**PLEASE SHOW WORK AND CALCULATION** THANK YOU VERY MUCH!!!

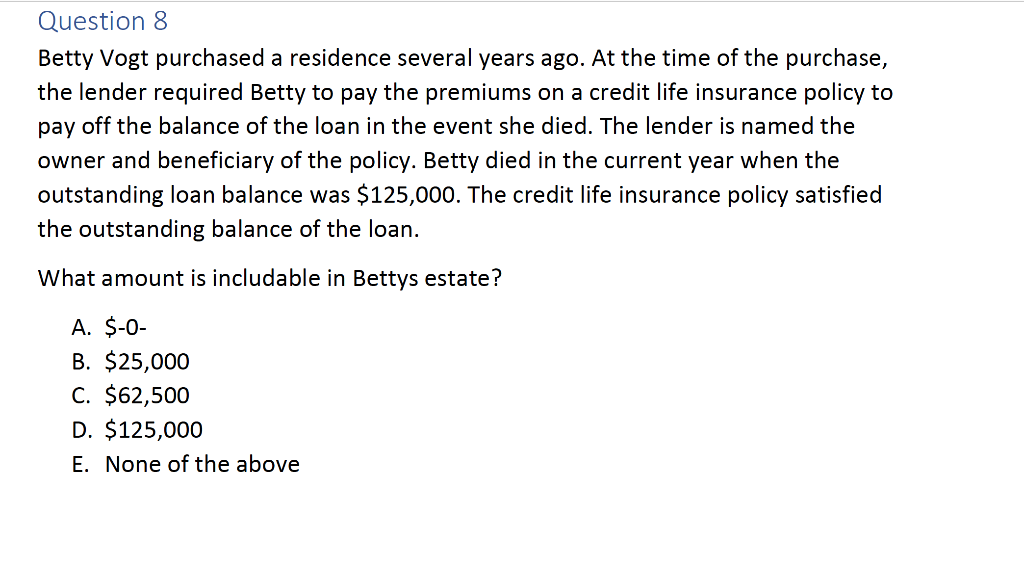

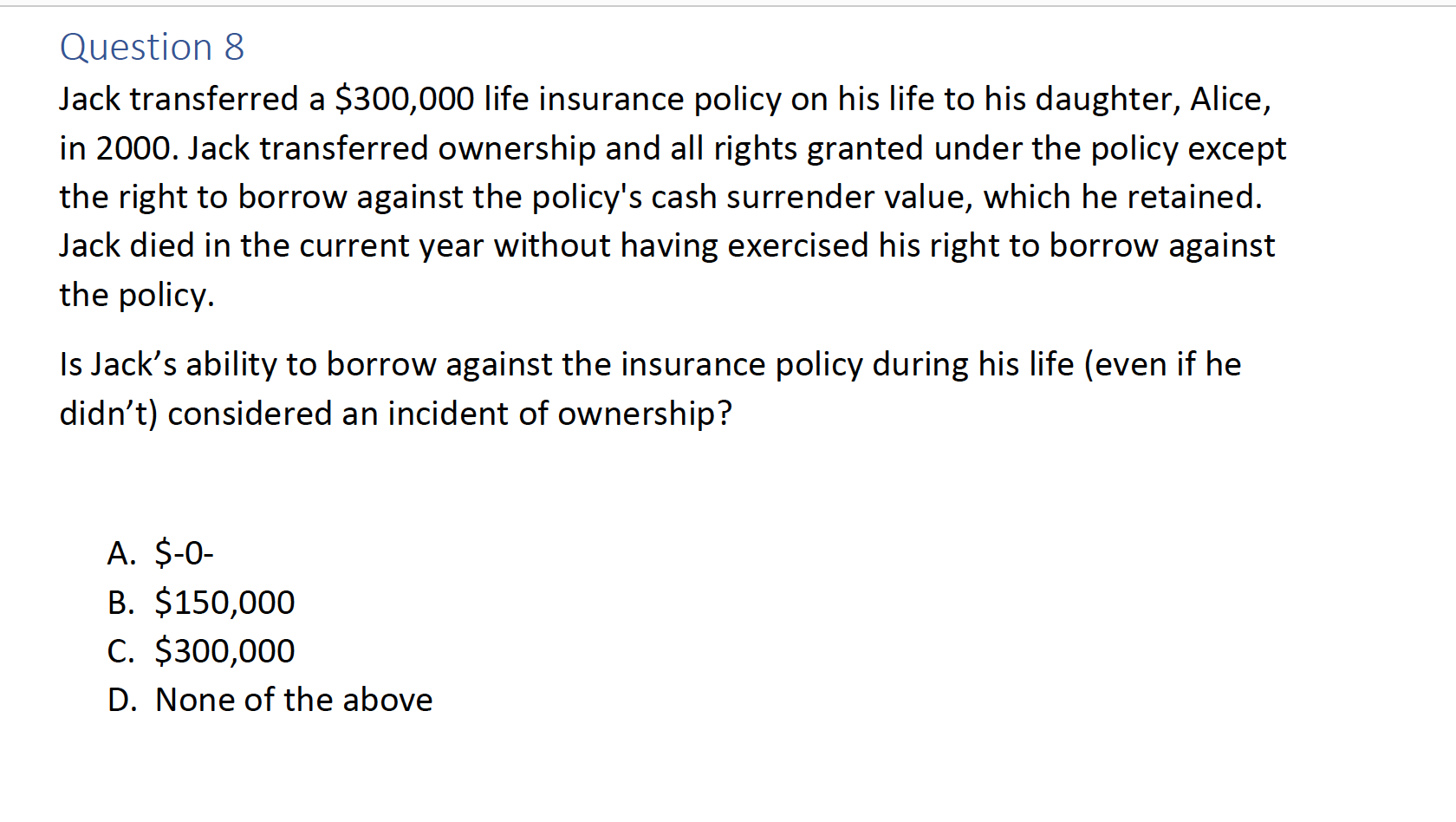

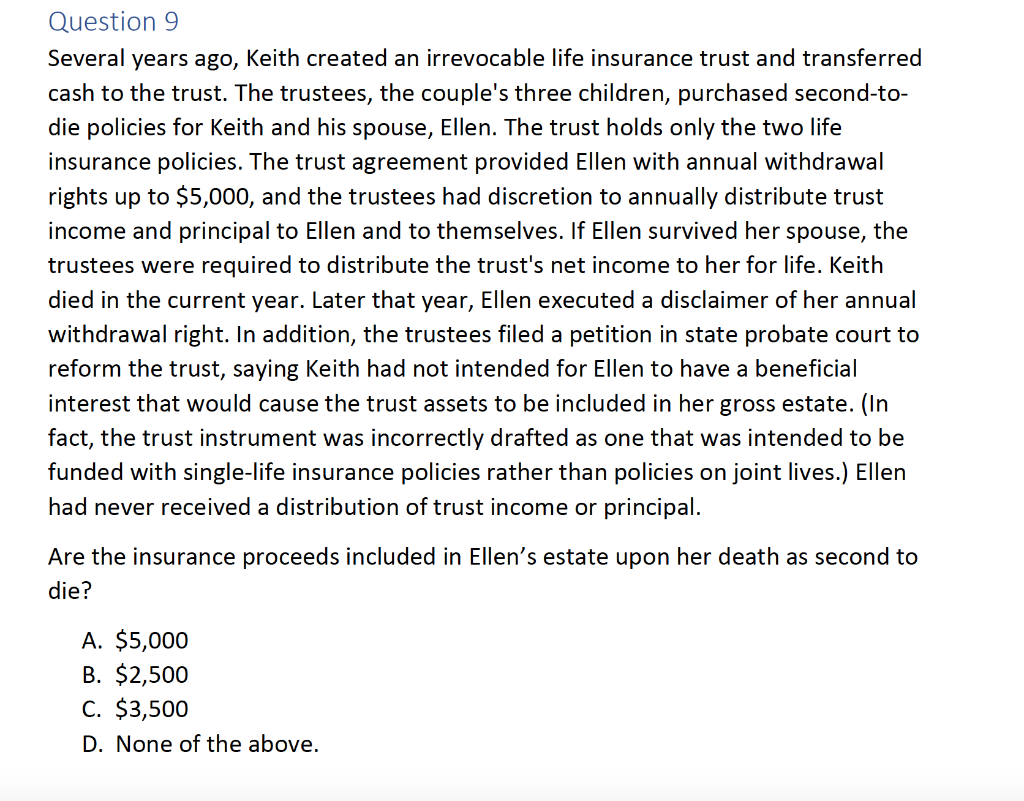

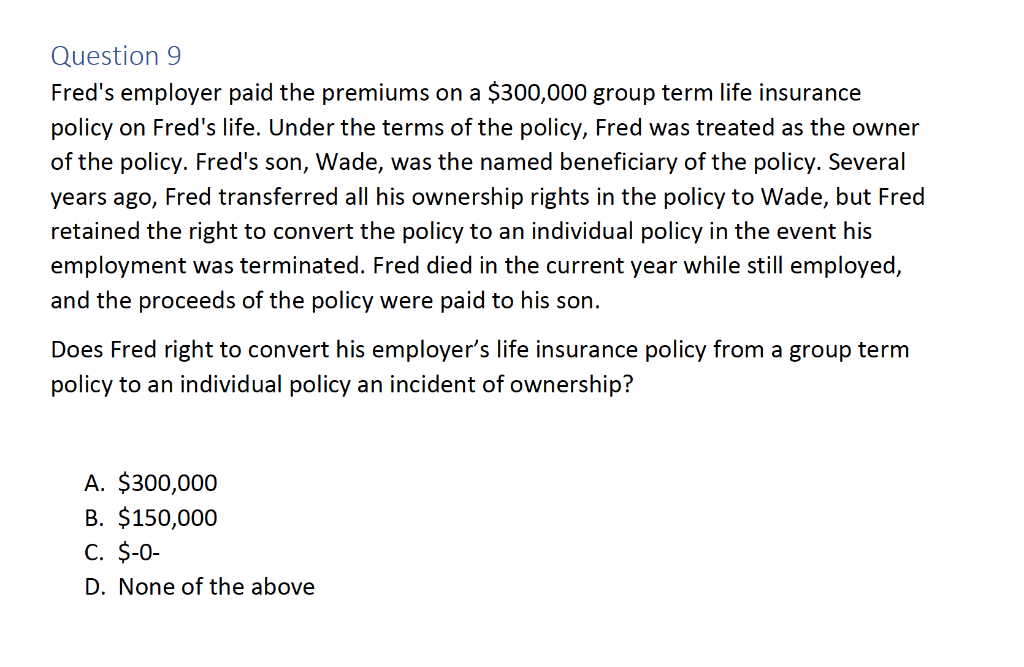

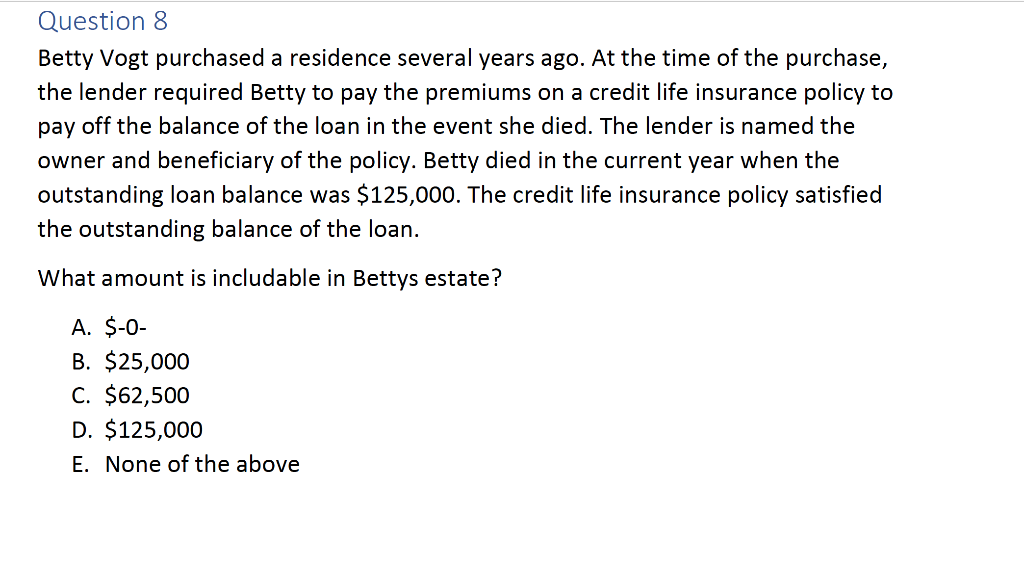

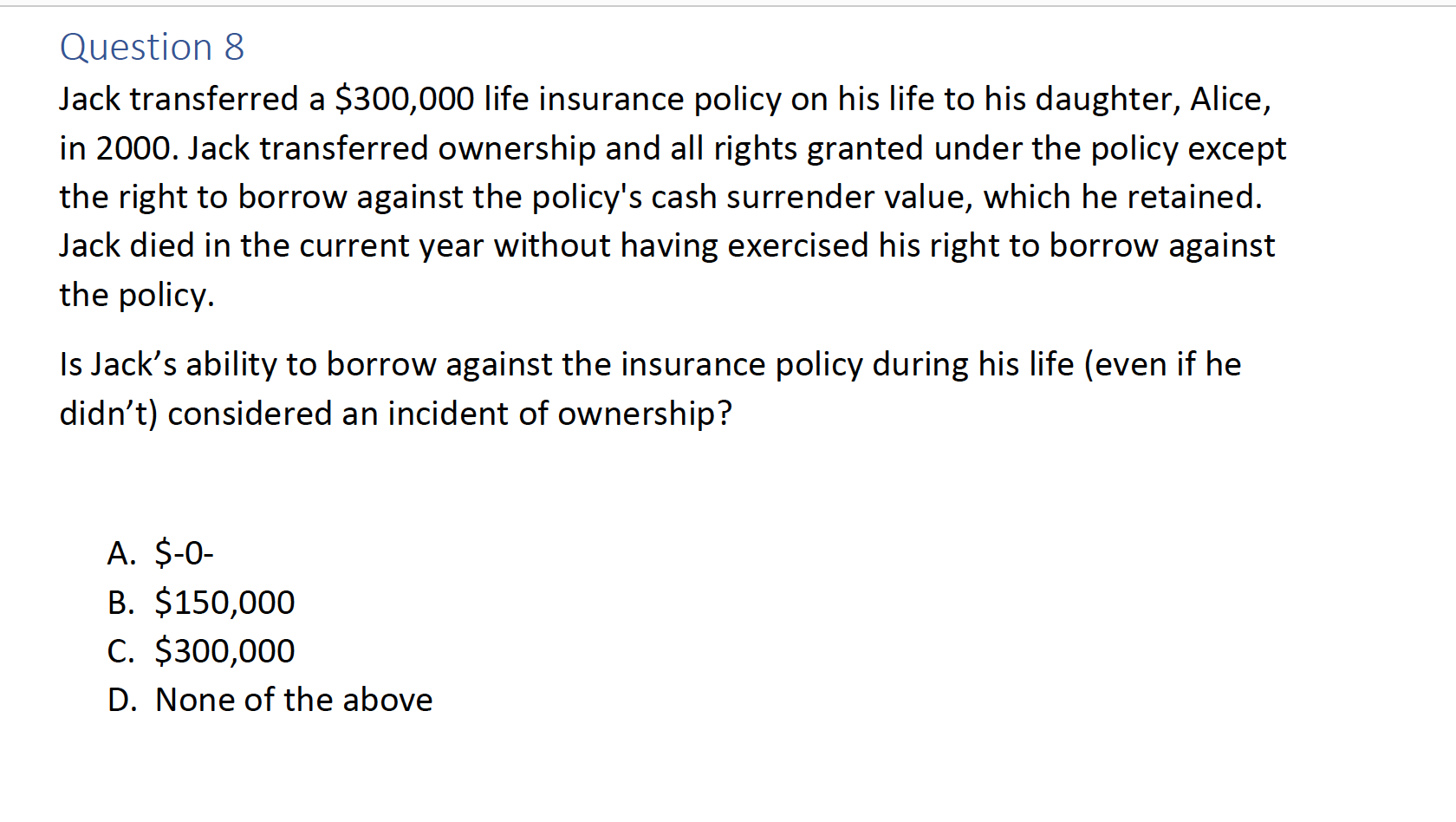

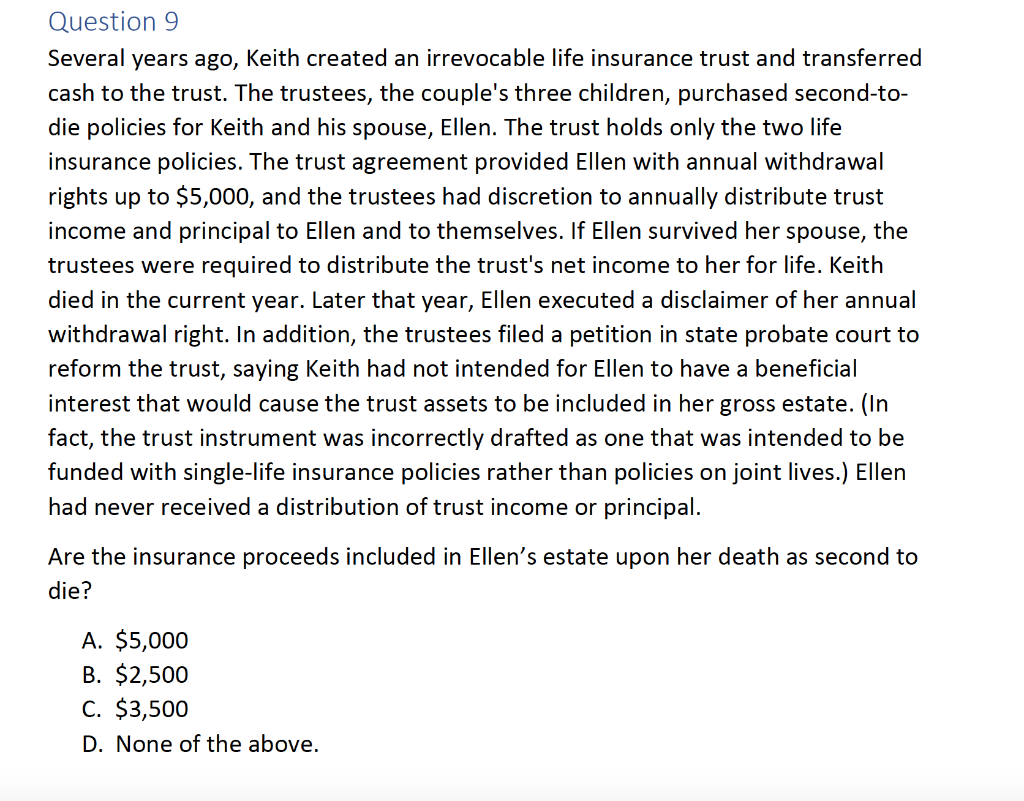

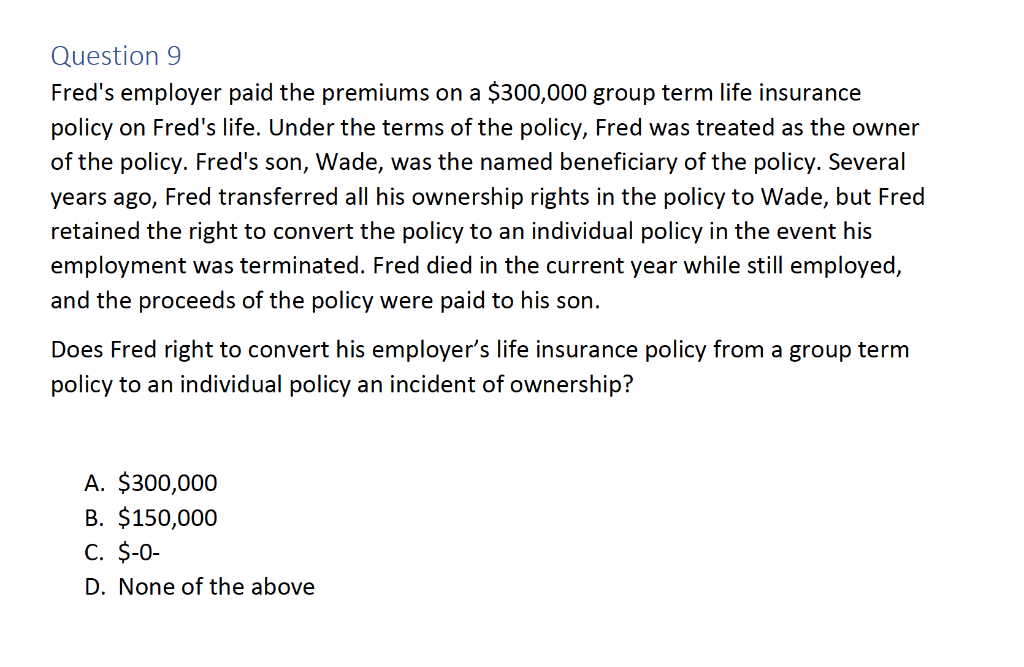

Question 8 Betty Vogt purchased a residence several years ago. At the time of the purchase, the lender required Betty to pay the premiums on a credit life insurance policy to pay off the balance of the loan in the event she died. The lender is named the owner and beneficiary of the policy. Betty died in the current year when the outstanding loan balance was $125,000. The credit life insurance policy satisfied the outstanding balance of the loan. What amount is includable in Bettys estate? A. $-0- B. $25,000 C. $62,500 D. $125,000 