Please show work for both questions

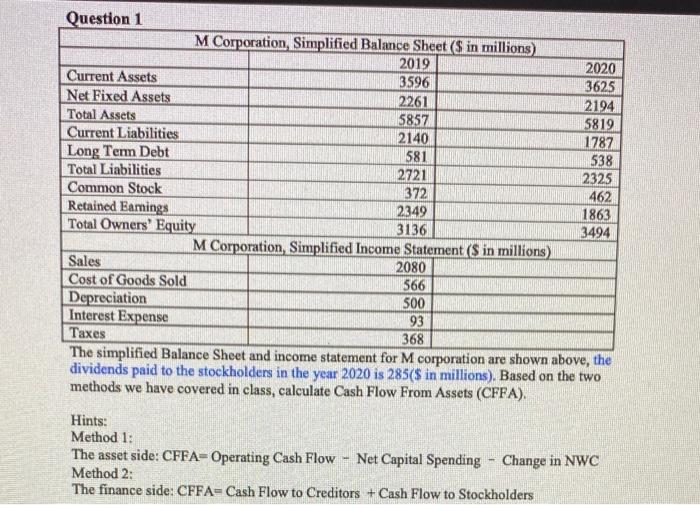

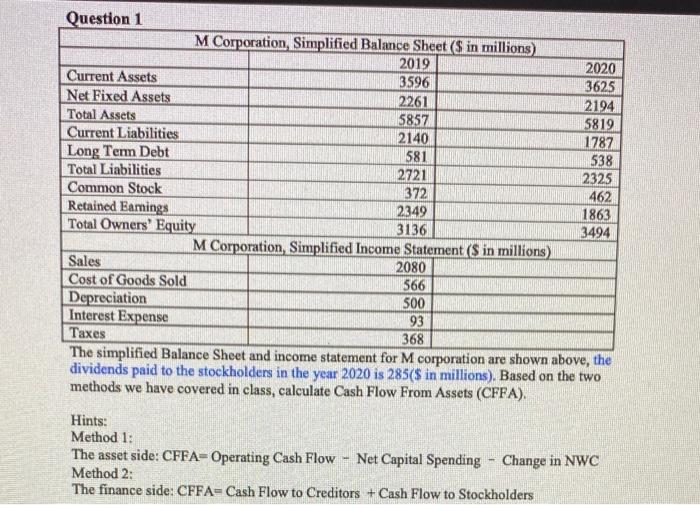

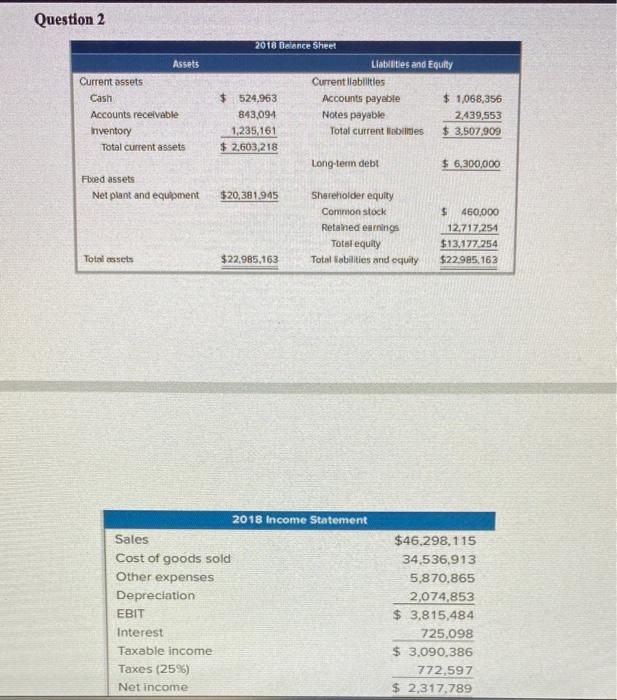

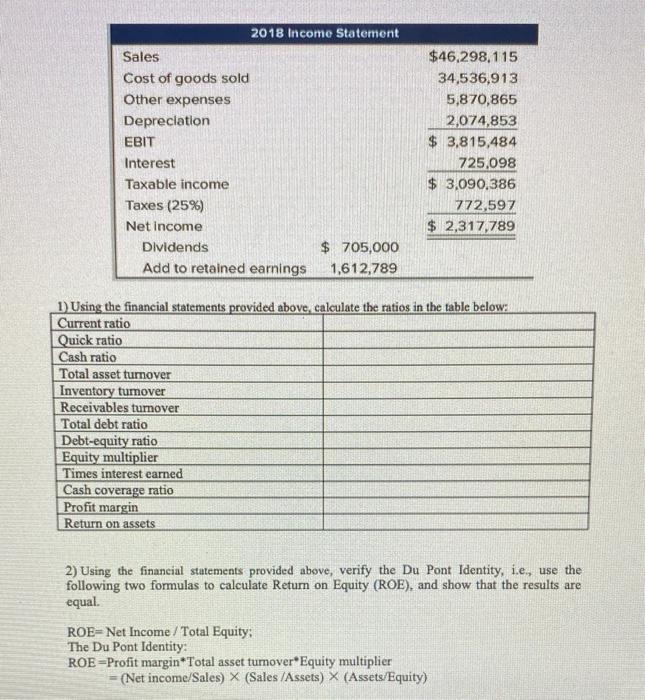

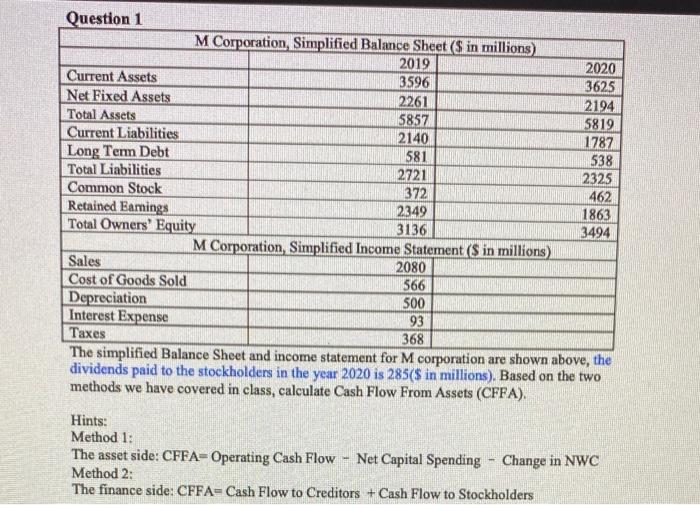

Question 1 M Corporation, Simplified Balance Sheet (S in millions) 2019 2020 Current Assets 3596 3625 Net Fixed Assets 2261 2194 Total Assets 5857 5819 Current Liabilities 2140 1787 Long Term Debt 581 538 Total Liabilities 2721 2325 Common Stock 372 Retained Eamings 2349 1863 Total Owners' Equity 3136 3494 M Corporation, Simplified Income Statement (S in millions) Sales 2080 Cost of Goods Sold 566 Depreciation 500 Interest Expense 93 Taxes 368 The simplified Balance Sheet and income statement for M corporation are shown above, the dividends paid to the stockholders in the year 2020 is 285($ in millions). Based on the two methods we have covered in class, calculate Cash Flow From Assets (CFFA). 462 Hints: Method 1: The asset side: CFFA- Operating Cash Flow Net Capital Spending - Change in NWC Method 2: The finance side: CFFA- Cash Flow to Creditors + Cash Flow to Stockholders Question 2 2018 Balance Sheet Assets Liabilities and Equity Current assets Currentllabilities Cash $ 524,963 $ 1,068,356 Accounts payable Notes payable Accounts receivable 843,094 2,439,553 Inventory Total current abilities $ 3,507,909 1,235,161 $2.603,218 Total current assets Long-term debt $ 6,300,000 Floed assets Net plant and equipment $20,381.945 Shareholder equity Common stock Retained earnings Total equity $ 460,000 12717254 $13.177.254 $22.995.163 Total assets $22.985,163 Total abilities and equity 2018 Income Statement Sales $46,298,115 34,536,913 Cost of goods sold Other expenses 5,870.865 Depreciation EBIT 2,074,853 $ 3.815,484 725.098 $ 