Answered step by step

Verified Expert Solution

Question

1 Approved Answer

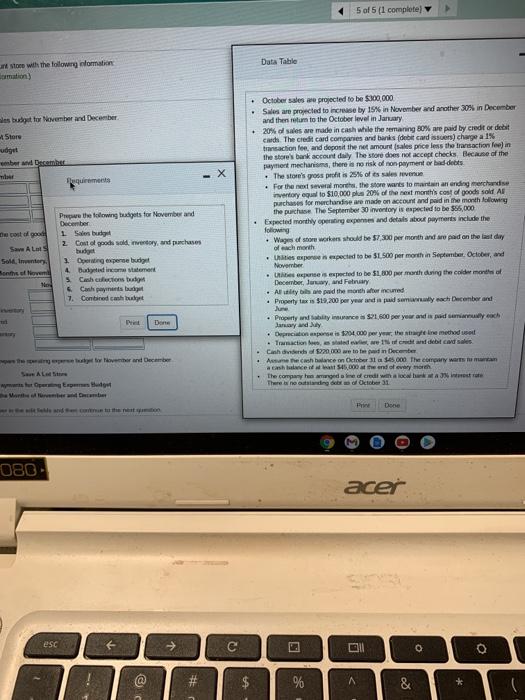

please show work and make it clear on what your answering 5 of 5 (1 complete) Data Table store with the following woman . les