E. None of the above Question 8 Jack transferred a $300,000 life insurance policy on his life to his daughter, Alice, in 2000. Jack transferred ownership and all rights granted under the policy except the right to borrow against the policy's cash surrender value, which he retained. Jack died in the current year without having exercised his right to borrow against the policy. Is Jack's ability to borrow against the insurance policy during his life (even if he didn't) considered an incident of ownership? A. $-0- B. $150,000 C. $300,000 D. None of the above Question 9 Several years ago, Keith created an irrevocable life insurance trust and transferred cash to the trust. The trustees, the couple's three children, purchased second-to- die policies for Keith and his spouse, Ellen. The trust holds only the two life insurance policies. The trust agreement provided Ellen with annual withdrawal rights up to $5,000, and the trustees had discretion to annually distribute trust income and principal to Ellen and to themselves. If Ellen survived her spouse, the trustees were required to distribute the trust's net income to her for life. Keith died in the current year. Later that year, Ellen executed a disclaimer of her annual withdrawal right. In addition, the trustees filed a petition in state probate court to reform the trust, saying Keith had not intended for Ellen to have a beneficial interest that would cause the trust assets to be included in her gross estate. (In fact, the trust instrument was incorrectly drafted as one that was intended to be funded with single-life insurance policies rather than policies on joint lives.) Ellen had never received a distribution of trust income or principal. Are the insurance proceeds included in Ellen's estate upon her death as second to die? A. $5,000 B. $2,500 C. $3,500 D. None of the above. Question 9 Fred's