Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**Please show work and how you find answers III Show Attempt History Current Attempt in Progress ADM Ltd. is a public company that manufactures and

**Please show work and how you find answers

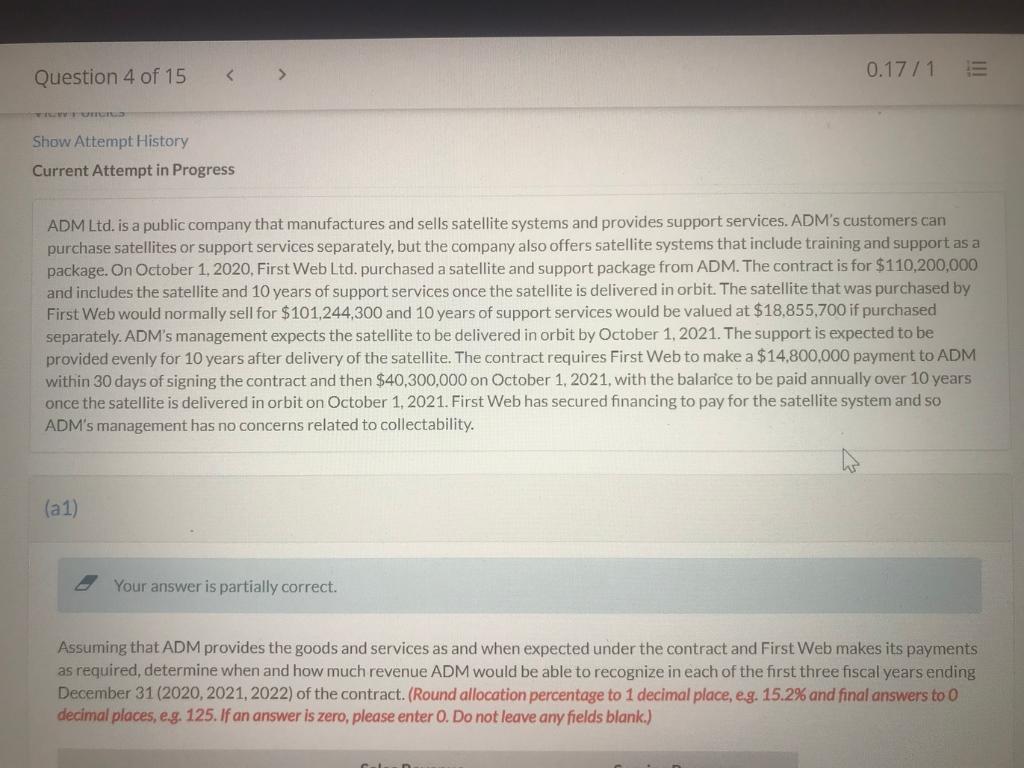

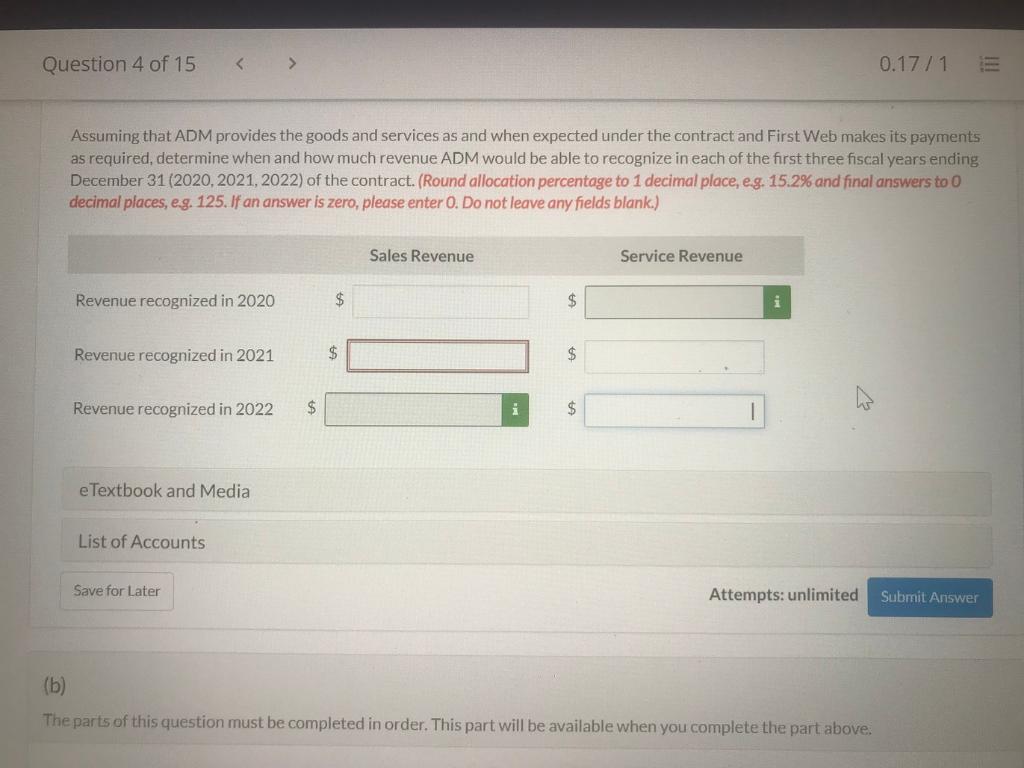

III Show Attempt History Current Attempt in Progress ADM Ltd. is a public company that manufactures and sells satellite systems and provides support services. ADM's customers can purchase satellites or support services separately, but the company also offers satellite systems that include training and support as a package. On October 1, 2020. First Web Ltd. purchased a satellite and support package from ADM. The contract is for $110,200,000 and includes the satellite and 10 years of support services once the satellite is delivered in orbit. The satellite that was purchased by First Web would normally sell for $101,244,300 and 10 years of support services would be valued at $18.855,700 if purchased separately. ADM's management expects the satellite to be delivered in orbit by October 1, 2021. The support is expected to be provided evenly for 10 years after delivery of the satellite. The contract requires First Web to make a $14,800,000 payment to ADM within 30 days of signing the contract and then $40,300,000 on October 1, 2021, with the balarice to be paid annually over 10 years once the satellite is delivered in orbit on October 1, 2021. First Web has secured financing to pay for the satellite system and so ADM's management has no concerns related to collectability. (a 1) Your answer is partially correct. Assuming that ADM provides the goods and services as and when expected under the contract and First Web makes its payments as required, determine when and how much revenue ADM would be able to recognize in each of the first three fiscal years ending December 31 (2020, 2021 2022) of the contract. (Round allocation percentage to 1 decimal place, eg. 15.2% and final answers to 0 decimal places, e.g. 125. If an answer is zero, please enter 0. Do not leave any fields blank.) Question 4 of 15 > 0.17 /1 Assuming that ADM provides the goods and services as and when expected under the contract and First Web makes its payments as required, determine when and how much revenue ADM would be able to recognize in each of the first three fiscal years ending December 31(2020, 2021, 2022) of the contract. (Round allocation percentage to 1 decimal place, eg. 15.2% and final answers to 0 decimal places, e.g. 125. If an answer is zero, please enter O. Do not leave any fields blank.) Sales Revenue Service Revenue Revenue recognized in 2020 $ $ i Revenue recognized in 2021 $ $ Revenue recognized in 2022 $ $ e Textbook and Media List of Accounts Save for Later Attempts: unlimited Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part above. III Show Attempt History Current Attempt in Progress ADM Ltd. is a public company that manufactures and sells satellite systems and provides support services. ADM's customers can purchase satellites or support services separately, but the company also offers satellite systems that include training and support as a package. On October 1, 2020. First Web Ltd. purchased a satellite and support package from ADM. The contract is for $110,200,000 and includes the satellite and 10 years of support services once the satellite is delivered in orbit. The satellite that was purchased by First Web would normally sell for $101,244,300 and 10 years of support services would be valued at $18.855,700 if purchased separately. ADM's management expects the satellite to be delivered in orbit by October 1, 2021. The support is expected to be provided evenly for 10 years after delivery of the satellite. The contract requires First Web to make a $14,800,000 payment to ADM within 30 days of signing the contract and then $40,300,000 on October 1, 2021, with the balarice to be paid annually over 10 years once the satellite is delivered in orbit on October 1, 2021. First Web has secured financing to pay for the satellite system and so ADM's management has no concerns related to collectability. (a 1) Your answer is partially correct. Assuming that ADM provides the goods and services as and when expected under the contract and First Web makes its payments as required, determine when and how much revenue ADM would be able to recognize in each of the first three fiscal years ending December 31 (2020, 2021 2022) of the contract. (Round allocation percentage to 1 decimal place, eg. 15.2% and final answers to 0 decimal places, e.g. 125. If an answer is zero, please enter 0. Do not leave any fields blank.) Question 4 of 15 > 0.17 /1 Assuming that ADM provides the goods and services as and when expected under the contract and First Web makes its payments as required, determine when and how much revenue ADM would be able to recognize in each of the first three fiscal years ending December 31(2020, 2021, 2022) of the contract. (Round allocation percentage to 1 decimal place, eg. 15.2% and final answers to 0 decimal places, e.g. 125. If an answer is zero, please enter O. Do not leave any fields blank.) Sales Revenue Service Revenue Revenue recognized in 2020 $ $ i Revenue recognized in 2021 $ $ Revenue recognized in 2022 $ $ e Textbook and Media List of Accounts Save for Later Attempts: unlimited Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started