3,090,386 Interest Taxable income Taxes (25%) 772.597 $ 2,317,789 Net income 2018 Income Statement Sales Cost of goods sold Other expenses Depreciation EBIT $46,298,115 34,536,913 5,870,865 2,074,853 $ 3,815,484 725,098 $ 3,090.386 772,597 $ 2,317,789 Interest Taxable income Taxes (25%) Net Income $ 705,000 Dividends Add to retained earnings 1,612,789 1) Using the financial statements provided above, calculate the ratios in the table below: Current ratio Quick ratio Cash ratio Total asset turnover Inventory tumover Receivables turnover Total debt ratio Debt-equity ratio Equity multiplier Times interest earned Cash coverage ratio Profit margin Return on assets 2) Using the financial statements provided above, verify the Du Pont Identity, i.e, use the following two formulas to calculate Return on Equity (ROE), and show that the results are equal. ROE= Net Income / Total Equity: The Du Pont Identity: ROE=Profit margin*Total asset tumover*Equity multiplier = (Net income/Sales) X (Sales /Assets) X (Assets/Equity) Question 1 M Corporation, Simplified Balance Sheet (S in millions) 2019 2020 Current Assets 3596 3625 Net Fixed Assets 2261 2194 Total Assets 5857 5819 Current Liabilities 2140 1787 Long Term Debt 581 538 Total Liabilities 2721 2325 Common Stock 372 Retained Eamings 2349 1863 Total Owners' Equity 3136 3494 M Corporation, Simplified Income Statement (S in millions) Sales 2080 Cost of Goods Sold 566 Depreciation 500 Interest Expense 93 Taxes 368 The simplified Balance Sheet and income statement for M corporation are shown above, the dividends paid to the stockholders in the year 2020 is 285($ in millions). Based on the two methods we have covered in class, calculate Cash Flow From Assets (CFFA). 462 Hints: Method 1: The asset side: CFFA- Operating Cash Flow Net Capital Spending - Change in NWC Method 2: The finance side: CFFA- Cash Flow to Creditors + Cash Flow to Stockholders Question 2 2018 Balance Sheet Assets Liabilities and Equity Current assets Currentllabilities Cash $ 524,963 $ 1,068,356 Accounts payable Notes payable Accounts receivable 843,094 2,439,553 Inventory Total current abilities $ 3,507,909 1,235,161 $2.603,218 Total current assets Long-term debt $ 6,300,000 Floed assets Net plant and equipment $20,381.945 Shareholder equity Common stock Retained earnings Total equity $ 460,000 12717254 $13.177.254 $22.995.163 Total assets $22.985,163 Total abilities and equity 2018 Income Statement Sales $46,298,115 34,536,913 Cost of goods sold Other expenses 5,870.865 Depreciation EBIT 2,074,853 $ 3.815,484 725.098 $ 3,090,386 Interest Taxable income Taxes (25%) 772.597 $ 2,317,789 Net income 2018 Income Statement Sales Cost of goods sold Other expenses Depreciation EBIT $46,298,115 34,536,913 5,870,865 2,074,853 $ 3,815,484 725,098 $ 3,090.386 772,597 $ 2,317,789 Interest Taxable income Taxes (25%) Net Income $ 705,000 Dividends Add to retained earnings 1,612,789 1) Using the financial statements provided above, calculate the ratios in the table below: Current ratio Quick ratio Cash ratio Total asset turnover Inventory tumover Receivables turnover Total debt ratio Debt-equity ratio Equity multiplier Times interest earned Cash coverage ratio Profit margin Return on assets 2) Using the financial statements provided above, verify the Du Pont Identity, i.e, use the following two formulas to calculate Return on Equity (ROE), and show that the results are equal. ROE= Net Income / Total Equity: The Du Pont Identity: ROE=Profit margin*Total asset tumover*Equity multiplier = (Net income/Sales) X (Sales /Assets) X (Assets/Equity)