please show work and make it clear on what your answering

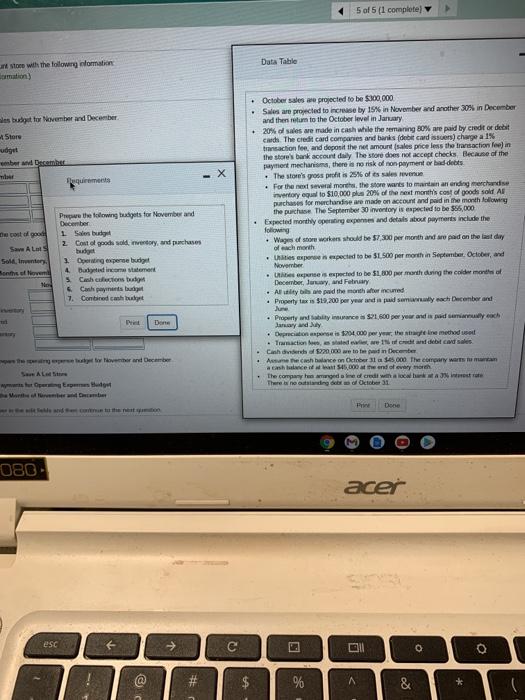

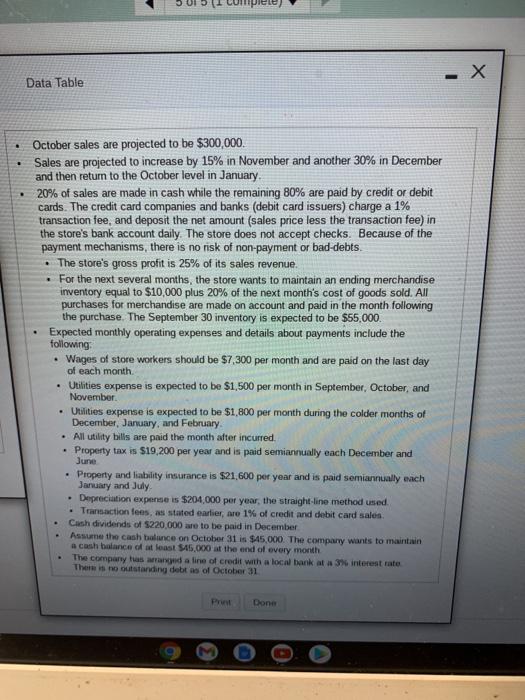

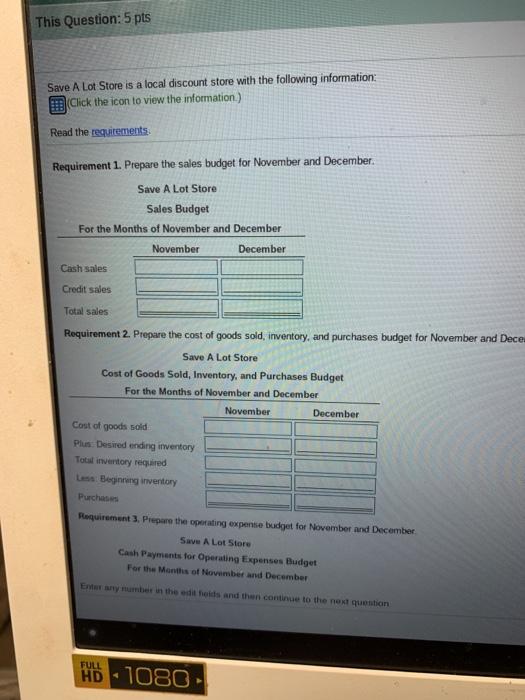

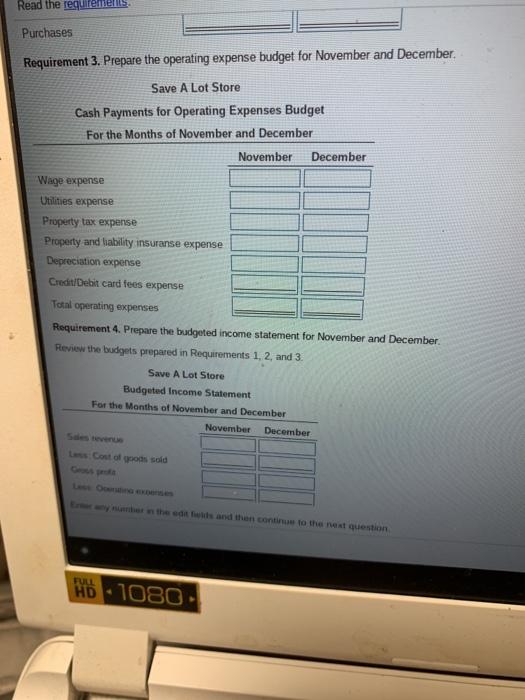

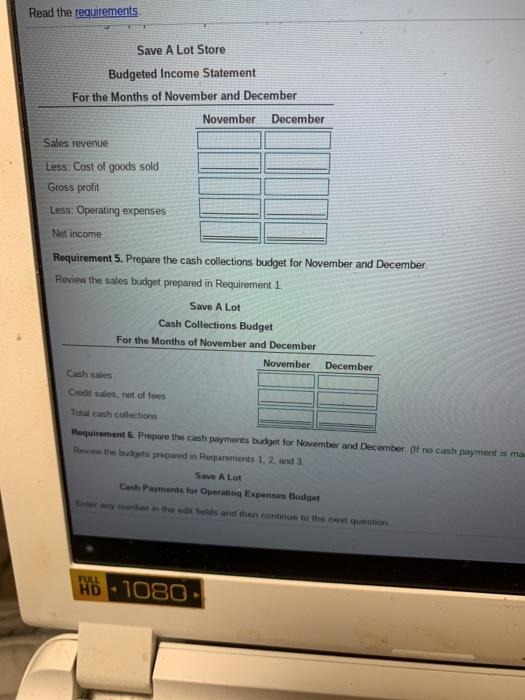

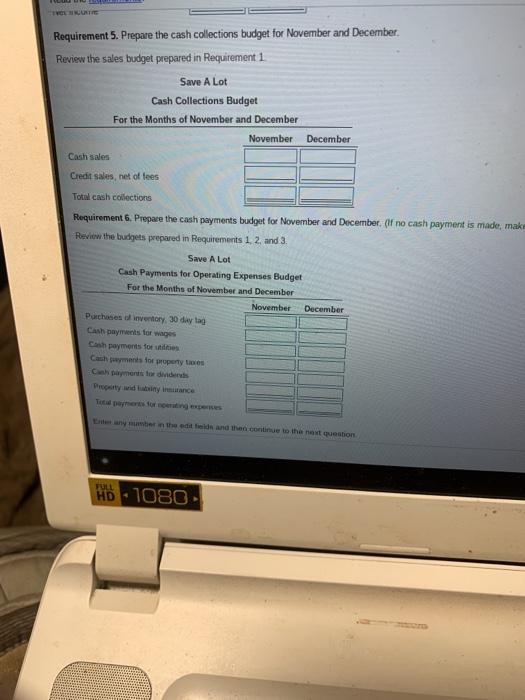

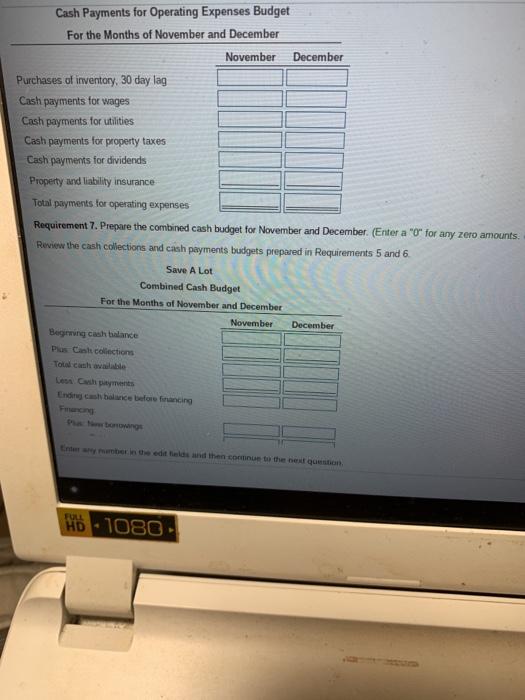

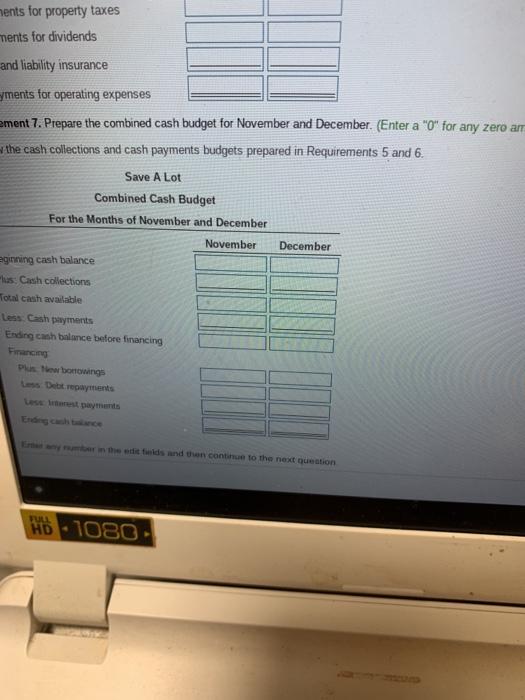

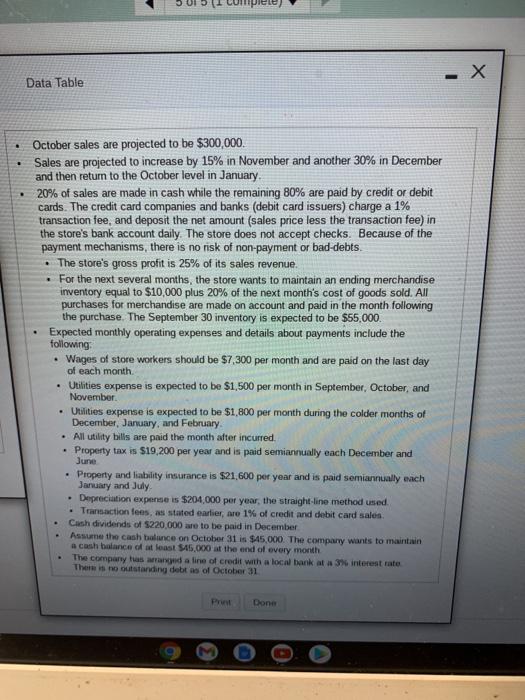

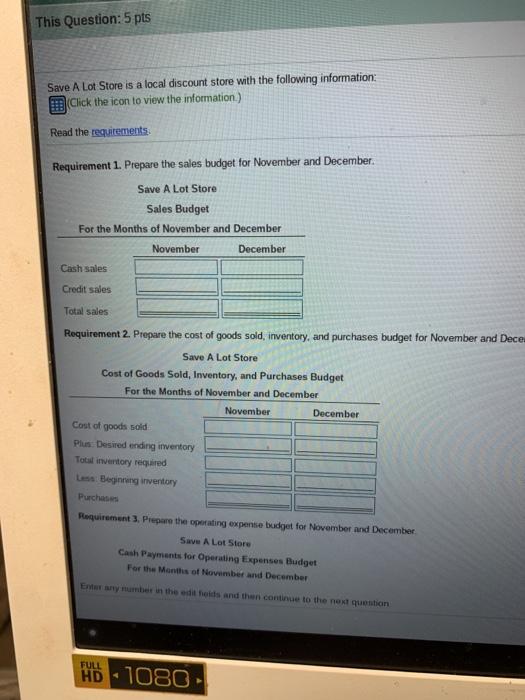

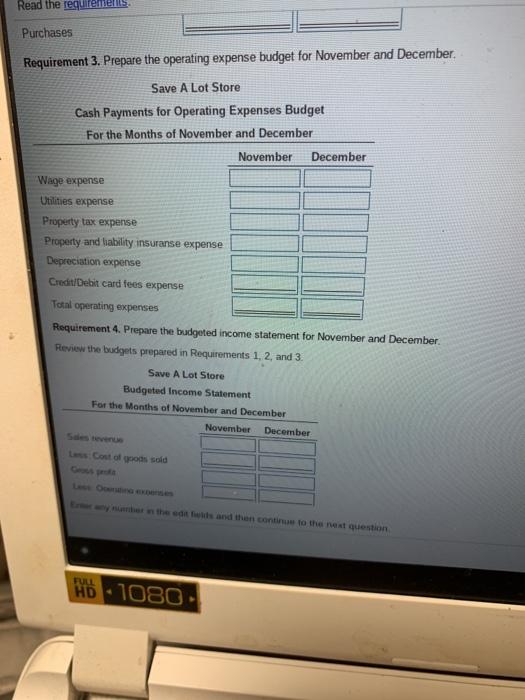

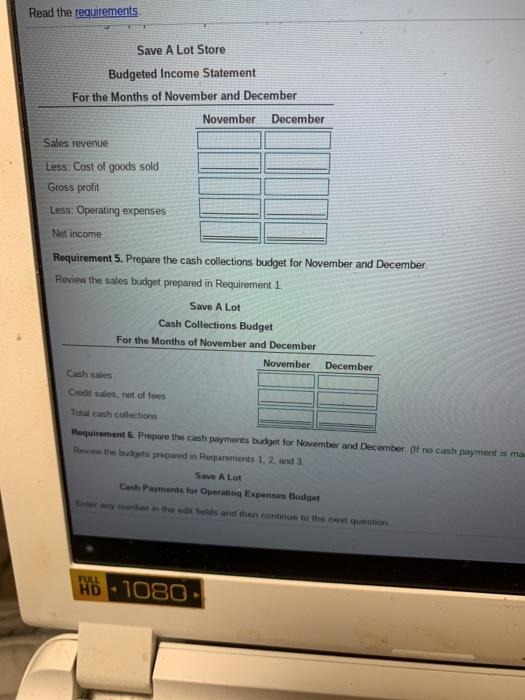

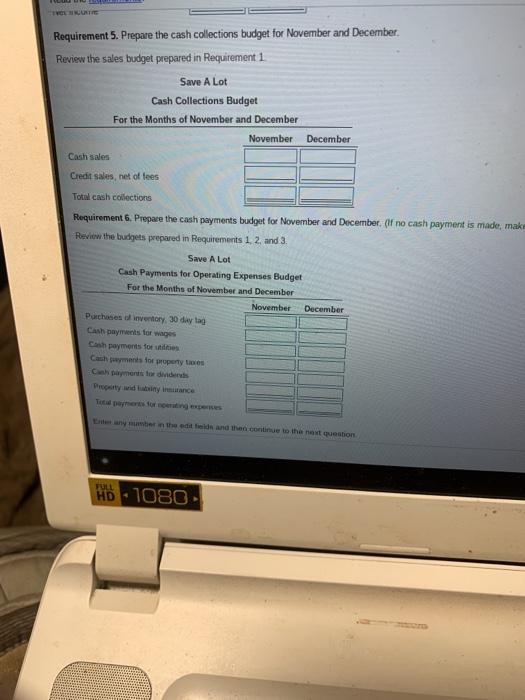

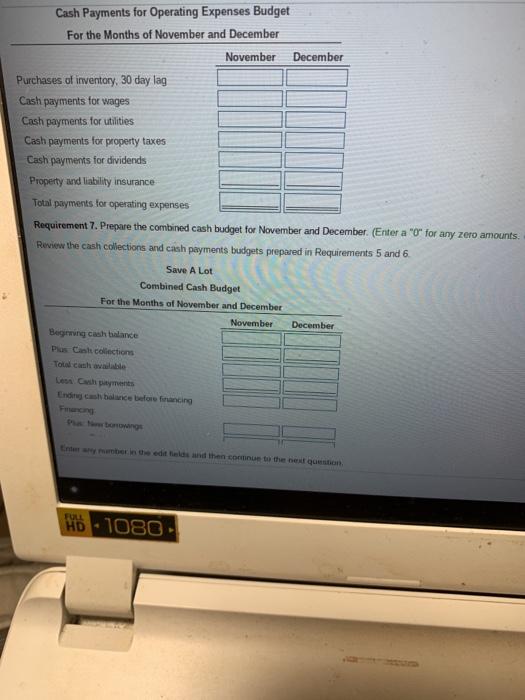

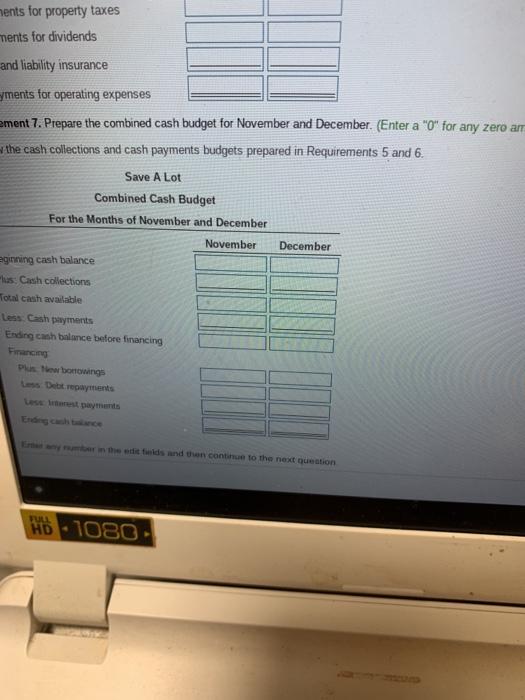

5 of 5 (1 complete) Data Table store with the following woman . les budget for November and December Store voget ber December - X Requirements October sales are projected to be $300,000 Sales are projected to increase by 15% in November and another 30% in December and then return to the October level in January + 20% of sales are made in cash while the remaining 80% are paid by Credit or debut card. The credit card companies and banks (debit card issues) charge a 1% transaction fee and deposit the net amour sales price less the transaction fee) in the store's bank account daily The store does not accept checks Because of the payment mechanisms, there is no risk of non payment or bad debts The store's gross profit is 25% of is serve For the next several months, the store was to maintain an ending merchandise inventory equal to $10,000 plus 20% of the next month's cost of goods sold Al pachase for merchandise we made on account and paid in the month following the purchase The September 30 inventory is expected to be $85,000 Expected monthly operating expenses and details about payments include the following . We of some workers should be 57.300 per month