Please show work

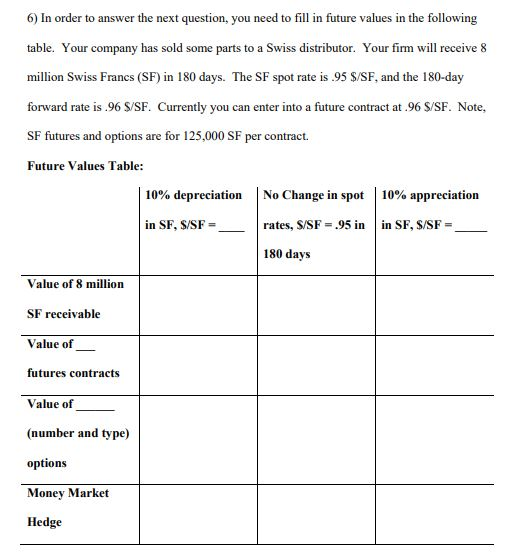

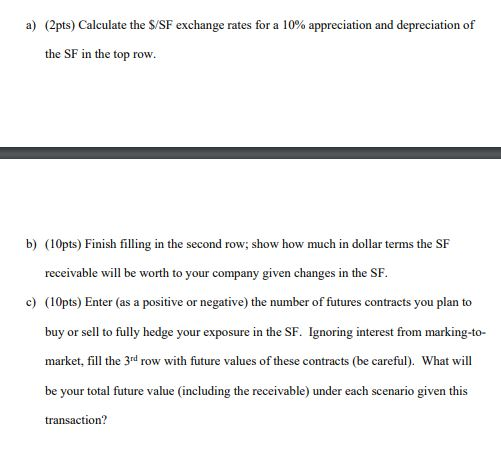

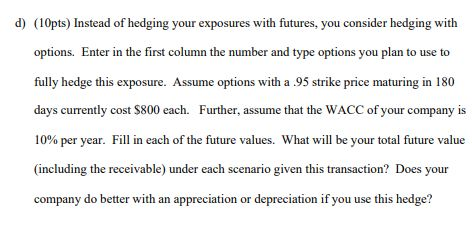

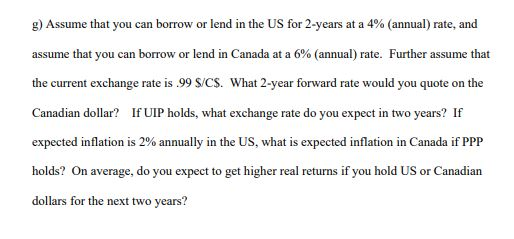

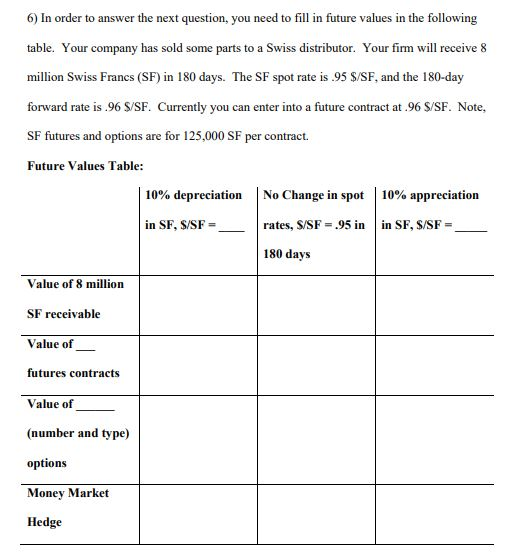

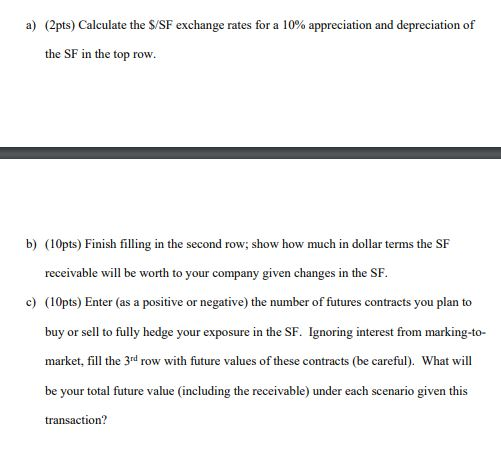

6) In order to answer the next question, you need to fill in future values in the following table. Your company has sold some parts to a Swiss distributor. Your firm will receive 8 million Swiss Francs (SF) in 180 days. The SF spot rate is .95 $/SF, and the 180-day forward rate is.96 S/SF. Currently you can enter into a future contract at.96 $/SF. Note, SF futures and options are for 125,000 SF per contract. Future Values Table: 10% depreciation No Change in spot 10% appreciation in SF, S/SF=_ rates, S/SF = 95 in in SF, S/SF = 180 days Value of 8 million SF receivable Value of futures contracts Value of (number and type) options Money Market Hedge a) (2pts) Calculate the S/SF exchange rates for a 10% appreciation and depreciation of the SF in the top row. b) (10pts) Finish filling in the second row, show how much in dollar terms the SF receivable will be worth to your company given changes in the SF. c) (10pts) Enter (as a positive or negative) the number of futures contracts you plan to buy or sell to fully hedge your exposure in the SF. Ignoring interest from marking-to- market, fill the 3rd row with future values of these contracts (be careful). What will be your total future value (including the receivable) under each scenario given this transaction? d) (10pts) Instead of hedging your exposures with futures, you consider hedging with options. Enter in the first column the number and type options you plan to use to fully hedge this exposure. Assume options with a 95 strike price maturing in 180 days currently cost $800 each. Further, assume that the WACC of your company is 10% per year. Fill in each of the future values. What will be your total future value (including the receivable) under each scenario given this transaction? Does your company do better with an appreciation or depreciation if you use this hedge? e) (10pts) Now construct a money-market hedge for this exposure. Your firm can borrow SF at 5%, or invest in SF at 4% annual rates. You can borrow US$ at 2% or invest in US$ at 1%. Again these are annually compounded annual rates. Describe exactly how you would construct a money-market hedge. Compare the money market hedge with the futures hedge you constructed in part (c), which one is a better deal for your company? 1) What are the arguments for and against hedging this receivable? g) Assume that you can borrow or lend in the US for 2-years at a 4% (annual) rate, and assume that you can borrow or lend in Canada at a 6% (annual) rate. Further assume that the current exchange rate is 99 S/C$. What 2-year forward rate would you quote on the Canadian dollar? If UIP holds, what exchange rate do you expect in two years? If expected inflation is 2% annually in the US, what is expected inflation in Canada if PPP holds? On average, do you expect to get higher real returns if you hold US or Canadian dollars for the next two years? 