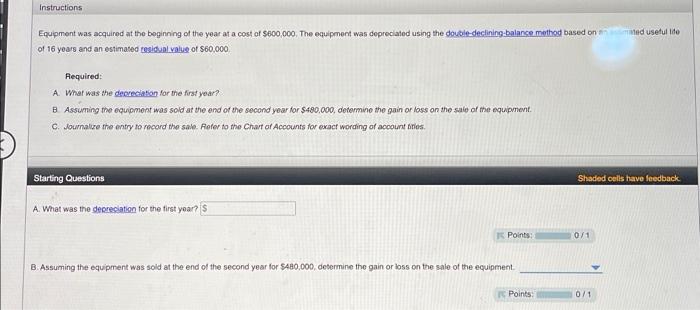

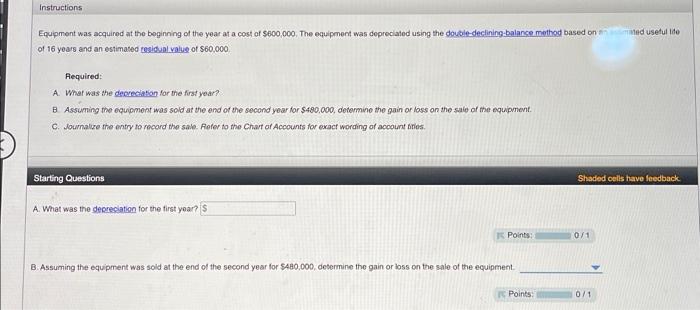

Please show the work! of 16 years and an estimated tesidun value of $60,000. Required: A. What was the decrectition for the first year? B

Please show the work!