and read on the last day ofach month . U pois expected to be st 500 per month in September October, and November . Les expected to be $1,800 per month during the cold monta December, Jury, and Albare pad the month for incred Property tax is $19,200 per year and is usemi wachDecember and Pre the flowing badgets for November and December 1 Sales budget 2 Cost of goods sold wory, and purchases the cost of good Save Alat Sollery Sonths of love 1 Operating expersebut 4 Bancomatement Cashcoctions Cash payment budget 7. Combined canhat Done Property and innance is $21.600 per year and is paid cach January andy Depreciation en pose is $294.000 per yew the line metode . Traction de credit debit card Sales Cash dhe 2000 we tot center Ancash balance on October 31 a $45.000 The company was an a cash ice od 15.000 end of every more The company doors with low Nestro There no one October 31 be Done 080 acer esc CR @ % a & & - X Data Table . . October sales are projected to be $300,000 Sales are projected to increase by 15% in November and another 30% in December and then return to the October level in January 20% of sales are made in cash while the remaining 80% are paid by credit or debit cards. The credit card companies and banks (debit card issuers) charge a 1% transaction fee, and deposit the net amount (sales price less the transaction fee) in the store's bank account daily. The store does not accept checks. Because of the payment mechanisms, there is no risk of non-payment or bad debts The store's gross profit is 25% of its sales revenue. . For the next several months, the store wants to maintain an ending merchandise inventory equal to $10,000 plus 20% of the next month's cost of goods sold. All purchases for merchandise are made on account and paid in the month following the purchase. The September 30 inventory is expected to be $55.000. Expected monthly operating expenses and details about payments include the following Wages of store workers should be $7,300 per month and are paid on the last day of each month Utilities expense is expected to be $1,500 per month in September October, and November Utilities expense is expected to be $1,800 per month during the colder months of December, January, and February All utility bills are paid the month after incurred Property tax is $19,200 per year and is paid semiannually each December and June Property and liability insurance is $21,600 per year and is paid semiannually each January and July Depreciation expense is $204,000 per year, the straight-line method used. Transaction fees, as stated earlier, are 1% of credit and debit card salen Cash dividends of $220.000 are to be paid in December Assume the cash bolunce on October 31 is $45,000. The company wants to maintain a cash balance of at least $45.000 at the end of every month The company tas ranged a line of credit with a local bank at 3% interest rate There is no outstanding debt as of October 31 . Prum Done This Question: 5 pts Save A Lot Store is a local discount store with the following information: (Click the icon to view the information.) Read the requirements Requirement 1. Prepare the sales budget for November and December Save A Lot Store Sales Budget For the Months of November and December November December Cash sales Credit sales Total sales Requirement 2. Prepare the cost of goods sold inventory, and purchases budget for November and Dece Save A Lot Store Cost of Goods Sold, Inventory, and Purchases Budget For the Months of November and December November December Cost of goods sold Plus Desired ending inventory Total inventory required Le Beginning inventory Purchases Requirements. Prepare the operating expense budget for November and December