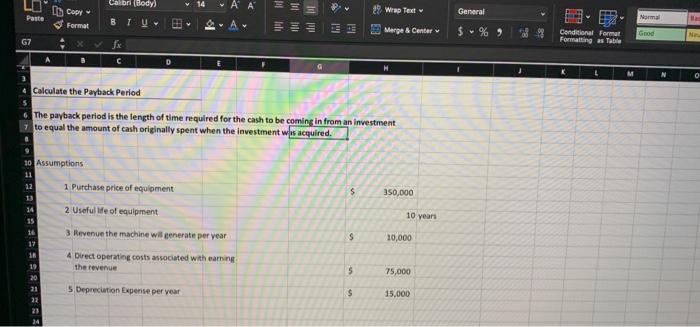

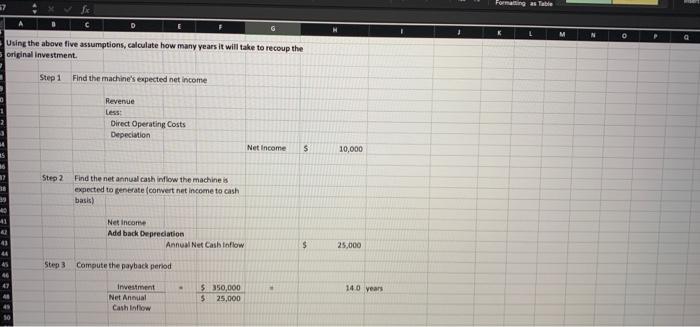

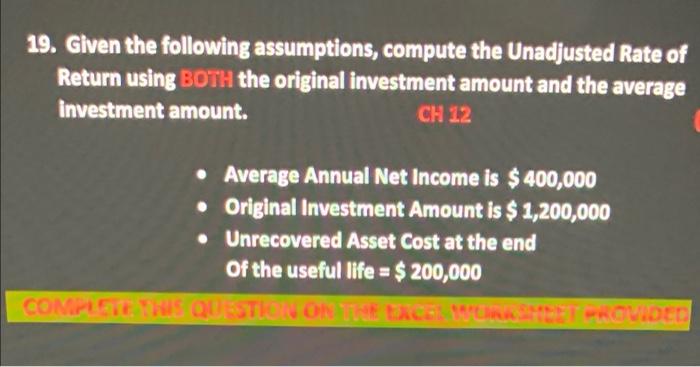

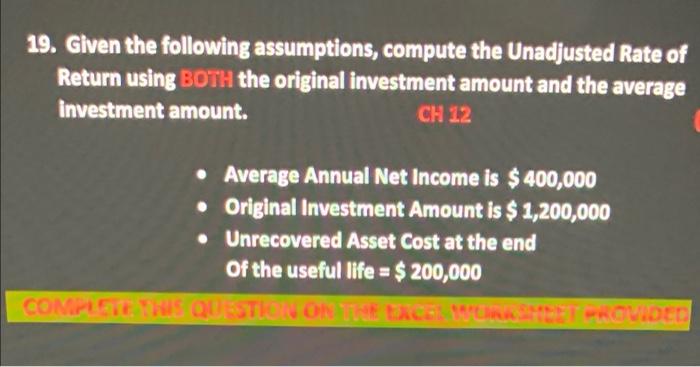

+ A A Calibr (Body) B TV 29 Wrap Text General Copy Format Paste w . Normal A Merge & Center $ % ) 99 Conditional Format Formatting as Table Good NE G7 fx C E M O Calculate the Payback Period The payback period is the length of time required for the cash to be coming in from an investment to equal the amount of cash originally spent when the investment was acquired. $ 350,000 10 years 9 10 Assumptions 11 22 1 Purchase price of equipment 13 14 2 Useful life of equipment 15 3 Revenue the machine will generate per year 17 4 Direct operating costs associated with earning the revenue 20 5 Depreciation Expense per year 22 16 $ 10,000 5 75,000 SS & NOX 21 $ 15,000 21 24 Formatting e Table K L M Using the above five assumptions, calculate how many years it will take to recoup the original investment. Step 1 Find the machine's expected net income Revenue Less: Direct Operating costs Depreciation Net Income 5 10,000 17 Step 2 Find the net annual cash inflow the machine is expected to generate corwert net income to cash bask) 39 40 41 Net Income Add back Deprecation Annual Net Casb toflow $ 25,000 Step 3 Compute the payback period - 140 years Investment Net Annual Cash Inflow 5 350,000 5 25,000 19. Given the following assumptions, compute the Unadjusted Rate of Return using BOTH the original investment amount and the average investment amount. CH 12 Average Annual Net Income is $400,000 Original Investment Amount is $ 1,200,000 Unrecovered Asset Cost at the end Of the useful life = $ 200,000 COMPLETE THIS QUESTION OR EXCELETROVIDED + A A Calibr (Body) B TV 29 Wrap Text General Copy Format Paste w . Normal A Merge & Center $ % ) 99 Conditional Format Formatting as Table Good NE G7 fx C E M O Calculate the Payback Period The payback period is the length of time required for the cash to be coming in from an investment to equal the amount of cash originally spent when the investment was acquired. $ 350,000 10 years 9 10 Assumptions 11 22 1 Purchase price of equipment 13 14 2 Useful life of equipment 15 3 Revenue the machine will generate per year 17 4 Direct operating costs associated with earning the revenue 20 5 Depreciation Expense per year 22 16 $ 10,000 5 75,000 SS & NOX 21 $ 15,000 21 24 Formatting e Table K L M Using the above five assumptions, calculate how many years it will take to recoup the original investment. Step 1 Find the machine's expected net income Revenue Less: Direct Operating costs Depreciation Net Income 5 10,000 17 Step 2 Find the net annual cash inflow the machine is expected to generate corwert net income to cash bask) 39 40 41 Net Income Add back Deprecation Annual Net Casb toflow $ 25,000 Step 3 Compute the payback period - 140 years Investment Net Annual Cash Inflow 5 350,000 5 25,000 19. Given the following assumptions, compute the Unadjusted Rate of Return using BOTH the original investment amount and the average investment amount. CH 12 Average Annual Net Income is $400,000 Original Investment Amount is $ 1,200,000 Unrecovered Asset Cost at the end Of the useful life = $ 200,000 COMPLETE THIS QUESTION OR EXCELETROVIDED