Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work for each item. Canada accounting The following information relates to various transactions conducted by Owen Winehouse during 20x8: 1) For several years,

Please show work for each item. Canada accounting

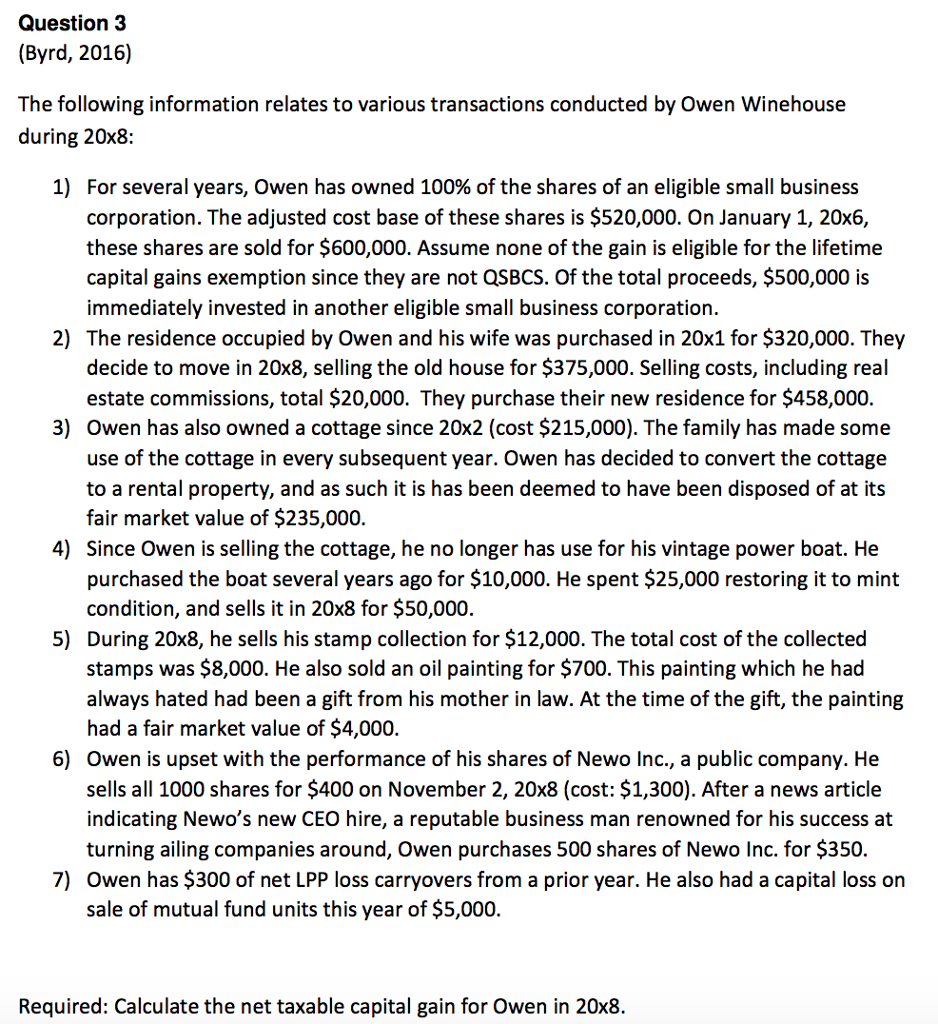

The following information relates to various transactions conducted by Owen Winehouse during 20x8: 1) For several years, Owen has owned 100% of the shares of an eligible small business corporation. The adjusted cost base of these shares is $520,000. On January 1, 20x6, these shares are sold for $600,000. Assume none of the gain is eligible for the lifetime capital gains exemption since they are not QSBCS. Of the total proceeds, $500,000 is immediately invested in another eligible small business corporation. 2) The residence occupied by Owen and his wife was purchased in 20x1 for $320,000. They decide to move in 20x8, selling the old house for $375,000. Selling costs, including real estate commissions, total $20,000. They purchase their new residence for $458,000. 3) Owen has also owned a cottage since 20x2 (cost $215,000). The family has made some use of the cottage in every subsequent year. Owen has decided to convert the cottage to a rental property, and as such it is has been deemed to have been disposed of at its fair market value of $235,000. 4) Since Owen is selling the cottage, he no longer has use for his vintage power boat. He purchased the boat several years ago for $10,000. He spent $25,000 restoring it to mint condition, and sells it in 20x8 for $50,000. 5) During 20x8, he sells his stamp collection for $12,000. The total cost of the collected stamps was $8,000. He also sold an oil painting for $700. This painting which he had always hated had been a gift from his mother in law. At the time of the gift, the painting had a fair market value of $4,000. 6) Owen is upset with the performance of his shares of Newo Inc., a public company. He sells all 1000 shares for $400 on November 2, 20x8 (cost: $1, 300). After a news article indicating Newo's new CEO hire, a reputable business man renowned for his success at turning ailing companies around, Owen purchases 500 shares of Newo Inc. for $350. 7) Owen has $300 of net LPP loss carryovers from a prior year. He also had a capital loss on sale of mutual fund units this year of $5,000. Required: Calculate the net taxable capital gain for Owen in 20x8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started