Answered step by step

Verified Expert Solution

Question

1 Approved Answer

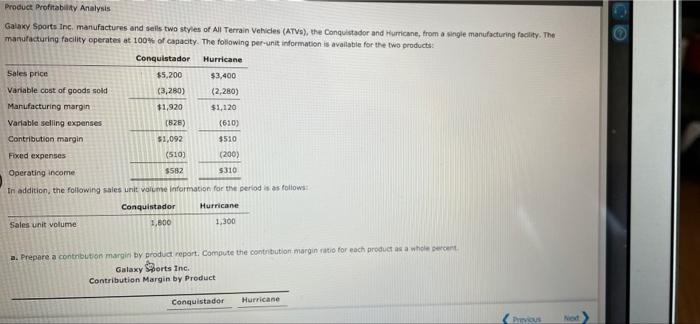

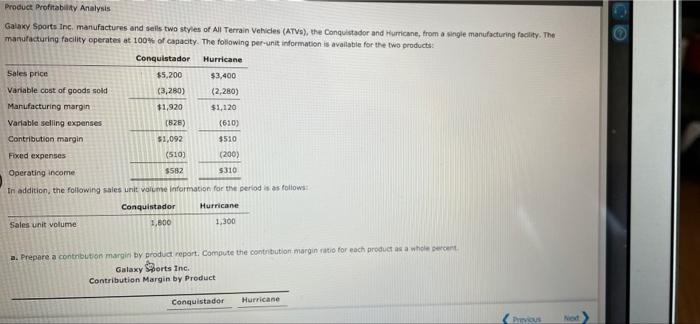

Please show work as well! Thank you! Product Profitability Analysis Galaxy Sports Inc., manufactures and sells two styles of All Terrain Vehicles (ATV), the Conquistador

Please show work as well! Thank you!

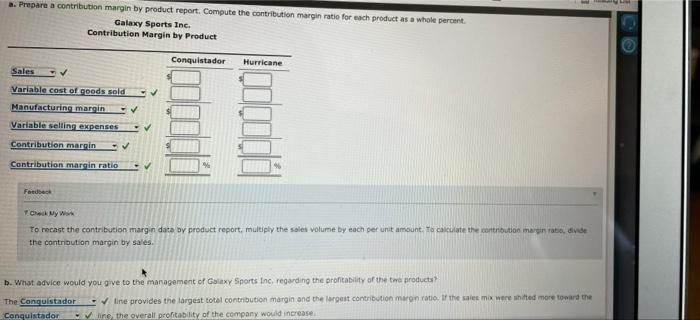

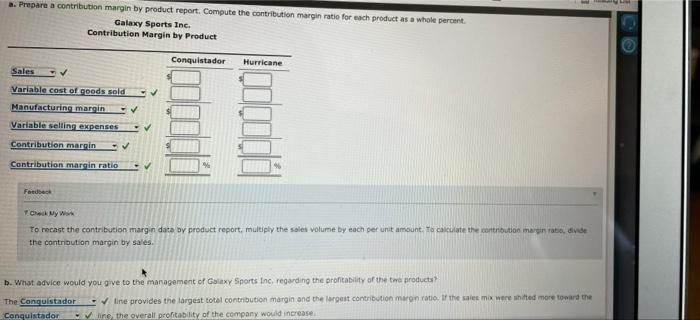

Product Profitability Analysis Galaxy Sports Inc., manufactures and sells two styles of All Terrain Vehicles (ATV), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products Conquistador Hurricane Sales price $5,200 $3,400 Variable cost of goods sold (3,280) (2,280) Manufacturing margin $1,920 $1,120 Variable selling expenses (828) (610) Contribution margin 51,092 $510 Fixed expenses (510) (200) Operating income $582 5310 In addition, the following sales unit volume information for the period is as follows: Conquistador Hurricane Sales unit volume 1.800 1,300 a. Prepare a contribution margin by product report. Compute the contribution marginatio for each product as a whole percent Galaxy Sports Inc. Contribution Margin by Product Conquistador Hurricane Chaus a. Prepare a contribution margin by product report. Compute the contribution margin rate for each product as a whole percent Galaxy Sports Inc Contribution Margin by Product Conquistador Hurricane Sales Variable cost of goods sold Manufacturing margin Variable selling expenses Contribution margin Contribution margin ratio Ford My w To recast the contribution margin data by product report, multiply the sales volume by each per unit amount. To calculate the contribution margin ratio divide the contribution margin by sales b. What advice would you give to the management of Galaxy Sports Inc, regarding the profitability of the two products The Conquistador line provides the largest total contribution margin and the largest contribution maron ratio. If the sales mix were shifted more toward the Conquistador line the overall profitability of the company would increase Product Profitability Analysis Galaxy Sports Inc., manufactures and sells two styles of All Terrain Vehicles (ATV), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products Conquistador Hurricane Sales price $5,200 $3,400 Variable cost of goods sold (3,280) (2,280) Manufacturing margin $1,920 $1,120 Variable selling expenses (828) (610) Contribution margin 51,092 $510 Fixed expenses (510) (200) Operating income $582 5310 In addition, the following sales unit volume information for the period is as follows: Conquistador Hurricane Sales unit volume 1.800 1,300 a. Prepare a contribution margin by product report. Compute the contribution marginatio for each product as a whole percent Galaxy Sports Inc. Contribution Margin by Product Conquistador Hurricane Chaus a. Prepare a contribution margin by product report. Compute the contribution margin rate for each product as a whole percent Galaxy Sports Inc Contribution Margin by Product Conquistador Hurricane Sales Variable cost of goods sold Manufacturing margin Variable selling expenses Contribution margin Contribution margin ratio Ford My w To recast the contribution margin data by product report, multiply the sales volume by each per unit amount. To calculate the contribution margin ratio divide the contribution margin by sales b. What advice would you give to the management of Galaxy Sports Inc, regarding the profitability of the two products The Conquistador line provides the largest total contribution margin and the largest contribution maron ratio. If the sales mix were shifted more toward the Conquistador line the overall profitability of the company would increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started