Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW WORK AND CASH FLOW DIAGRAM 4. A firm must choose between two projects A and B, shown below. Their effective income tax rate

PLEASE SHOW WORK AND CASH FLOW DIAGRAM

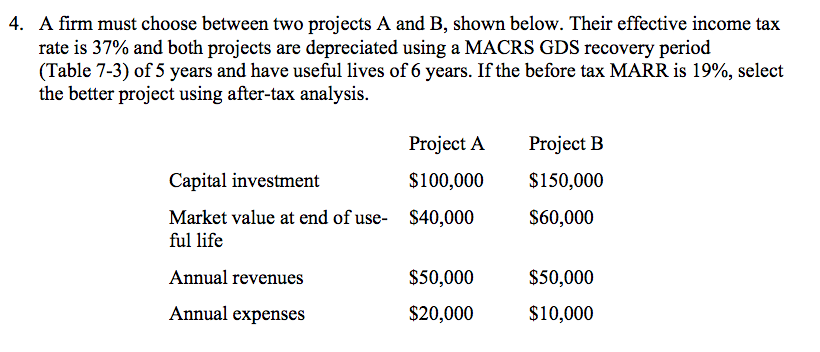

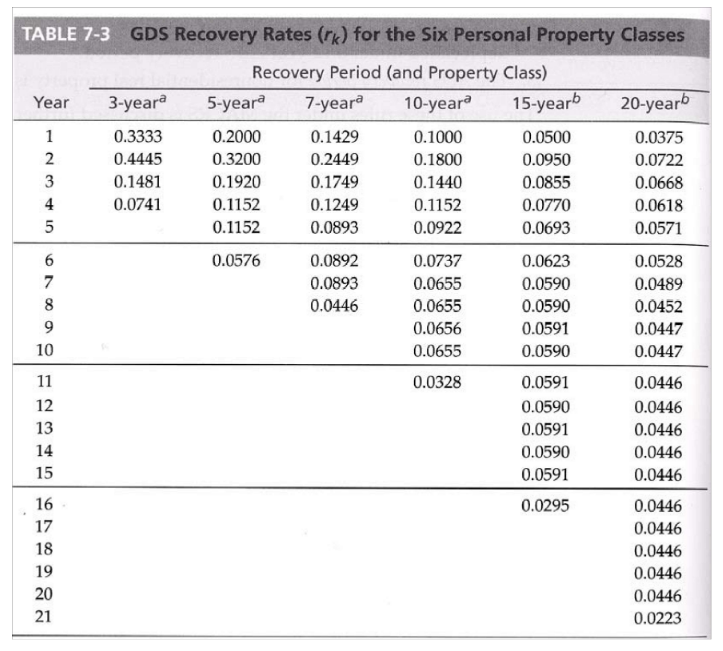

4. A firm must choose between two projects A and B, shown below. Their effective income tax rate is 37% and both projects are depreciated using a MACRS GDS recovery period (Table 7-3) of 5 years and have useful lives of 6 years. If the before tax MARR is 19%, select the better project using after-tax analysis. Project A $100,000 Capital investment Project B $150,000 $60,000 $40,000 Market value at end of use- ful life Annual revenues $50,000 $50,000 $20,000 Annual expenses $10,000 TABLE 7-3 GDS Recovery Rates (r) for the Six Personal Property Classes Recovery Period (and Property Class) Year 3-yeara 5-yeara 7-yeara 10-yeara 15-yearb 20-yearb 0.3333 0.4445 0.1481 0.0741 0.2000 0.3200 0.1920 0.1152 0.1152 0.1429 0.2449 0.1749 0.1249 0.0893 0.1000 0.1800 0.1440 0.1152 0.0922 0.0500 0.0950 0.0855 0.0770 0.0693 0.0375 0.0722 0.0668 0.0618 0.0571 0.0576 0.0892 0.0893 0.0446 0.0737 0.0655 0.0655 0.0656 0.0655 0.0623 0.0590 0.0590 0.0591 0.0590 0.0528 0.0489 0.0452 0.0447 0.0447 0.0328 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 4. A firm must choose between two projects A and B, shown below. Their effective income tax rate is 37% and both projects are depreciated using a MACRS GDS recovery period (Table 7-3) of 5 years and have useful lives of 6 years. If the before tax MARR is 19%, select the better project using after-tax analysis. Project A $100,000 Capital investment Project B $150,000 $60,000 $40,000 Market value at end of use- ful life Annual revenues $50,000 $50,000 $20,000 Annual expenses $10,000 TABLE 7-3 GDS Recovery Rates (r) for the Six Personal Property Classes Recovery Period (and Property Class) Year 3-yeara 5-yeara 7-yeara 10-yeara 15-yearb 20-yearb 0.3333 0.4445 0.1481 0.0741 0.2000 0.3200 0.1920 0.1152 0.1152 0.1429 0.2449 0.1749 0.1249 0.0893 0.1000 0.1800 0.1440 0.1152 0.0922 0.0500 0.0950 0.0855 0.0770 0.0693 0.0375 0.0722 0.0668 0.0618 0.0571 0.0576 0.0892 0.0893 0.0446 0.0737 0.0655 0.0655 0.0656 0.0655 0.0623 0.0590 0.0590 0.0591 0.0590 0.0528 0.0489 0.0452 0.0447 0.0447 0.0328 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started