employer paid the premiums on a $300,000 group term life insurance policy on Fred's life. Under the terms of the policy, Fred was treated as the owner of the policy. Fred's son, Wade, was the named beneficiary of the policy. Several years ago, Fred transferred all his ownership rights in the policy to Wade, but Fred retained the right to convert the policy to an individual policy in the event his employment was terminated. Fred died in the current year while still employed, and the proceeds of the policy were paid to his son. Does Fred right to convert his employer's life insurance policy from a group term policy to an individual policy an incident of ownership? A. $300,000 B. $150,000 C. $-0- D. None of the above Question 10 Frank and Bob are each 50% shareholders in FB Corp. and jointly bought a policy on Bob's life naming FB Corp. as the beneficiary. No rights under the policy can be exercised by Bob without Frank's consent. Since Frank has a 50% interest in the corporation, he will be adversely affected by the exercise of any right that would reduce the proceeds payable to the corporation at Bob's death. Are the proceeds of insurance policy in includable in Bob's gross estate on Schedule D? A. Yes B. No Question 11 Faber Corp. (Faber) owns a $500,000 key person life insurance policy on the life of its president and majority shareholder, Jack Faber. Pursuant to the beneficiary designation on the policy, the proceeds are payable 40% to Jack's spouse and 60% to Faber. Jack died in the current year when he owned 65% of Faber's stock. What amount of the insurance proceeds includable in Jack's gross estate? A. $200,000 B. $-0- C. $300,000 D. $325,000 Question 12 Bob, Dave, and Frank are partners in a general partnership. They respectively own 50%, 25%, and 25% interests in the partnership. The partnership owns a $1 million insurance policy on Bob's life, for which the partnership is the beneficiary. The partnership is under no obligation to use the proceeds to satisfy any of Bob's estate tax payments or other debts. What the tax consequences to partnership upon Bob's death? A. Since Bob was a general partner $500,000 is included in his gross estate. B. Since the proceeds are not used to satisfy any of Bob's estate then none of the proceeds are included in Bob's estate. C. The insurance is included in Bob's estate through the valuation of Bob's partnership. D. 50% of the insurance proceeds are consider when determining the value of Bob's interest in the partnership. Question 13 General The value of the gross estate of the decedent shall be determined by including to the extent provided for in this part, the value at the time of his death of all property, real, or personal, tangible, wherever situated. A. IRC $2031 B. IRC $2032 C. IRC $2042 D. IRC $2010 E. IRC $2001