Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work for thumbs up:) A stock has an expected return of 20% with a standard deviation of 0.15. Assume you can borrow and

please show work for thumbs up:)

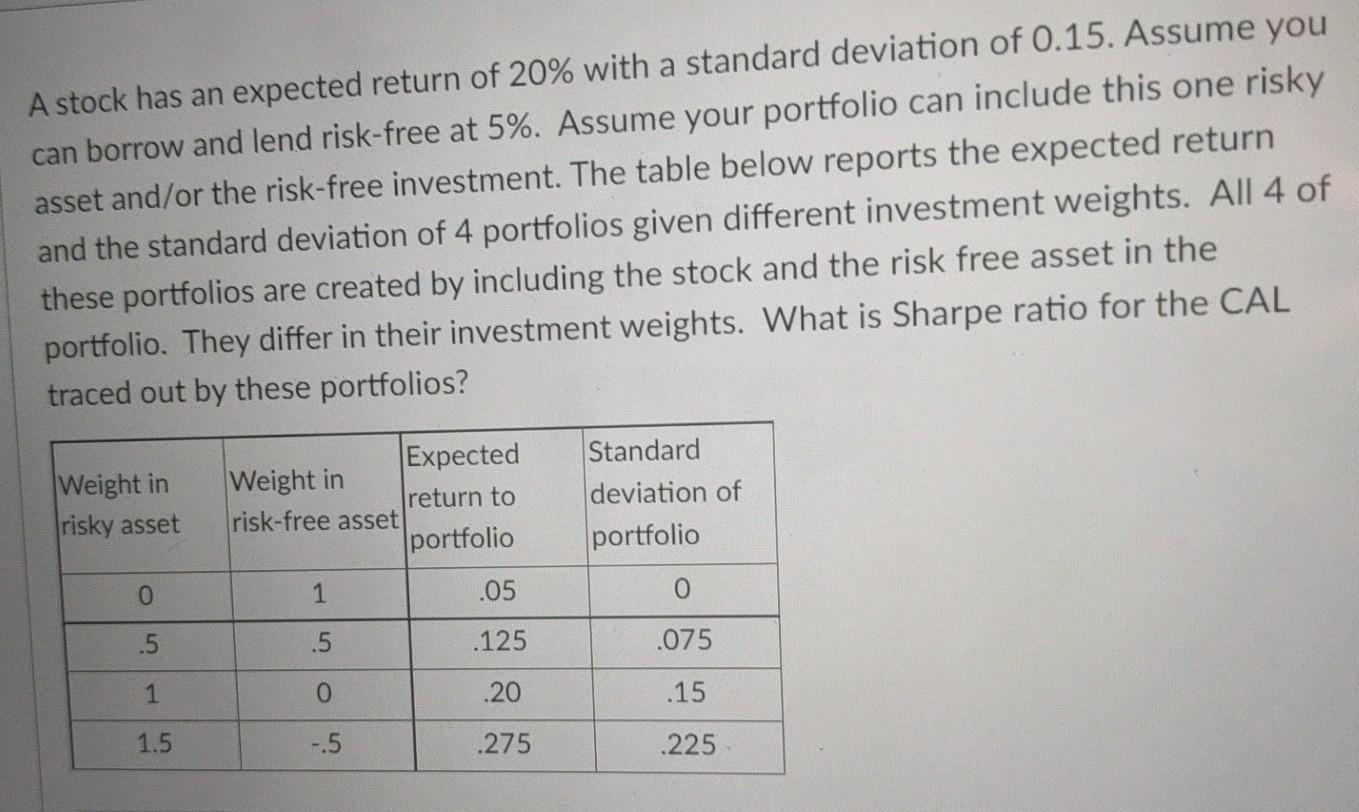

A stock has an expected return of 20% with a standard deviation of 0.15. Assume you can borrow and lend risk-free at 5%. Assume your portfolio can include this one risky asset and/or the risk-free investment. The table below reports the expected return and the standard deviation of 4 portfolios given different investment weights. All 4 of these portfolios are created by including the stock and the risk free asset in the portfolio. They differ in their investment weights. What is Sharpe ratio for the CAL traced out by these portfolios? Weight in risky asset Expected Weight in return to risk-free asset portfolio 1 .05 Standard deviation of portfolio 0 0 .5 .5 .125 .075 1 O .20 .15 1.5 -.5 .275 .225

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started