Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**Please show work and how you found the answers :) View Policies Show Attempt History Current Attempt in Progress Novotna Ltd. is a public company

**Please show work and how you found the answers :)

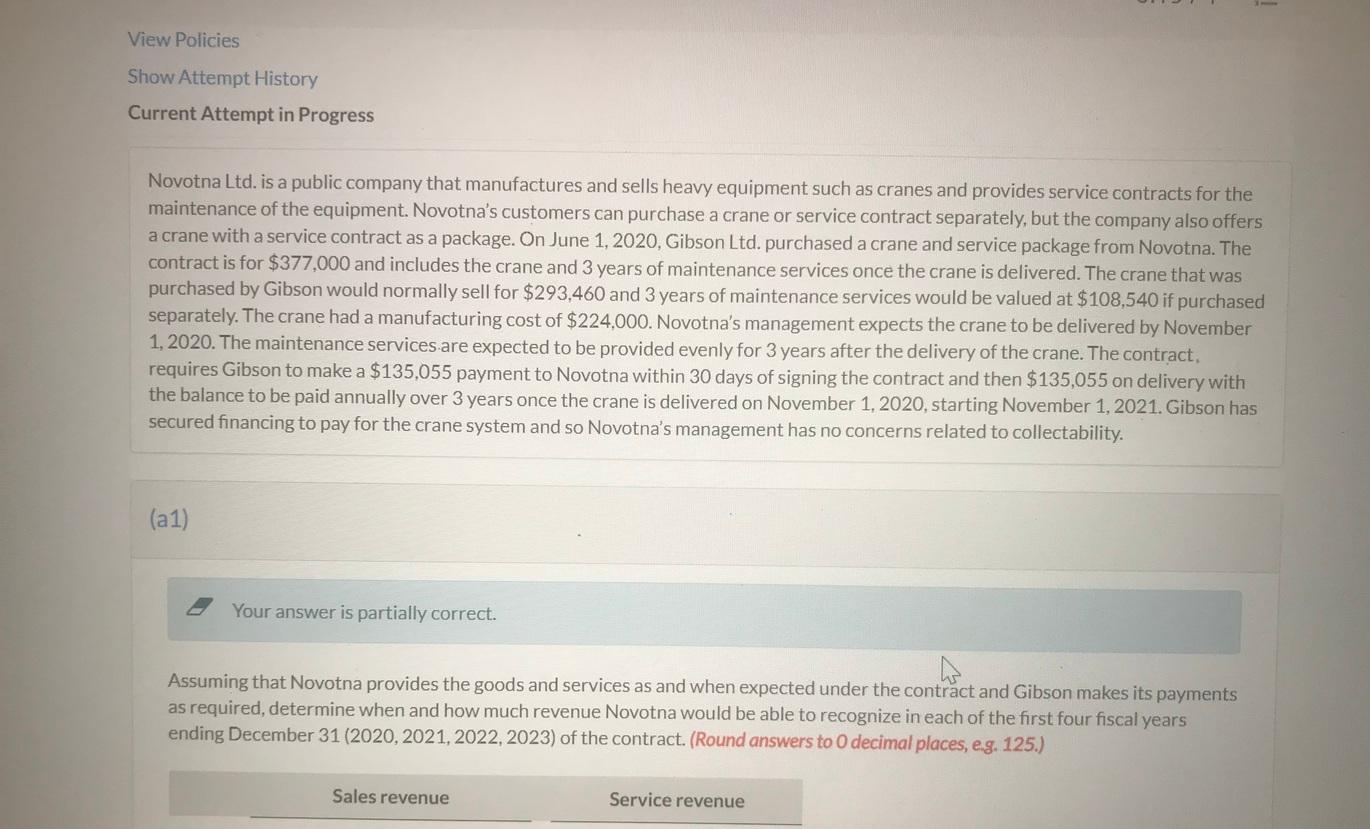

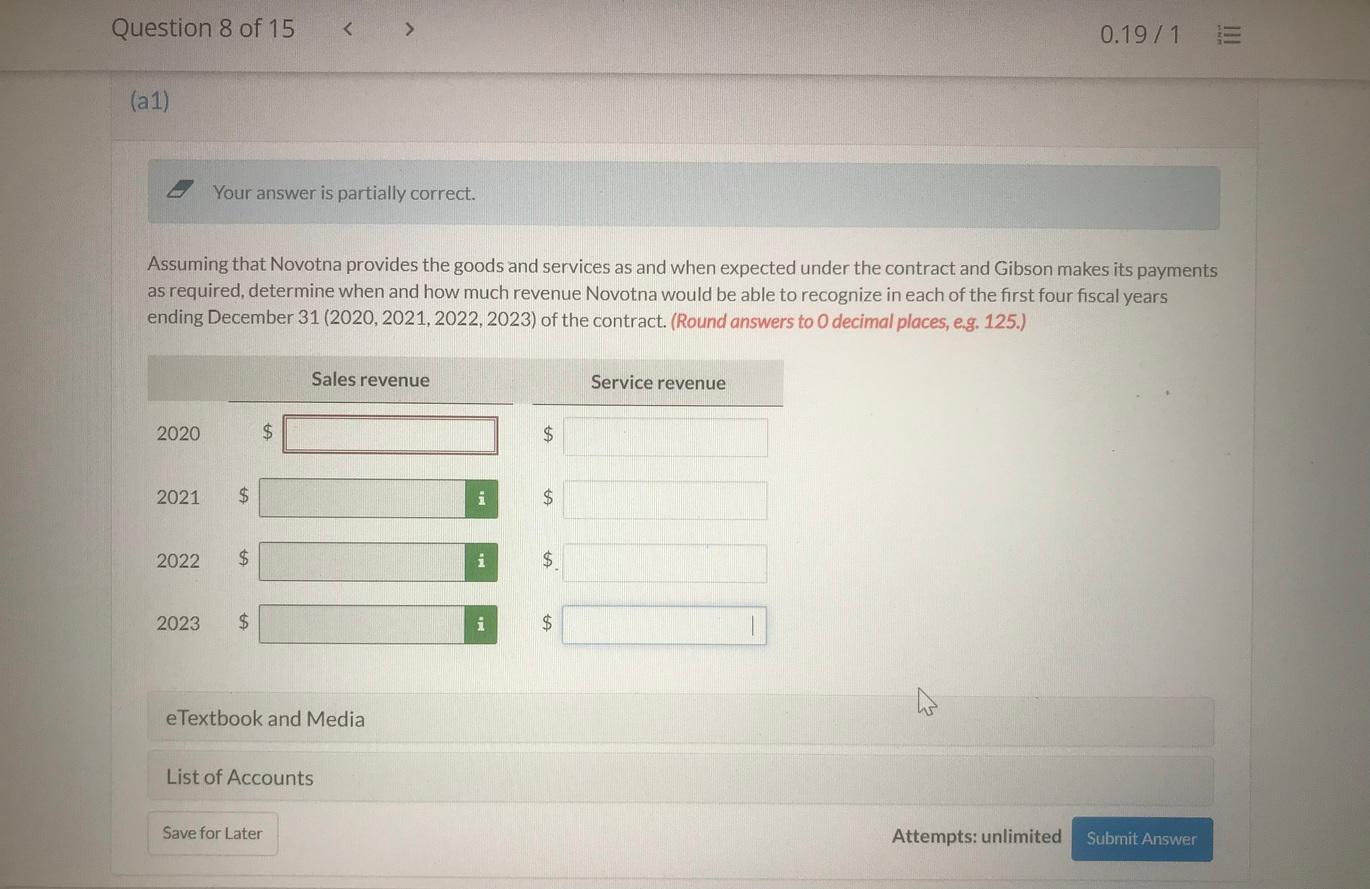

View Policies Show Attempt History Current Attempt in Progress Novotna Ltd. is a public company that manufactures and sells heavy equipment such as cranes and provides service contracts for the maintenance of the equipment. Novotna's customers can purchase a crane or service contract separately, but the company also offers a crane with a service contract as a package. On June 1, 2020, Gibson Ltd. purchased a crane and service package from Novotna. The contract is for $377,000 and includes the crane and 3 years of maintenance services once the crane is delivered. The crane that was purchased by Gibson would normally sell for $293,460 and 3 years of maintenance services would be valued at $108,540 if purchased separately. The crane had a manufacturing cost of $224,000. Novotna's management expects the crane to be delivered by November 1, 2020. The maintenance services are expected to be provided evenly for 3 years after the delivery of the crane. The contract, requires Gibson to make a $135,055 payment to Novotna within 30 days of signing the contract and then $135,055 on delivery with the balance to be paid annually over 3 years once the crane is delivered on November 1, 2020, starting November 1, 2021. Gibson has secured financing to pay for the crane system and so Novotna's management has no concerns related to collectability. (a1) Your