Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work for the calculation on May 31 Question 7 The adjusted trial balance for Yanik Financial Services Ltd. at May 31, 2018 is

Please show work for the calculation on May 31

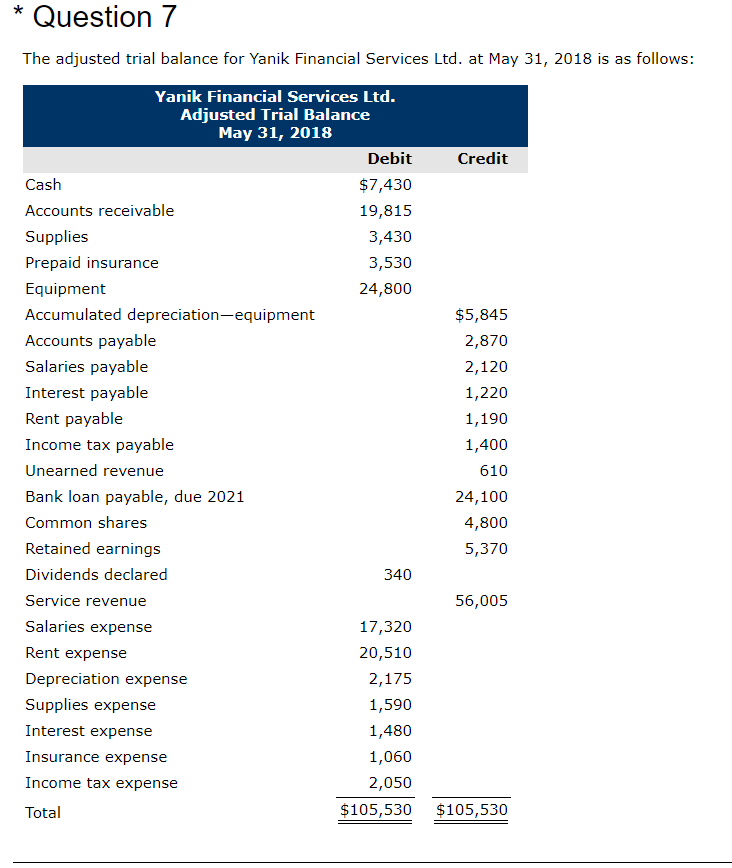

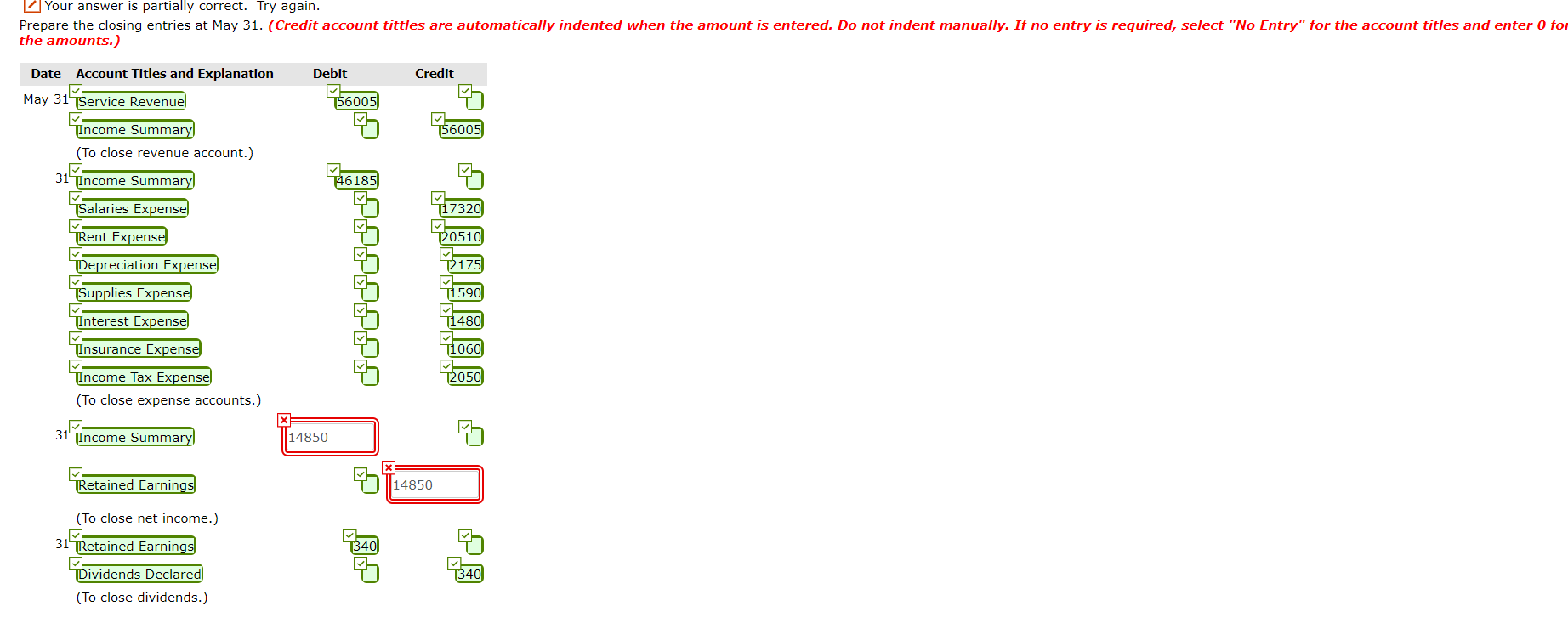

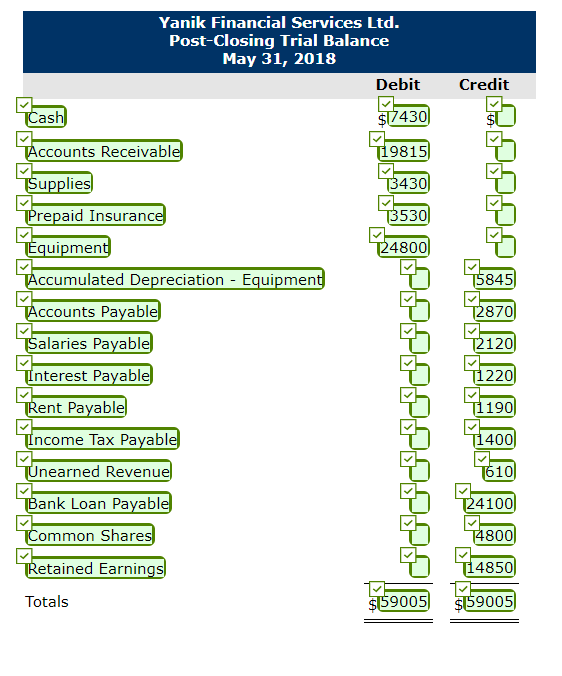

Question 7 The adjusted trial balance for Yanik Financial Services Ltd. at May 31, 2018 is as follows: Credit Yanik Financial Services Ltd. Adjusted Trial Balance May 31, 2018 Debit Cash $7,430 Accounts receivable 19,815 Supplies 3,430 Prepaid insurance 3,530 Equipment 24,800 Accumulated depreciation-equipment Accounts payable Salaries payable Interest payable Rent payable Income tax payable Unearned revenue Bank loan payable, due 2021 Common shares Retained earnings Dividends declared 340 Service revenue Salaries expense 17,320 Rent expense 20,510 Depreciation expense 2,175 Supplies expense 1,590 Interest expense 1,480 Insurance expense 1,060 Income tax expense 2,050 Total $105,530 $5,845 2,870 2,120 1,220 1,190 1,400 610 24,100 4,800 5,370 56,005 $105,530 Your answer is partially correct. Try again. Prepare the closing entries at May 31. (Credit account tittles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Debit Credit Date Account Titles and Explanation . May 31 Service Revenue 156005 156005) Income Summary) (To close revenue account.) 31 Income Summaryl 146185 Salaries Expense 17320 120510 TRent Expense Depreciation Expense Supplies Expense T2175 T1590) TInterest Expense HERE T1480 Insurance Expense T1060 T2050) Tincome Tax Expense (To close expense accounts.) 31 Income Summaryl 14850 TRetained Earnings 14850 (To close net income.) 31 Retained Earnings 1340 5 1340) TDividends Declared (To close dividends.) Yanik Financial Services Ltd. Post-Closing Trial Balance May 31, 2018 Debit Credit Cash $17430 T19815] 13430) (3530) TAccounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation - Equipment Accounts Payable T24800 75845 T2870 1Salaries Payable T2120 T1220 [1190 T1400 Interest Payable Rent Payable Income Tax Payable Tunearned Revenue Bank Loan Payable Common Shares Retained Earnings 1610 124100) T4800 T14850 Totals $159005 $159005Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started