Answered step by step

Verified Expert Solution

Question

1 Approved Answer

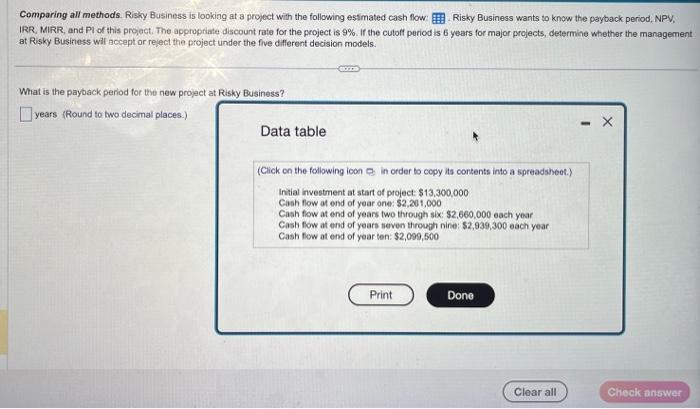

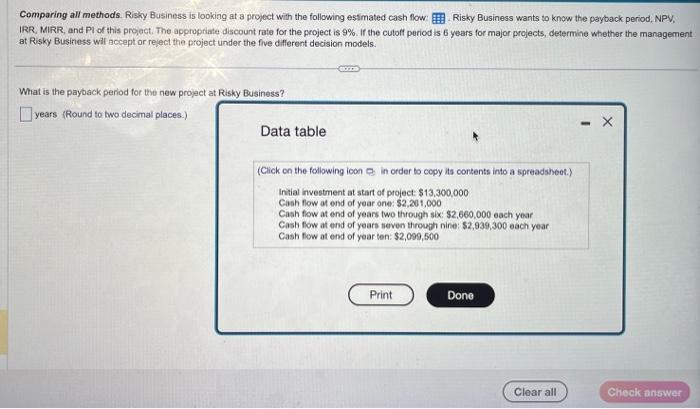

please show work Comparing all methods. Risky Business is looking at a project with the following estmated cash flow: . Risky Business wants to know

please show work

Comparing all methods. Risky Business is looking at a project with the following estmated cash flow: . Risky Business wants to know the payback period, NPV, IRR, MIRR, and Pl of this project. The appropriate discount rate for the project is 9%. If the cutoff period is 6 years for major projects, determine whether the management at Risky Business wil bocept or reject the project under the five different decision models. What is the payback period for the new project at Risky Business? years (Round to two decimal places.) Data table (Click on the following ioon p: in order to copy its contents into a spreadsheot.) Initial investment at start of project: $13,300.000 Cash flow at end of year one: 52,201,000 Cash fow at end of years two through six: $2,660,000 each year Cash fow at end of years seven through nine: $2,939,300 each year Cash fow at end of year ten: $2,099,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started