6) In order to answer the next question, you need to fill in future values in the following table. Your company has sold some parts to a Swiss distributor. Your firm will receive 8 million Swiss Francs (SF) in 180 days. The SF spot rate is .95 $/SF, and the 180-day forward rate is.96 S/SF. Currently you can enter into a future contract at.96 $/SF. Note, SF futures and options are for 125,000 SF per contract. Future Values Table: 10% depreciation No Change in spot 10% appreciation in SF, S/SF=_ rates, S/SF = 95 in in SF, S/SF = 180 days Value of 8 million SF receivable Value of futures contracts Value of (number and type) options Money Market Hedge a) (2pts) Calculate the S/SF exchange rates for a 10% appreciation and depreciation of the SF in the top row. b) (10pts) Finish filling in the second row, show how much in dollar terms the SF receivable will be worth to your company given changes in the SF. c) (10pts) Enter (as a positive or negative) the number of futures contracts you plan to buy or sell to fully hedge your exposure in the SF. Ignoring interest from marking-to- market, fill the 3rd row with future values of these contracts (be careful). What will be your total future value (including the receivable) under each scenario given this transaction? d) (10pts) Instead of hedging your exposures with futures, you consider hedging with options. Enter in the first column the number and type options you plan to use to fully hedge this exposure. Assume options with a 95 strike price maturing in 180 days currently cost $800 each. Further, assume that the WACC of your company is 10% per year. Fill in each of the future values. What will be your total future value (including the receivable) under each scenario given this transaction? Does your company do better with an appreciation or depreciation if you use this hedge? e) (10pts) Now construct a money-market hedge for this exposure. Your firm can borrow SF at 5%, or invest in SF at 4% annual rates. You can borrow US$ at 2% or invest in US$ at 1%. Again these are annually compounded annual rates. Describe exactly how you would construct a money-market hedge. Compare the money market hedge with the futures hedge you constructed in part (c), which one is a better deal for your company? 1) What are the arguments for and against hedging this receivable? g) Assume that you can borrow or lend in the US for 2-years at a 4% (annual) rate, and assume that you can borrow or lend in Canada at a 6% (annual) rate. Further assume that the current exchange rate is 99 S/C$. What 2-year forward rate would you quote on the Canadian dollar? If UIP holds, what exchange rate do you expect in two years? If expected inflation is 2% annually in the US, what is expected inflation in Canada if PPP holds? On average, do you expect to get higher real returns if you hold US or Canadian dollars for the next two years