Answered step by step

Verified Expert Solution

Question

1 Approved Answer

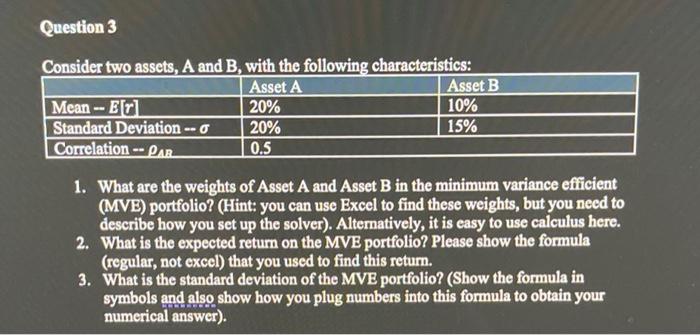

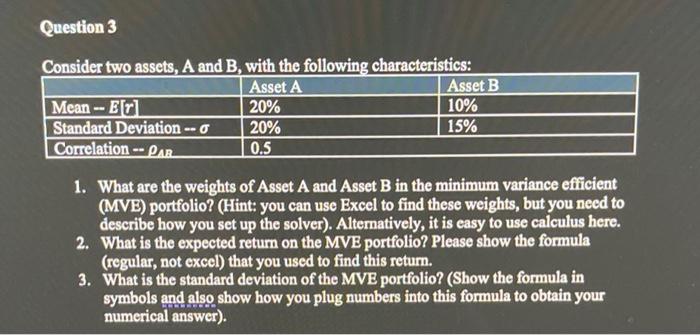

please show work and brief explanations Question 3 Consider two assets, A and B, with the following characteristics: Asset A Asset B Mean -- Er]

please show work and brief explanations

Question 3 Consider two assets, A and B, with the following characteristics: Asset A Asset B Mean -- Er] 20% 10% Standard Deviation -- 0 20% 15% Correlation -- PAR 0.5 1. What are the weights of Asset A and Asset B in the minimum variance efficient (MVE) portfolio? (Hint: you can use Excel to find these weights, but you need to describe how you set up the solver). Alternatively, it is easy to use calculus here. 2. What is the expected return on the MVE portfolio? Please show the formula (regular, not excel) that you used to find this return. 3. What is the standard deviation of the MVE portfolio? (Show the formula in symbols and also show how you plug numbers into this formula to obtain your numerical answer)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started