answer is partially correct. h Assuming that Novotna provides the goods and services as and when expected under the contract and Gibson makes its payments as required, determine when and how much revenue Novotna would be able to recognize in each of the first four fiscal years ending December 31 (2020, 2021, 2022, 2023) of the contract. (Round answers to 0 decimal places, e.g. 125.) Sales revenue Service revenue Question 8 of 15 0.19 / 1 (a 1) Your answer is partially correct. Assuming that Novotna provides the goods and services as and when expected under the contract and Gibson makes its payments as required, determine when and how much revenue Novotna would be able to recognize in each of the first four fiscal years ending December 31 (2020, 2021, 2022, 2023) of the contract. (Round answers to 0 decimal places, eg. 125.) Sales revenue Service revenue 2020 $ $ 2021 $ i $ 2022 $ $ 2023 $ i $ e Textbook and Media List of Accounts Save for Later Attempts: unlimited Submit Answer View Policies Show Attempt History Current Attempt in Progress Novotna Ltd. is a public company that manufactures and sells heavy equipment such as cranes and provides service contracts for the maintenance of the equipment. Novotna's customers can purchase a crane or service contract separately, but the company also offers a crane with a service contract as a package. On June 1, 2020, Gibson Ltd. purchased a crane and service package from Novotna. The contract is for $377,000 and includes the crane and 3 years of maintenance services once the crane is delivered. The crane that was purchased by Gibson would normally sell for $293,460 and 3 years of maintenance services would be valued at $108,540 