please show work and correct answer!

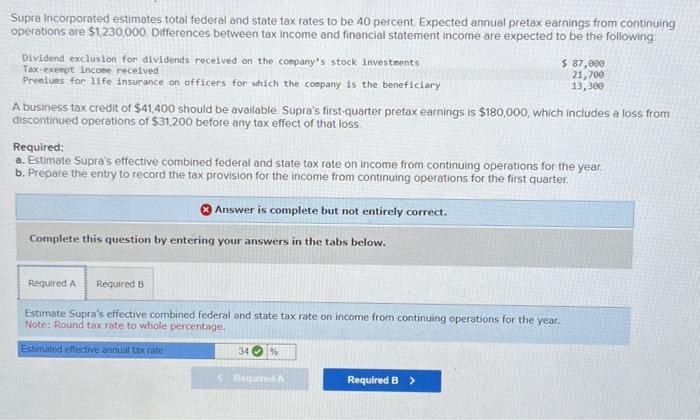

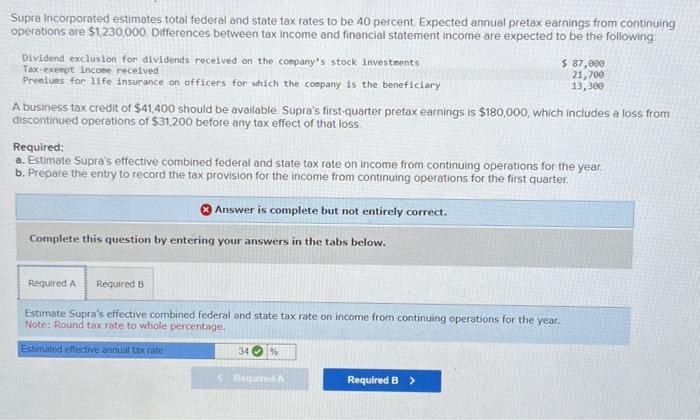

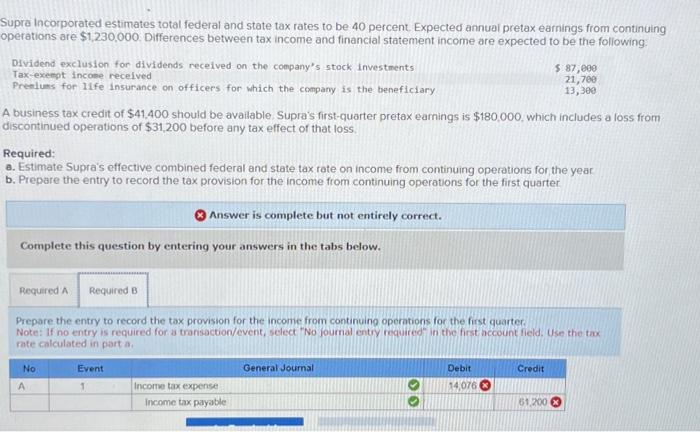

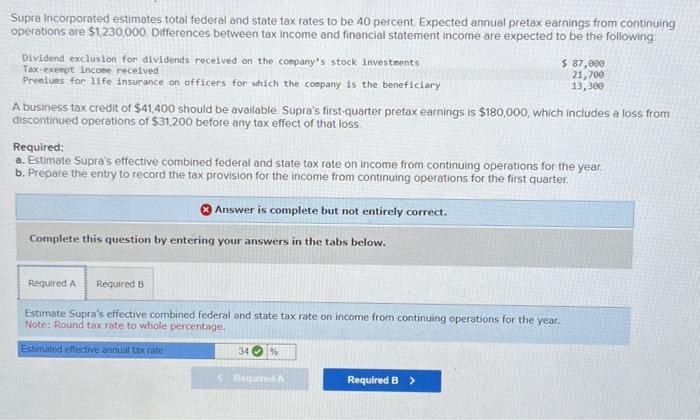

Supra incorporated estimates total federal and state tax rates to be 40 percent Expected annual pretax earnings from continuing operations are $1,230,000. Differences between tax income and financial statement income are expected to be the following. Oividend exclusion for dividends received on the company's stock investents Tax-exempt incone received Preniums for life insurance on officers for witich the company is the beneficiary 587,00021,70013,300 A business tax credit of $41,400 should be available. Supra's first-quarter pretax earnings is $180,000, which includes a loss from discontinued operations of $31,200 before any tax effect of that loss. Required: a. Estimate Supra's effective combined federal and state tax rate on income from continuing operations for the year. b. Prepare the entry to record the tax provision for the income from continuing operations for the first quarter. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Estimate Supra's effective combined federal and state tax rate on income from continuing operations for the year. Note: Round tax rate to whole percentage. Supra incorporated estimates total federal and state tax rates to be 40 percent. Expected annual pretax earnings from continuing operations are $1,230,000. Differences between tax income and financial statement income are expected to be the following: Dividend exclusion for dividends received on the company's stock investments Tax-exeept incone recelved Preeluass for 11 fe insurance on officers for which the company is the beneficiary 87,60021,70013,300 A business tax credit of $41,400 should be available. Supra's first-quarter pretax earnings is $180,000, which includes a loss from discontinued operations of $31,200 before any tax effect of that loss. Required: a. Estimate Supra's effective combined federal and state tax rate on income from continuing operations for the year b. Prepare the entry to record the tax provision for the income from continuing operations for the first quarter. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare the entry to record the tax provision for the income from continuing operations for the first quarter. Note: If no entry is required for a transaction/event, select 'No Journal entry required" in the first account field. Use the tax. rate calculated in part a