Answered step by step

Verified Expert Solution

Question

1 Approved Answer

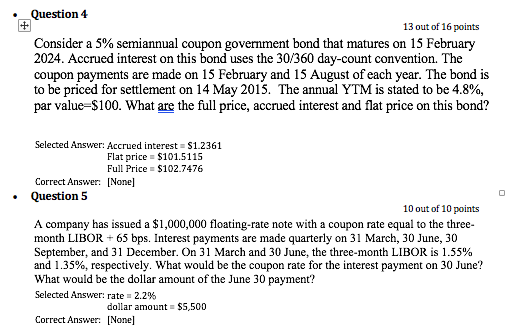

Please show work and do not use excel! Thanks Question 4 13 out of 16 points Consider a 5% semiannual coupon government bond that matures

Please show work and do not use excel! Thanks

Question 4 13 out of 16 points Consider a 5% semiannual coupon government bond that matures on 15 February 2024. Accrued interest on this bond uses the 30/360 day-count convention. The coupon payments are made on 15 February and 15 August of each year. The bond is to be priced for settlement on 14 May 2015. The annual YTM is stated to be 4.8%, par value=$100. What are the full price, accrued interest and flat price on this bond? Selected Answer: Accrued interest = $1.2361 Flat price $101.5115 Full Price = $102.7476 Correct Answer: None Question 5 10 out of 10 points A company has issued a $1,000,000 floating-rate note with a coupon rate equal to the three- month LIBOR + 65 bps. Interest payments are made quarterly on 31 March, 30 June, 30 September, and 31 December. On 31 March and 30 June, the three-month LIBOR is 1.55% and 1.35%, respectively. What would be the coupon rate for the interest payment on 30 June? What would be the dollar amount of the June 30 payment? Selected Answer: rate - 2.2% dollar amount $5,500 Correct Answer: [NonelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started