if purchased separately. The crane had a manufacturing cost of $224,000. Novotna's management expects the crane to be delivered by November 1, 2020. The maintenance services are expected to be provided evenly for 3 years after the delivery of the crane. The contract, requires Gibson to make a $135,055 payment to Novotna within 30 days of signing the contract and then $135,055 on delivery with the balance to be paid annually over 3 years once the crane is delivered on November 1, 2020, starting November 1, 2021. Gibson has secured financing to pay for the crane system and so Novotna's management has no concerns related to collectability. (a1) Your answer is partially correct. h Assuming that Novotna provides the goods and services as and when expected under the contract and Gibson makes its payments as required, determine when and how much revenue Novotna would be able to recognize in each of the first four fiscal years ending December 31 (2020, 2021, 2022, 2023) of the contract. (Round answers to 0 decimal places, e.g. 125.) Sales revenue Service revenue Question 8 of 15 0.19 / 1 (a 1) Your answer is partially correct. Assuming that Novotna provides the goods and services as and when expected under the contract and Gibson makes its payments as required, determine when and how much revenue Novotna would be able to recognize in each of the first four fiscal years ending December 31 (2020, 2021, 2022, 2023) of the contract. (Round answers to 0 decimal places, eg. 125.) Sales revenue Service revenue 2020 $ $ 2021 $ i $ 2022 $ $ 2023 $ i $ e Textbook and Media List of Accounts Save for Later Attempts: unlimited SubmitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started