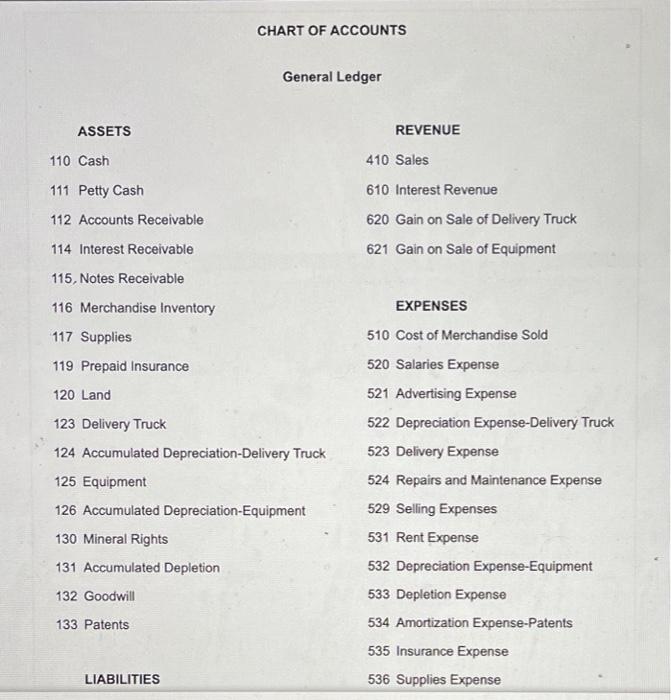

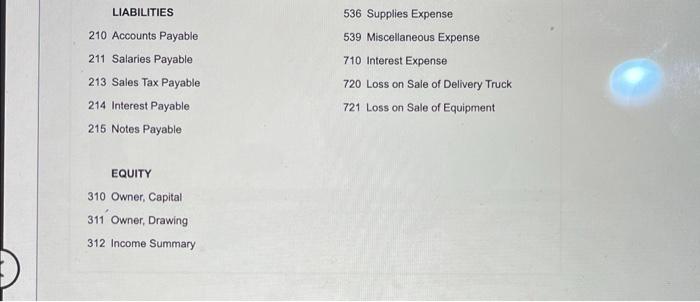

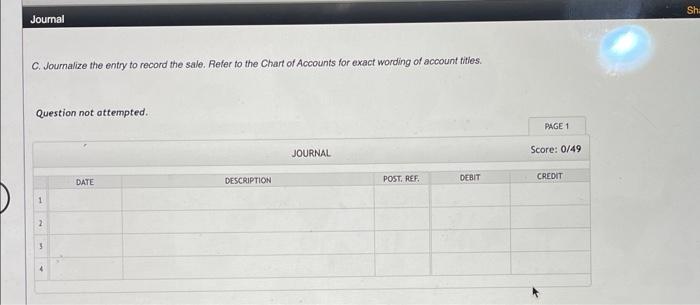

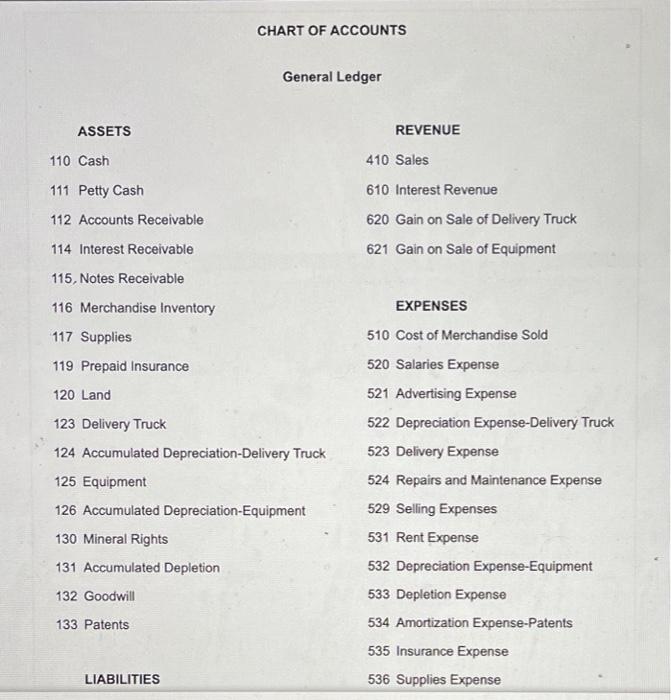

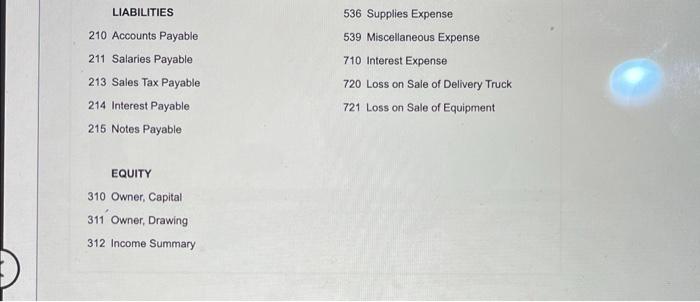

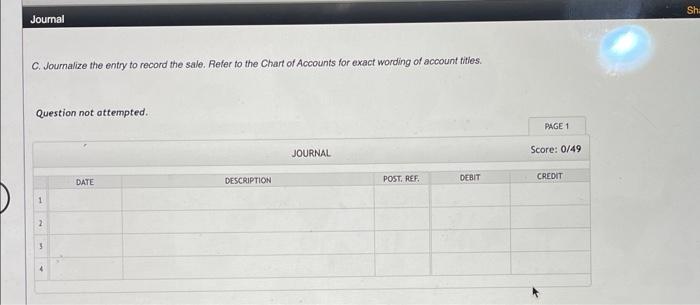

of 16 years and an estimated tesidun value of $60,000. Required: A. What was the decrectition for the first year? B Assuming the equipment was sold at the end of the second year for $480,000, determine the gain or loss on the sale of the equipment. C. Sournalue the entry to recard the sale. Fefer to the Chart of Accounts for exacf wording of account bites. Starting Questions Shaded cells have fledaack. A. What was the decreciation for the first yoar? B. Assuming the equipment was soid at the end of the second year for 5480,000 , desermine the gain or loss on the sale of the equipment. CHART OF ACCOUNTS General Ledger LIABILITIES 536 Supplies Expense 210 Accounts Payable 539 Miscellaneous Expense 211 Salaries Payable 710 Interest Expense 213 Sales Tax Payable 720 Loss on Sale of Delivery Truck 214 Interest Payable 721 Loss on Sale of Equipment 215 Notes Payable EQUITY 310 Owner, Capital 311 Owner, Drawing 312 Income Summary C. Sournalize the entry to record the sale. Refer to the Chart of Accounts for exact wording of account fities. Question not attempted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started