Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work 13. Perform a current position analysis by calculating the working capital, current ratio, and quick ratio on the following company for 2018

Please show work

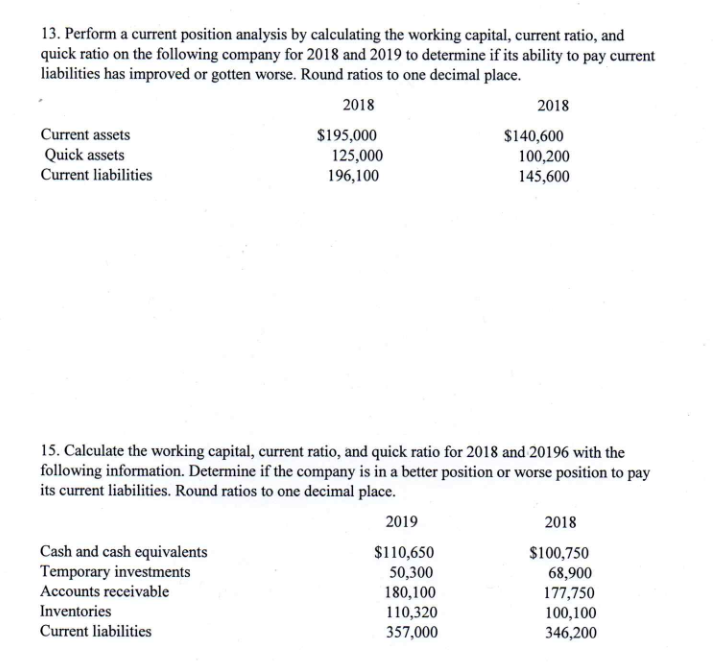

13. Perform a current position analysis by calculating the working capital, current ratio, and quick ratio on the following company for 2018 and 2019 to determine if its ability to pay current liabilities has improved or gotten worse. Round ratios to one decimal place 2018 2018 Current assets Quick assets Current liabilities $195,000 125,000 196,100 $140,600 100,200 145,600 15. Calculate the working capital, current ratio, and quick ratio for 2018 and 20196 with the following information. Determine if the company is in a better position or worse position to pay its current liabilities. Round ratios to one decimal place. 2018 $110,650 50,300 180,100 110,320 357,000 Cash and cash equivalents Temporary investments Accounts receivable Inventories Current liabilities $100,750 68,900 177,750 100,100 346,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started