Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW WORK D Question 1 6 pts A trader opens a new position by writing two put option contracts. Each contract is on 100

PLEASE SHOW WORK

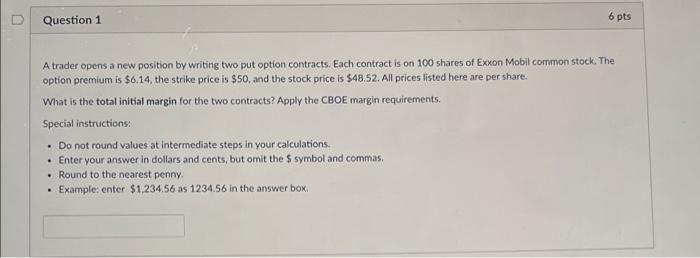

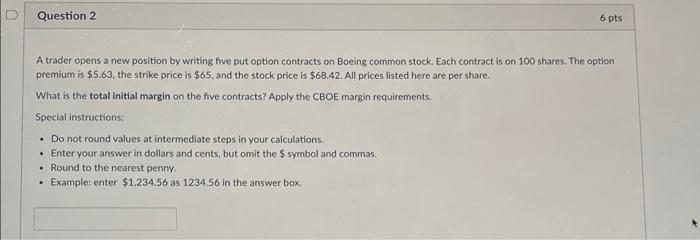

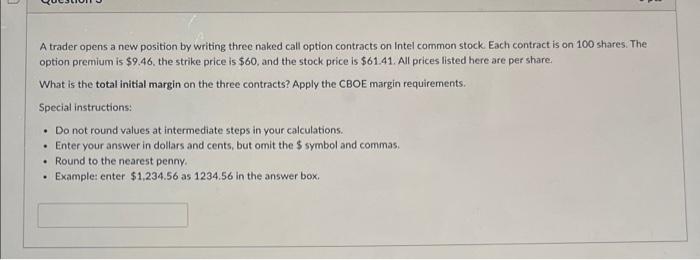

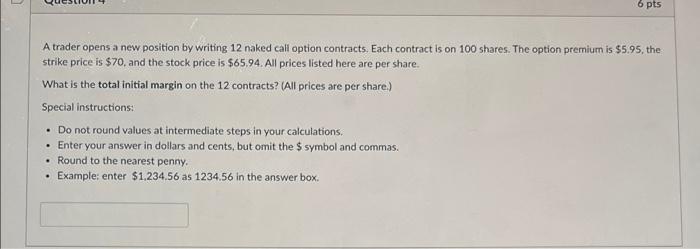

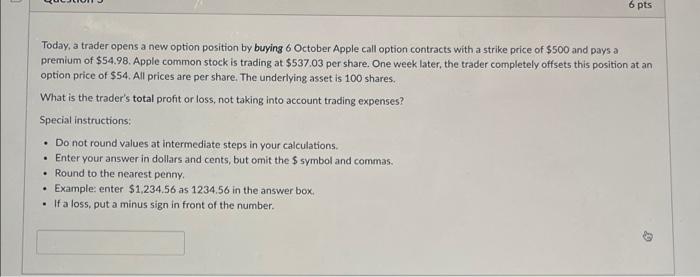

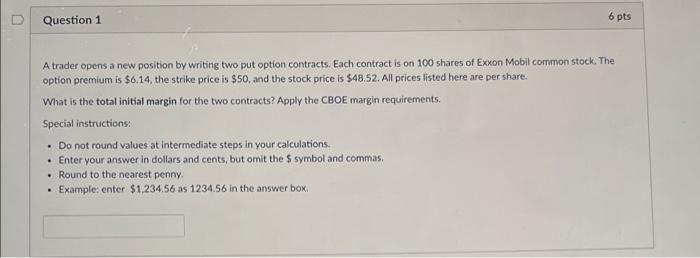

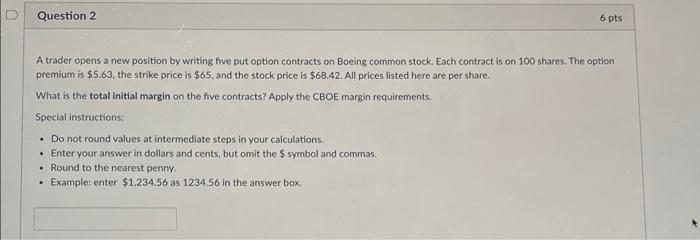

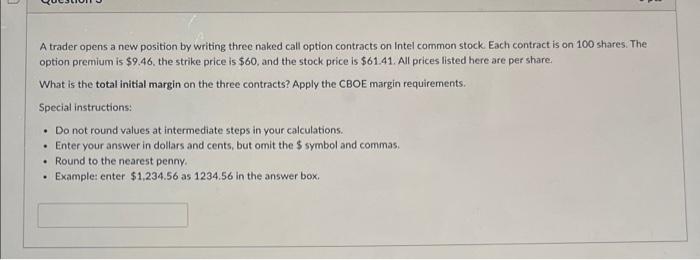

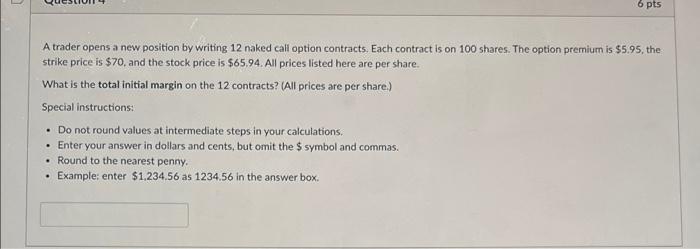

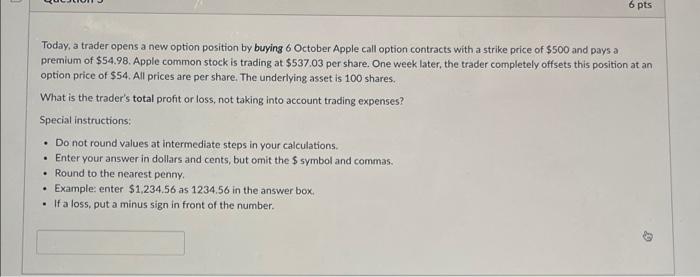

D Question 1 6 pts A trader opens a new position by writing two put option contracts. Each contract is on 100 shares of Exxon Mobil common stock. The option premium is $6.14, the strike price is $50, and the stock price is $48.52. All prices listed here are per share. What is the total initial margin for the two contracts? Apply the CBOE margin requirements. Special instructions: . Do not round values at intermediate steps in your calculations Enter your answer in dollars and cents, but omit the $ symbol and commas. Round to the nearest penny. Example: enter $1.234.56 as 1234.56 in the answer box U Question 2 6 pts A trader opens a new position by writing five put option contracts on Boeing common stock. Each contract is on 100 shares. The option premium is $5.63, the strike price is $65, and the stock price is $68.42. All prices listed here are per share. What is the total initial margin on the five contracts? Apply the CBOE margin requirements. Special instructions: . Do not round values at intermediate steps in your calculations Enter your answer in dollars and cents, but omit the $ symbol and commas. Round to the nearest penny. Example: enter $1.234.56 as 1234.56 in the answer box . . A trader opens a new position by writing three naked call