Save A Lot Store Cash Payments for Operating Expenses Budget For the Months of November and December En ymmer in the edited and then continue to the next question FULL HD 1080 Read the requirements Purchases Requirement 3. Prepare the operating expense budget for November and December Save A Lot Store Cash Payments for Operating Expenses Budget For the Months of November and December November December Wage expense Utilities expense Property tax expense Property and liability insuranse expense Depreciation expense Credit/Debit card fees expense Total operating expenses Requirement 4. Prepare the budgeted income statement for November and December Review the budgets prepared in Requirements 1, 2, and 3. Save A Lot Store Budgeted Income Statement For the Months of November and December November December Cost of ons sold in the eas and then continue to the next question FULL HD 1080 . Read the requirements Save A Lot Store Budgeted Income Statement For the Months of November and December November December Sales revenue Less: Cost of goods sold Gross profit Less: Operating expenses Net income Requirement 5. Prepare the cash collections budget for November and December Review the sales budget prepared in Requirement 1 Save A Lot Cash Collections Budget For the Months of November and December November December Cash sales Credit sales, net of fees Total cash collections Requirement 6. Prepare the cash payments budget for November and December (1t no cash payment is ma Review the budgets prepared in Requirements 1.2 and 3 Save A Lot Cash Payments for Operating Expenses Budget be in the deals and then continue to the next question FULL HD-1080 Requirement 5. Prepare the cash collections budget for November and December Review the sales budget prepared in Requirement 1 Save A Lot Cash Collections Budget For the Months of November and