Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work as well as answers! Exercise 15-10 (Algorithmic) (LO. 3) Helpers, Inc., a qualifying 501(c)(3) organization, incurs lobbying expenditures of $366,750 for the

Please show work as well as answers!

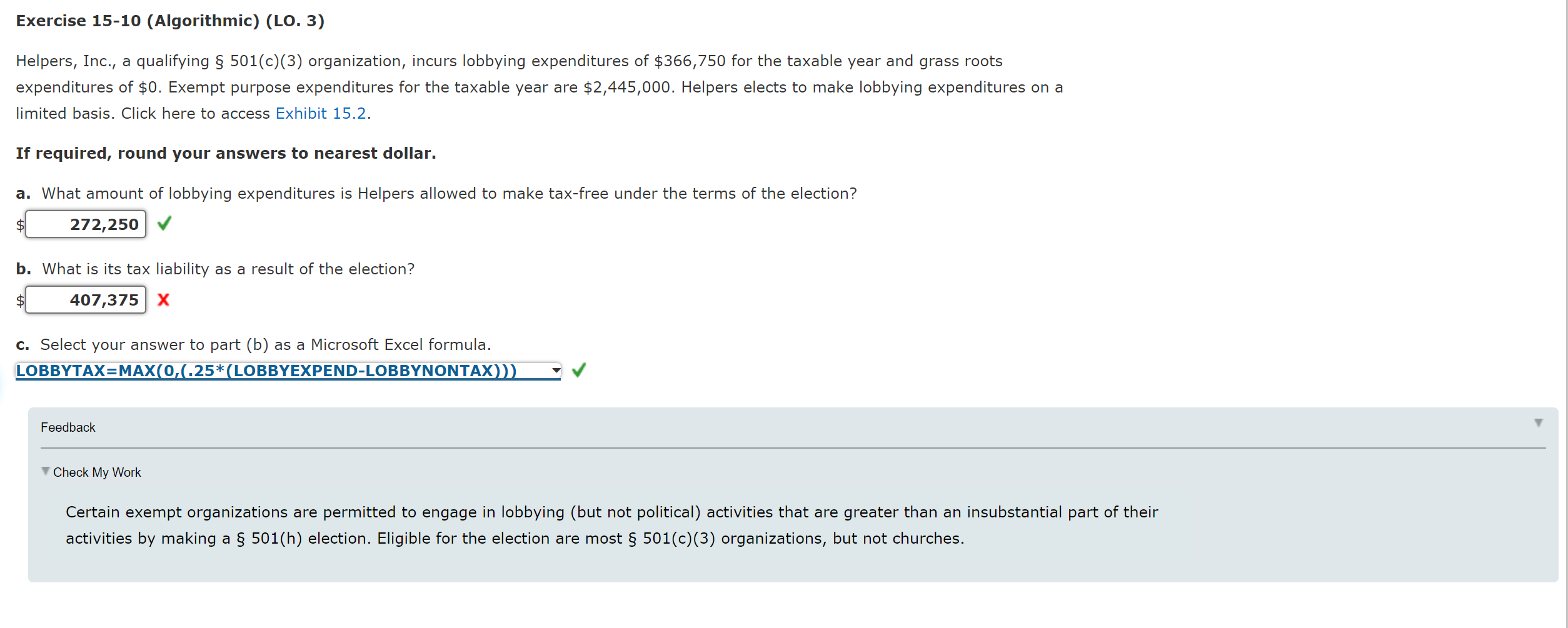

Exercise 15-10 (Algorithmic) (LO. 3) Helpers, Inc., a qualifying 501(c)(3) organization, incurs lobbying expenditures of $366,750 for the taxable year and grass roots expenditures of $0. Exempt purpose expenditures for the taxable year are $2,445,000. Helpers elects to make lobbying expenditures on a limited basis. Click here to access Exhibit 15.2. If required, round your answers to nearest dollar. a. What amount of lobbying expenditures is Helpers allowed to make tax-free under the terms of the election? 272,250 $ b. What is its tax liability as a result of the election? $1 407,375 x c. Select your answer to part (b) as a Microsoft Excel formula. LOBBYTAX=MAX(O.(.25*(LOBBYEXPEND-LOBBYNONTAX)). Feedback Check My Work Certain exempt organizations are permitted to engage in lobbying (but not political) activities that are greater than an insubstantial part of their activities by making a 501(h) election. Eligible for the election are most 501(c)(3) organizations, but not churchesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started