Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work. Assume that the delivery truck is not a luxury auto. Calculate Way Corporation's 2022 depreciation deduction (ignore 179 expense and bonus depreciation

Please show work.

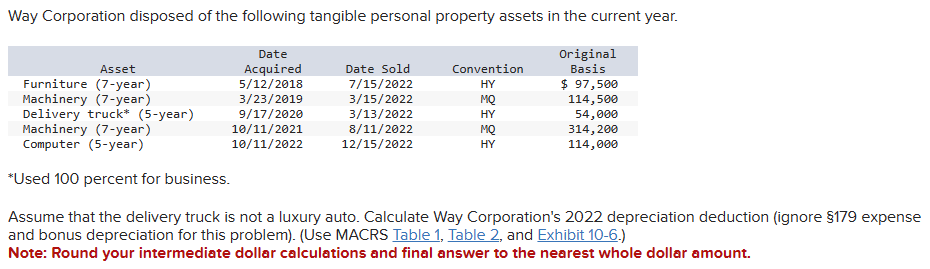

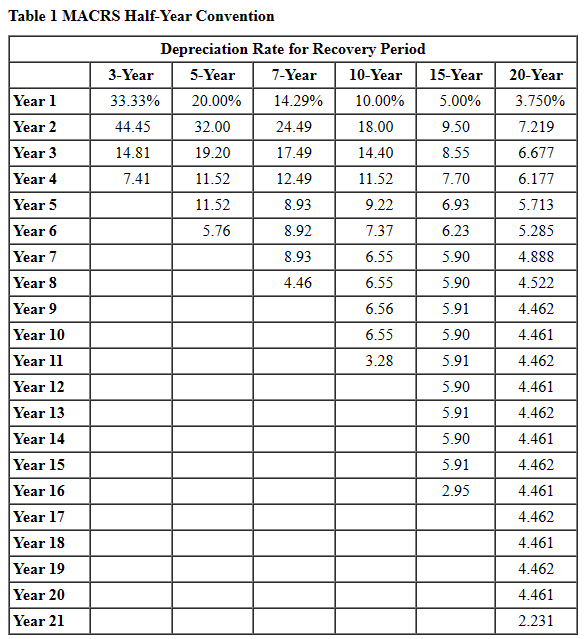

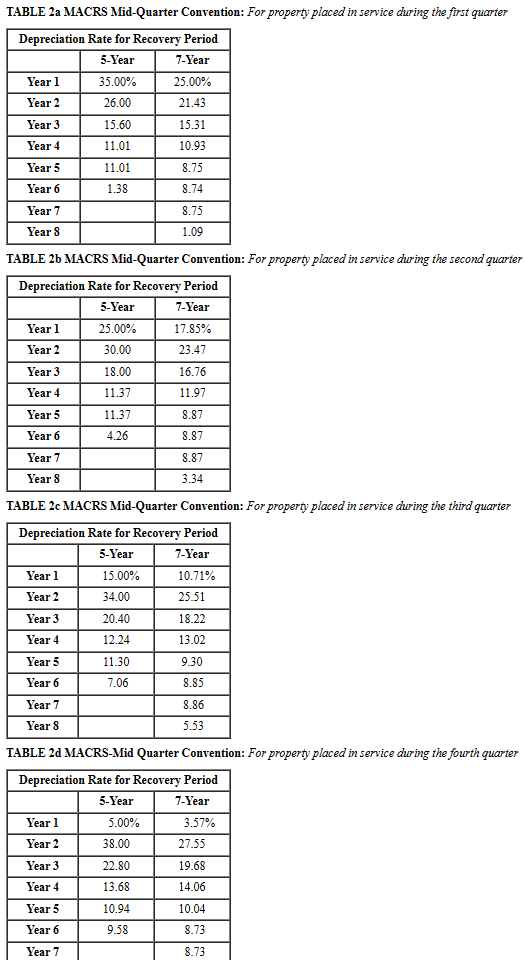

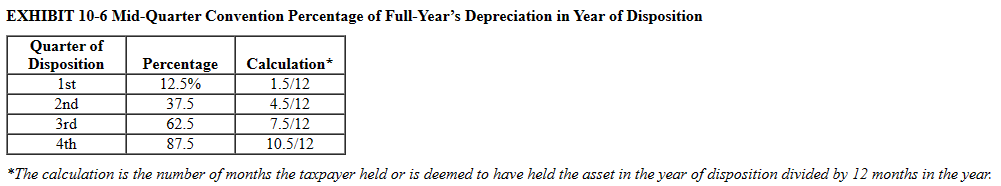

Assume that the delivery truck is not a luxury auto. Calculate Way Corporation's 2022 depreciation deduction (ignore 179 expense and bonus depreciation for this problem). (Use MACRS Table 1, Table 2, and Exhibit 10-6.) Note: Round your intermediate dollar calculations and final answer to the nearest whole dollar amount. Table 1 MACRS Half-Year Convention TABLE 2 a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter EXHIBIT 10-6 Mid-Quarter Convention Percentage of Full-Year's Depreciation in Year of Disposition \begin{tabular}{|c|c|c|} \hline QuarterofDisposition & Percentage & Calculation \\ \hline 1st & 12.5% & 1.5/12 \\ \hline 2nd & 37.5 & 4.5/12 \\ \hline 3rd & 62.5 & 7.5/12 \\ \hline 4th & 87.5 & 10.5/12 \\ \hline \end{tabular} *The calculation is the number of months the taxpayer held or is deemed to have held the asset in the year of disposition divided by 12 months in the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started