option contracts on Intel common stock. Each contract is on 100 shares. The option premium is $9.46, the strike price is $60, and the stock price is $61.41. All prices listed here are per share What is the total initial margin on the three contracts? Apply the CBOE margin requirements. Special instructions: Do not round values at intermediate steps in your calculations. Enter your answer in dollars and cents, but omit the $ symbol and commas. Round to the nearest penny. Example: enter $1,234.56 as 1234,56 in the answer box, . 6 pts Atrader opens a new position by writing 12 naked call option contracts. Each contract is on 100 shares. The option premium is $5.95, the strike price is $70, and the stock price is $65.94. All prices listed here are per share. What is the total initial margin on the 12 contracts? (All prices are per share.) Special instructions: Do not round values at intermediate steps in your calculations. Enter your answer in dollars and cents, but omit the $ symbol and commas. Round to the nearest penny. Example: enter $1.234.56 as 1234,56 in the answer box 6 pts Today, a trader opens a new option position by buying 6 October Apple call option contracts with a strike price of $500 and pays a premium of $54.98. Apple common stock is trading at $537.03 per share. One week later, the trader completely offsets this position at an option price of $54. All prices are per share. The underlying asset is 100 shares. What is the trader's total profit or loss, not taking into account trading expenses? Special instructions: Do not round values at Intermediate steps in your calculations. Enter your answer in dollars and cents, but omit the $ symbol and commas. Round to the nearest penny. Example: enter $1,234.56 as 1234,56 in the answer box Ifaloss, put a minus sign in front of the number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started