December November December Cash sales Credit sales, net of lees Total cash collections Requirement 6. Prepare the cash payments budget for November and December. (if no cash payment is made, make Review the budgets prepared in Requirements 1, 2, and 3 Save A Lot Cash Payments for Operating Expenses Budget For the Months of November and December November December Puchoses inventory 30 day lag Cash payments for wages Cash payments forts Cashments for property taxes FULL HD 1080- Cash Payments for Operating Expenses Budget For the Months of November and December November December Purchases of inventory, 30 day lag Cash payments for wages Cash payments for utilities Cash payments for property taxes Cash payments for dividends Property and liability insurance Total payments for operating expenses Requirement 7. Prepare the combined cash budget for November and December. (Enter a "0" for any zero amounts. Review the cash collections and cash payments budgets prepared in Requirements 5 and 6. Save A Lot Combined Cash Budget For the Months of November and December November December Begang cash balance Plus Cash Collections Total cash available Les as payments Endi bounce before financing FULL HD 1080 ments for property taxes ments for dividends and liability insurance ayments for operating expenses ement 7. Prepare the combined cash budget for November and December. (Enter a "0" for any zero am the cash collections and cash payments budgets prepared in Requirements 5 and 6. Save A Lot Combined Cash Budget For the Months of November and December November December eginning cash balance lus: Cash collections Total cash available Les Cash payments Ending cash balance before financing Financing Pew bongs Debt repayments the edities and then continue to the next question FULL HD 1080

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started