Question: please show the workdo not use Excel. thank you so much NU Inc outstanding bonds have a $1,000 par value which were issued 9 years

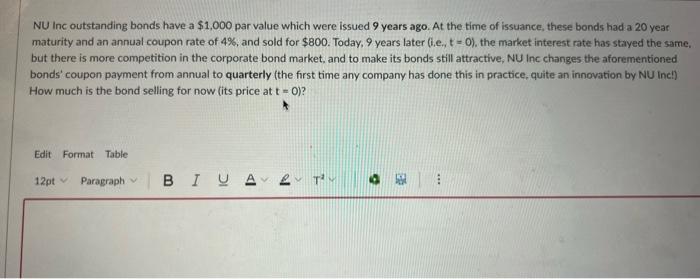

NU Inc outstanding bonds have a $1,000 par value which were issued 9 years ago. At the time of issuance, these bonds had a 20 year maturity and an annual coupon rate of 4%, and sold for $800. Today, 9 years later (i,e,t=0), the market interest rate has stayed the same, but there is more competition in the corporate bond market, and to make its bonds still attractive, NU Inc changes the aforementioned bonds' coupon payment from annual to quarterly (the first time any company has done this in practice, quite an innovation by NU Incl) How much is the bond selling for now (its price at t=0 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts