Answered step by step

Verified Expert Solution

Question

1 Approved Answer

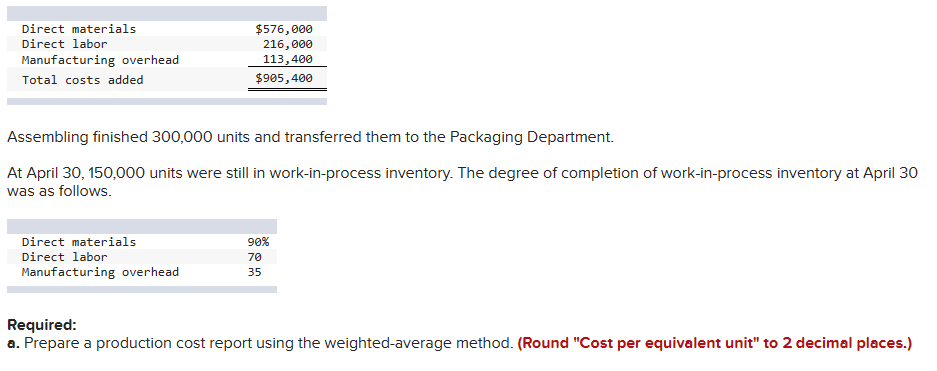

***PLEASE SHOW WORK*** Assembling finished 300,000 units and transferred them to the Packaging Department. At April 30, 150,000 units were still in work-in-process inventory. The

***PLEASE SHOW WORK***

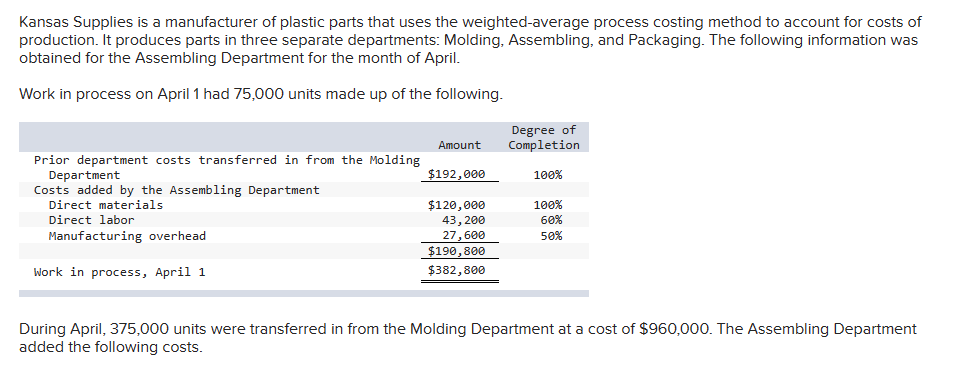

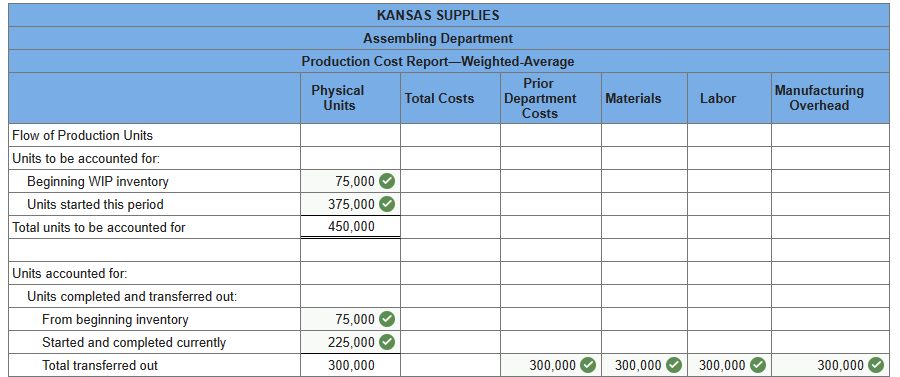

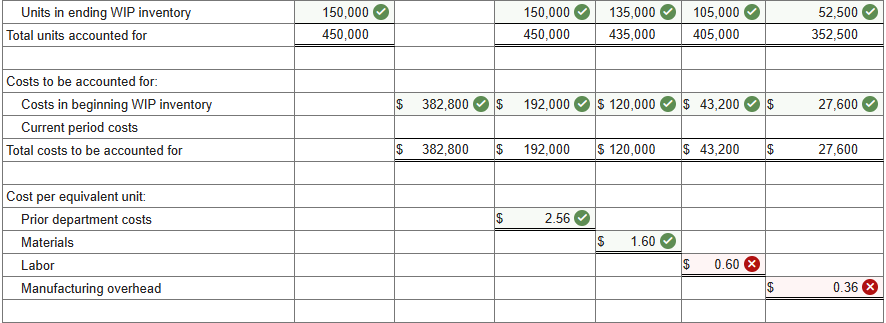

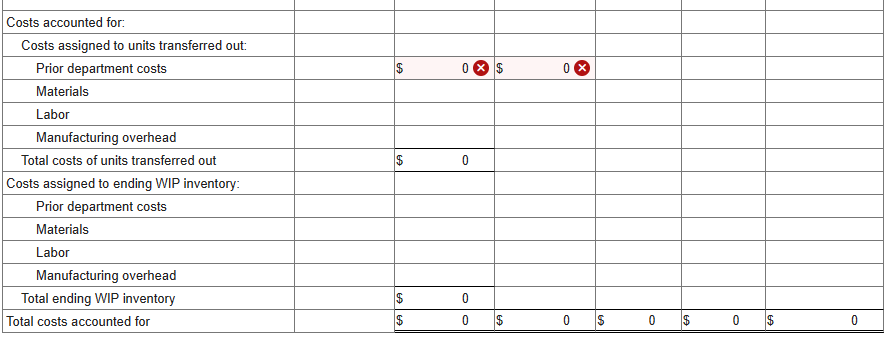

Assembling finished 300,000 units and transferred them to the Packaging Department. At April 30, 150,000 units were still in work-in-process inventory. The degree of completion of work-in-process inventory at April 30 was as follows. Required: a. Prepare a production cost report using the weighted-average method. (Round "Cost per equivalent unit" to 2 decimal places.) \begin{tabular}{|c|c|c|c|c|c|c|} \hline Units in ending WIP inventory & 150,000 & & 150,000 & 135,000 & 105,000 & 52,500 \\ \hline Total units accounted for & 450,000 & & 450,000 & 435,000 & 405,000 & 352,500 \\ \hline \multicolumn{7}{|l|}{ Costs to be accounted for: } \\ \hline Costs in beginning WIP inventory & & $382,800 & 192,000 & $120,000 & $43,200 & 27,600 \\ \hline \multicolumn{7}{|l|}{ Current period costs } \\ \hline Total costs to be accounted for & & $382,800 & $192,000 & $120,000 & $43,200 & 27,600 \\ \hline \multicolumn{7}{|l|}{ Cost per equivalent unit: } \\ \hline Prior department costs & & & 2.56 & & & \\ \hline Materials & & & & 1.60 & & \\ \hline Labor & & & & & 0.60x & \\ \hline Manufacturing overhead & & & & & & 0.36 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ KANSAS SUPPLIES } \\ \hline \multicolumn{7}{|c|}{ Assembling Department } \\ \hline \multicolumn{7}{|c|}{ Production Cost Report-Weighted-Average } \\ \hline & \begin{tabular}{c} Physical \\ Units \end{tabular} & Total Costs & \begin{tabular}{l} Prior \\ Department \\ Costs \end{tabular} & Materials & Labor & \begin{tabular}{c} Manufacturing \\ Overhead \end{tabular} \\ \hline \multicolumn{7}{|l|}{ Flow of Production Units } \\ \hline \multicolumn{7}{|l|}{ Units to be accounted for: } \\ \hline Beginning WIP inventory & 75,000 & & & & & \\ \hline Units started this period & 375,000 & & & & & \\ \hline Total units to be accounted for & 450,000 & & & & & \\ \hline \multicolumn{7}{|l|}{ Units accounted for: } \\ \hline \multicolumn{7}{|l|}{ Units completed and transferred out: } \\ \hline From beginning inventory & 75,000 & & & & & \\ \hline Started and completed currently & 225,000 & & & & & \\ \hline Total transferred out & 300,000 & & 300,000 & 300,000 & 300,000 & 300,000 \\ \hline \end{tabular} Kansas Supplies is a manufacturer of plastic parts that uses the weighted-average process costing method to account for costs of production. It produces parts in three separate departments: Molding, Assembling, and Packaging. The following information was obtained for the Assembling Department for the month of April. Work in process on April 1 had 75,000 units made up of the following. During April, 375,000 units were transferred in from the Molding Department at a cost of $960,000. The Assembling Department added the following costs. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|l|}{ Costs accounted for: } \\ \hline \multicolumn{8}{|l|}{ Costs assigned to units transferred out: } \\ \hline Prior department costs & $ & 0 & $ & 08 & & & \\ \hline \multicolumn{8}{|l|}{ Materials } \\ \hline \multicolumn{8}{|l|}{ Labor } \\ \hline \multicolumn{8}{|l|}{ Manufacturing overhead } \\ \hline Total costs of units transferred out & $ & 0 & & & & & \\ \hline \multicolumn{8}{|l|}{ Costs assigned to ending WIP inventory: } \\ \hline \multicolumn{8}{|l|}{ Prior department costs } \\ \hline \multicolumn{8}{|l|}{ Materials } \\ \hline \multicolumn{8}{|l|}{ Labor } \\ \hline \multicolumn{8}{|l|}{ Manufacturing overhead } \\ \hline Total ending WIP inventory & $ & 0 & & & & & \\ \hline Total costs accounted for & $ & 0 & $ & 0 & 0 & $ & $ \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started